As a business owner or independent contractor, filling out tax forms is a necessary part of your financial responsibilities. One important form that you may need to fill out is the W9 Printable Form. This form is used to gather information about a contractor or freelancer’s taxpayer identification number for tax purposes. Understanding how to properly fill out and submit this form is crucial for both businesses and individuals to ensure compliance with tax regulations.

When it comes to tax season, having all the necessary forms on hand is essential. The W9 Printable Form is a standardized form issued by the IRS that is used to collect the taxpayer identification number (TIN) of independent contractors or freelancers. This information is then used by businesses to report payments made to these individuals to the IRS. By having contractors fill out this form, businesses can ensure that they have the correct information needed to accurately report payments and avoid any potential penalties for non-compliance.

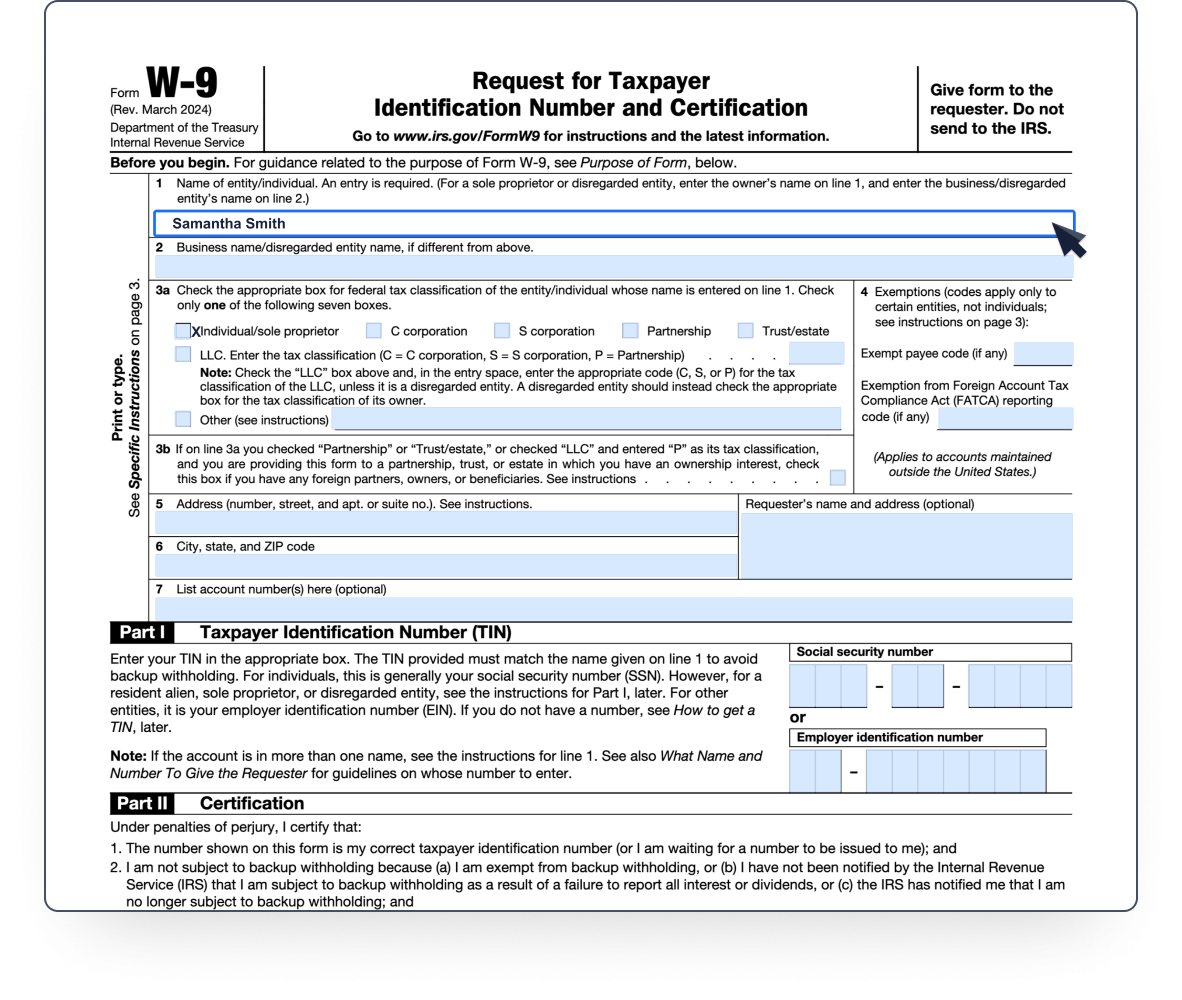

W9 Printable Form

The W9 Printable Form is a simple one-page document that requires contractors to provide their name, address, and TIN. Contractors must also certify that the information they provide is correct and that they are not subject to backup withholding. Once completed, the form can be submitted to the business that is requesting it. It is important for contractors to keep a copy of the form for their records as well.

Businesses that use independent contractors or freelancers must collect W9 forms from each individual before making any payments to them. This helps businesses ensure that they have the necessary information to accurately report payments to the IRS. By collecting and keeping these forms on file, businesses can demonstrate compliance with tax regulations and avoid any potential issues during tax audits.

Overall, the W9 Printable Form is a crucial document for both businesses and independent contractors. By understanding how to properly fill out and submit this form, both parties can ensure compliance with tax regulations and avoid any potential penalties. Make sure to have this form on hand whenever you are working with independent contractors or freelancers to streamline the payment process and maintain accurate financial records.

In conclusion, the W9 Printable Form is a key document for businesses and independent contractors to ensure compliance with tax regulations. By understanding the purpose of this form and how to properly fill it out, both parties can avoid potential issues and penalties during tax season. Be sure to keep this form handy and submit it whenever necessary to maintain accurate financial records and stay in good standing with the IRS.