Are you a freelancer or an independent contractor who needs to provide your tax information to clients? If so, you’ll likely need to fill out a W9 form. This form is crucial for businesses to report payments made to non-employees, and it helps the IRS track income that should be reported on your tax return.

While filling out tax forms may not be the most exciting task, having a printable version of the W9 form can make the process much easier. With a printable W9 form, you can quickly fill in your information and provide it to your clients without any hassle.

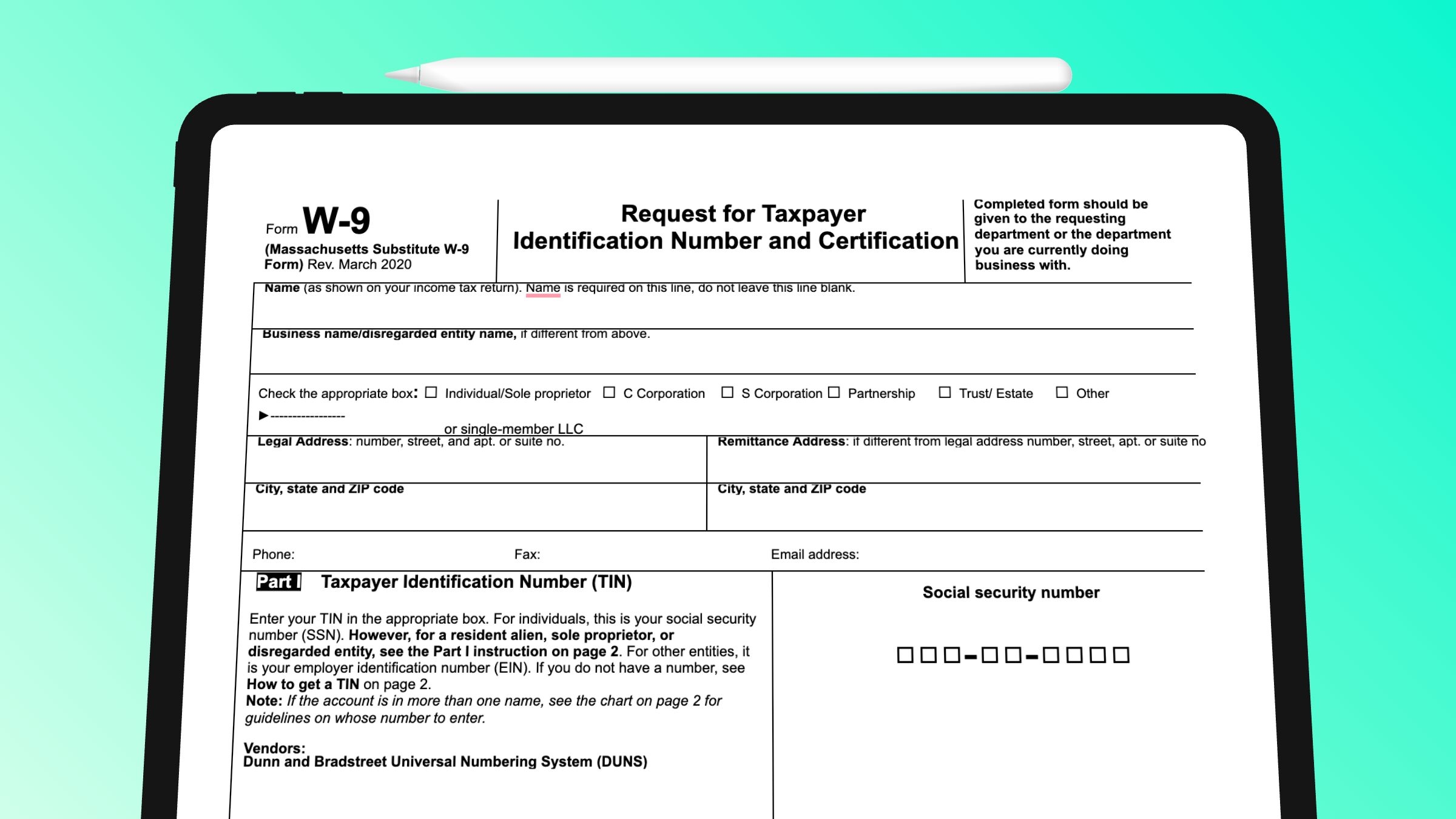

W9 Form Printable

When it comes to finding a printable W9 form, there are plenty of options available online. You can easily download a PDF version of the form from the IRS website or other reputable sources. Having a printable W9 form on hand can save you time and ensure that you have all the necessary information ready when it’s time to submit your tax documents.

When filling out the W9 form, make sure to provide accurate information, including your name, address, Social Security number, and tax classification. It’s essential to double-check all the details before submitting the form to avoid any errors that could lead to delays or issues with your tax filing.

Remember that the W9 form is not a tax return but rather a document that provides your tax information to clients who may need to report payments to the IRS. By having a printable W9 form ready to go, you can streamline the process and ensure that you meet all the necessary requirements for tax compliance.

Overall, having a printable W9 form is a convenient way to organize your tax information and provide it to clients efficiently. With easy access to the form online, you can quickly fill it out and stay on top of your tax obligations as a freelancer or independent contractor.

So, don’t wait until the last minute to fill out your W9 form. Take advantage of the convenience of a printable version and ensure that you’re prepared for tax season.