Are you in need of a W9 tax form but don’t know where to find one? Look no further! The W9 tax form is a crucial document that is often required by businesses and organizations when working with independent contractors or freelancers. This form collects important information such as your name, address, and taxpayer identification number (TIN) for tax purposes.

It is essential to have a W9 tax form on hand if you are a freelancer or independent contractor, as it ensures that you are properly classified for tax purposes. Without this form, you may not receive the necessary tax documents at the end of the year, which could lead to complications with the IRS.

Where to Find a Printable W9 Tax Form

There are several places where you can easily find a printable W9 tax form. The IRS website is a reliable source for obtaining the most up-to-date version of the form. You can simply search for “W9 tax form” on the IRS website and download the form in PDF format.

Alternatively, many tax preparation websites and office supply stores also offer printable versions of the W9 tax form. You can easily access and print the form from these sources as well. Make sure to use the official version of the form to ensure accuracy and compliance with IRS regulations.

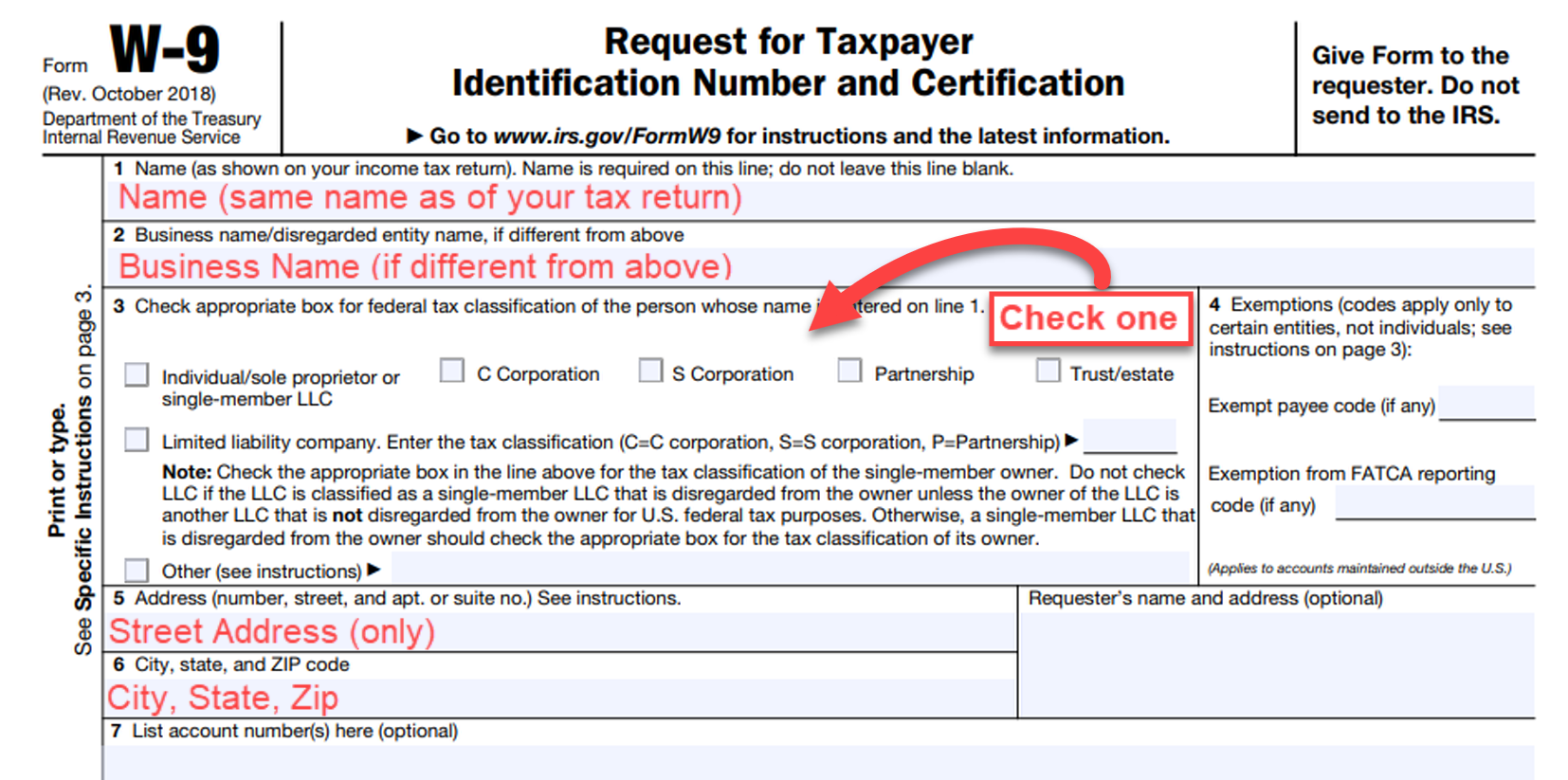

Once you have obtained the printable W9 tax form, fill out the required information accurately and legibly. Double-check your entries to avoid any errors that could delay processing. After completing the form, you can submit it to the requesting party either in person, by mail, or electronically, depending on their preferred method of submission.

By having a printable W9 tax form on hand, you can streamline the process of providing necessary tax information to businesses and organizations that you work with. It helps establish your status as an independent contractor and ensures that you receive the appropriate tax documents at the end of the year. Don’t wait until the last minute – download a W9 tax form today and stay ahead of your tax obligations!

In conclusion, a printable W9 tax form is a valuable tool for freelancers and independent contractors to accurately report their tax information to businesses and organizations. By obtaining and completing this form in a timely manner, you can avoid potential tax issues and ensure compliance with IRS regulations. Make sure to keep a copy of the completed form for your records and submit it promptly to the requesting party. Stay organized and prepared for tax season with a printable W9 tax form!