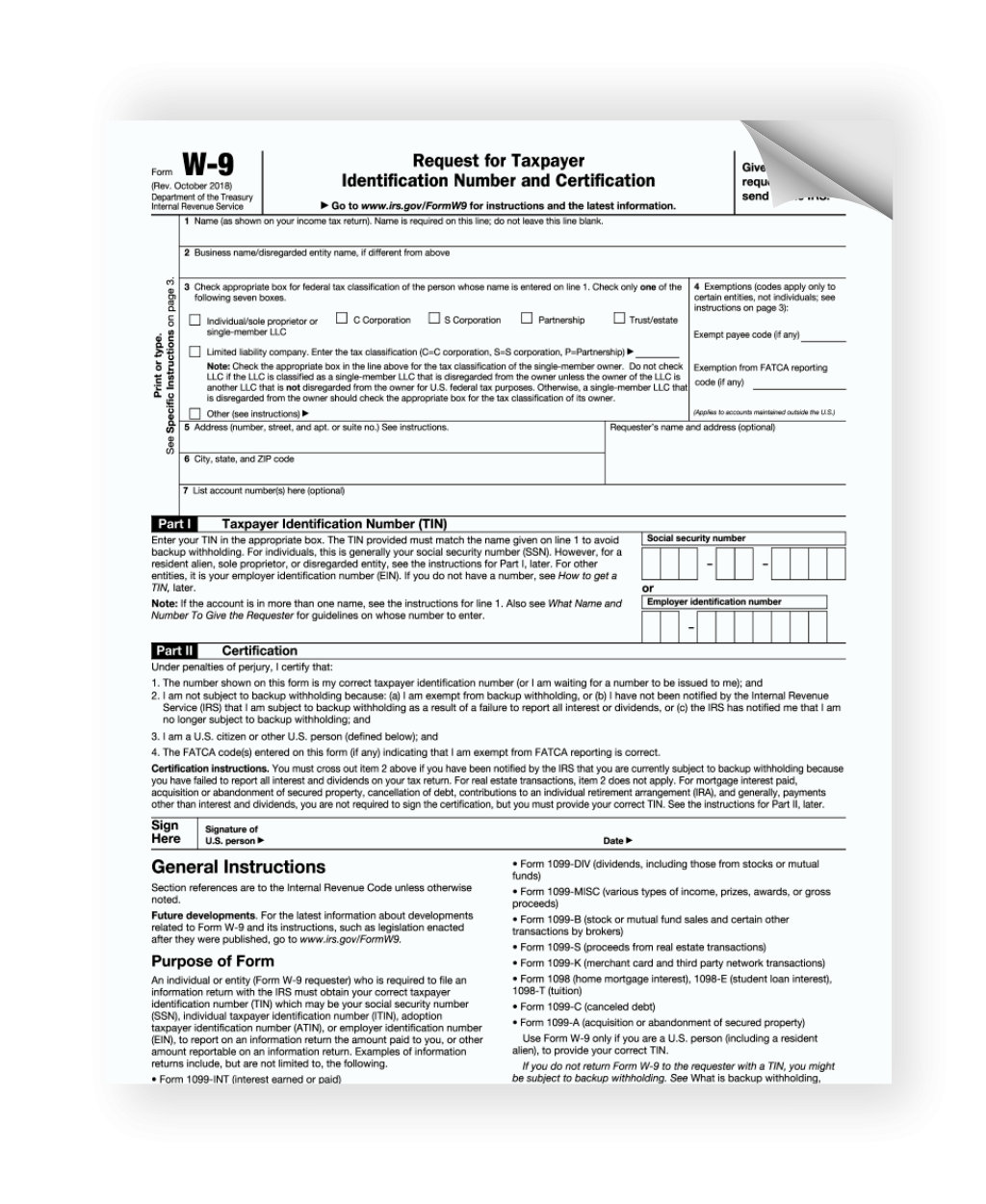

When it comes to tax season, it’s important for businesses to have all the necessary forms in order to comply with IRS regulations. One of the most commonly used forms is the W-9 form, which is used to request the taxpayer identification number (TIN) of a U.S. person.

The W-9 form is typically used by businesses that need to report payments made to independent contractors, freelancers, or other vendors. By obtaining the TIN of the payee, businesses can accurately report these payments to the IRS and avoid any potential penalties for non-compliance.

It’s important to note that the W-9 form is not submitted to the IRS, but rather kept on file by the business for their records. However, it is important to ensure that the form is filled out correctly and completely in order to avoid any discrepancies in reporting.

Businesses can easily obtain a printable version of the W-9 form directly from the IRS website. The form is available in PDF format and can be easily downloaded and printed for use. This makes it convenient for businesses to have the form readily available whenever it is needed.

When filling out the W-9 form, payees will need to provide their name, address, TIN, and certify that they are a U.S. person. It’s important to ensure that all information provided is accurate to avoid any issues down the line. Once the form is completed, it can be submitted to the business requesting it for their records.

In conclusion, the W-9 form is an essential document for businesses that need to report payments made to independent contractors and vendors. By obtaining the necessary information from payees and keeping the form on file, businesses can ensure compliance with IRS regulations and avoid any potential penalties. Having a printable version of the form readily available makes it easy for businesses to stay organized and prepared during tax season.