W2 Printable Form is an essential document that is used by employers to report the annual wages and taxes withheld from an employee’s paycheck. It is typically sent out at the beginning of the year and is necessary for filing taxes. Understanding what information is included on the form and how to properly fill it out is crucial for both employers and employees.

Employers are required by law to provide their employees with a W2 Form by January 31st each year. This form includes important information such as the employee’s total wages, taxes withheld, and any other deductions. It is important for employees to carefully review their W2 Form to ensure that all information is accurate before filing their taxes.

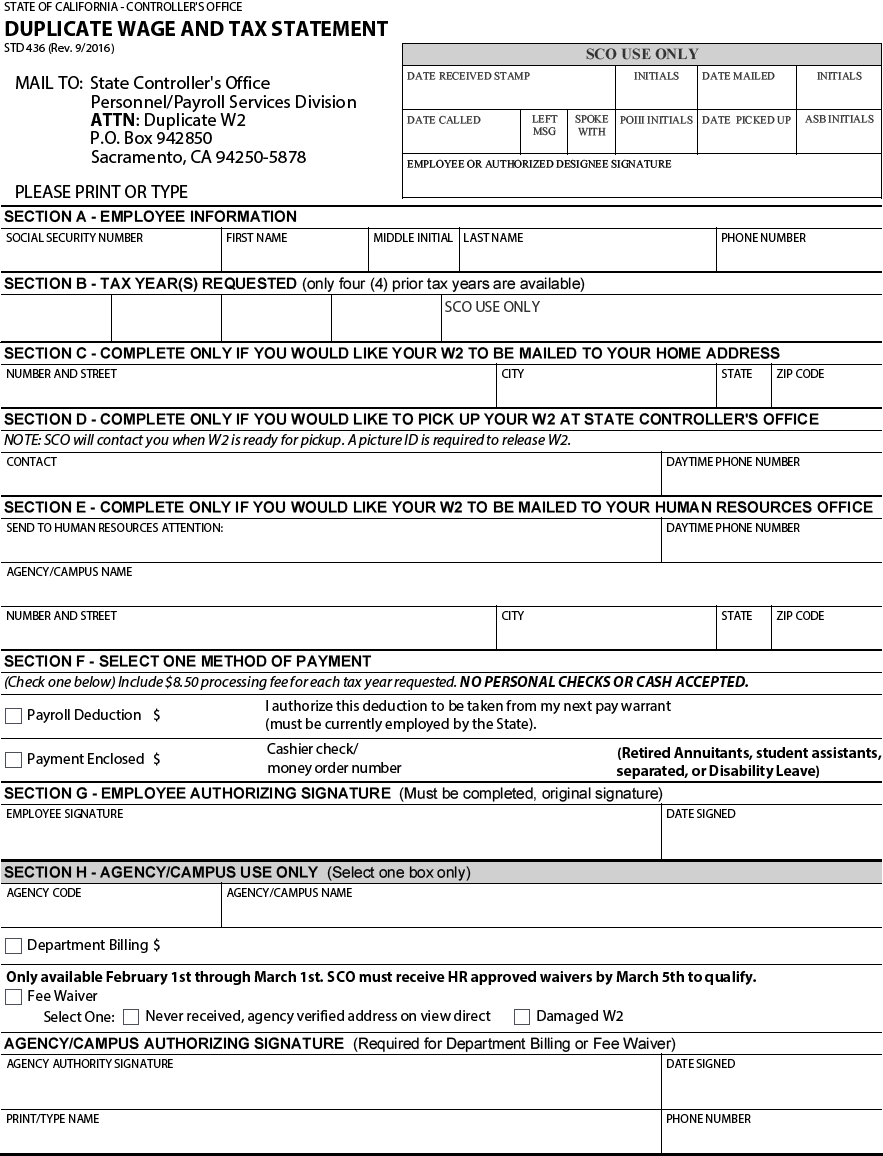

W2 Printable Form

W2 Printable Forms are easily accessible online and can be downloaded and printed out for convenience. This allows employees to quickly obtain their W2 Form without having to wait for it to be mailed to them. The form typically consists of several copies, with one copy being sent to the IRS, one copy for the employee’s records, and one copy to be included with their tax return.

When filling out the W2 Form, it is important to ensure that all information is accurate and up to date. Any mistakes or discrepancies can result in delays in processing the employee’s tax return. It is also important to keep a copy of the completed form for your records in case any questions or issues arise in the future.

Overall, the W2 Printable Form is a crucial document that plays a key role in the tax filing process for both employers and employees. By understanding the importance of this form and how to properly fill it out, individuals can ensure that their taxes are filed accurately and on time. Make sure to stay informed and up to date on any changes in tax laws to avoid any potential issues.

In conclusion, the W2 Printable Form is an essential document that provides important information about an employee’s wages and taxes withheld. It is crucial for both employers and employees to understand how to properly fill out and review this form to ensure accurate tax filing. By utilizing online resources to access and print out the form, individuals can streamline the tax filing process and avoid any potential delays or issues.