When it comes to taxes and financial matters, it is essential to have the necessary forms ready. One such form that is commonly used is the W9 Form. This form is used by businesses to request information from independent contractors and vendors they work with. It is vital for ensuring compliance with IRS regulations and for reporting payments made to these individuals.

The W9 Form IRS Printable is a convenient option for both businesses and individuals. It allows for easy access to the form, which can be quickly filled out and submitted as needed. This printable version eliminates the need for physical copies and can be easily stored electronically for future reference.

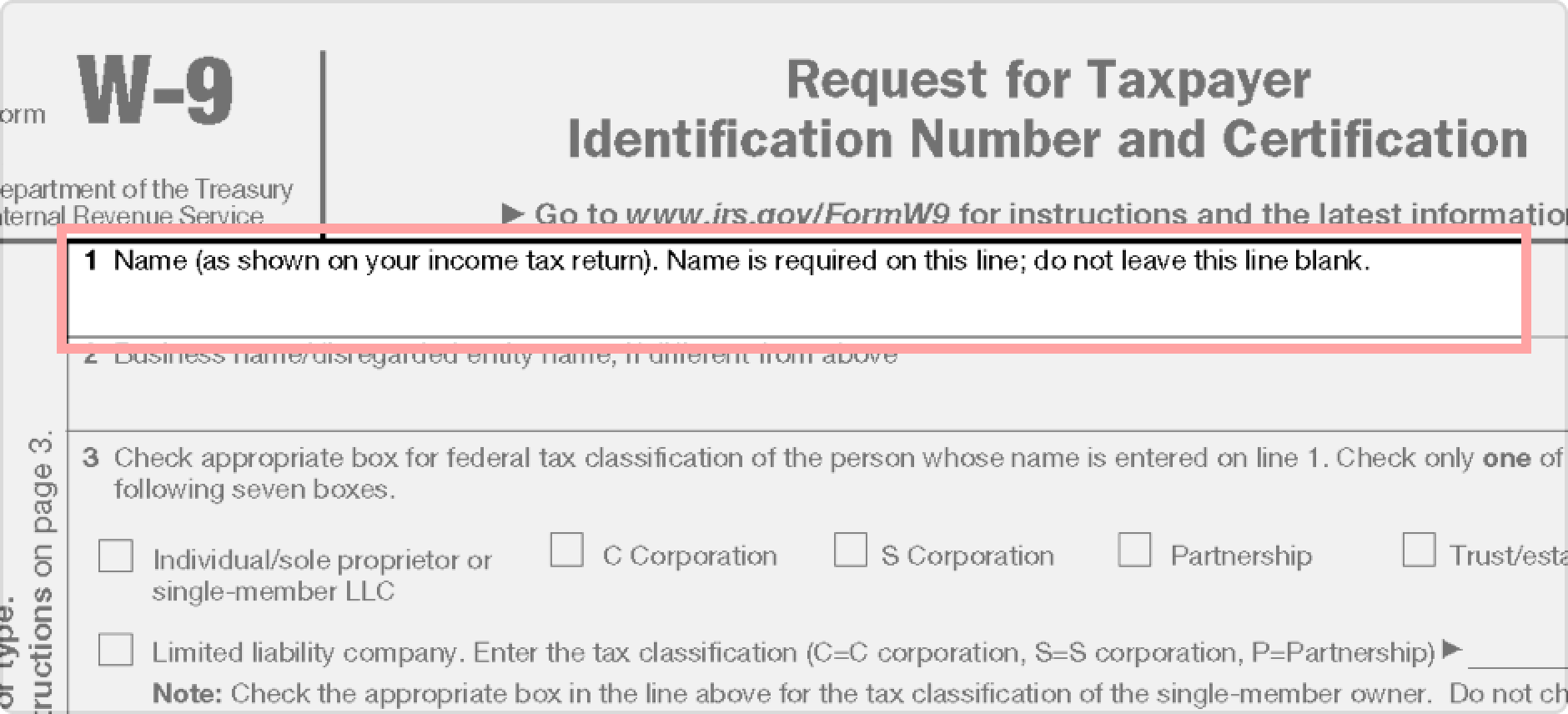

When filling out the W9 Form, individuals are required to provide their name, address, and taxpayer identification number (TIN). This information is crucial for businesses to accurately report payments made to the IRS. By using the printable version of the form, individuals can ensure that all the necessary information is correctly entered before submission.

Additionally, the W9 Form IRS Printable can be used for multiple purposes. Whether you are a freelancer, consultant, or vendor, having this form readily available can streamline the process of providing your information to businesses you work with. It also serves as a record of your earnings for tax purposes.

In conclusion, the W9 Form IRS Printable is a valuable tool for both businesses and individuals. It simplifies the process of gathering and submitting essential information required by the IRS. By utilizing this printable version, you can ensure compliance with tax regulations and maintain accurate records of your financial transactions.

Ensure you have the W9 Form IRS Printable on hand for any upcoming financial transactions or business agreements that require this information. Stay organized and compliant with IRS regulations by using this convenient and easy-to-access form.