When tax season rolls around, one of the most important documents you will need is your W2 form. This form is essential for filing your taxes and ensuring that you are reporting your income accurately to the IRS. While many employers provide electronic versions of the W2 form, having a printable version on hand can be extremely useful.

Having a printable W2 form allows you to easily access and review your tax information without having to log in to your employer’s website. It also gives you the flexibility to make any necessary corrections or updates before submitting your taxes. Whether you prefer to file your taxes online or through the mail, having a printed copy of your W2 form ensures that you have all the information you need at your fingertips.

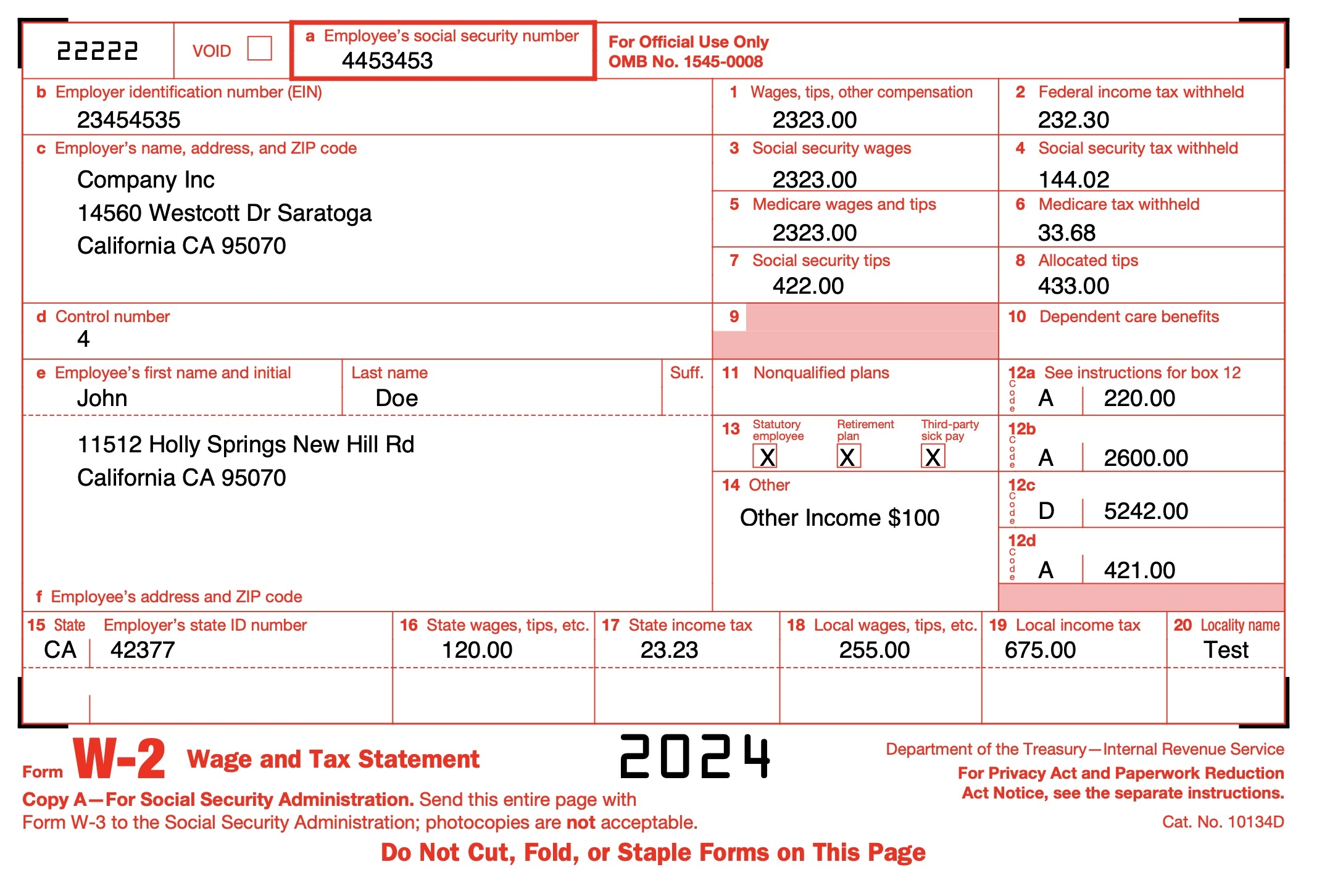

W2 Form Printable

One of the benefits of having a printable W2 form is that you can keep a physical copy for your records. This can come in handy if you ever need to reference your tax information in the future or if you are audited by the IRS. Additionally, having a printed copy of your W2 form allows you to easily share your tax information with a tax preparer or financial advisor.

Another advantage of using a printable W2 form is that it allows you to double-check your information for accuracy. Mistakes on your tax return can result in penalties or delays in processing your refund. By printing out your W2 form, you can review each section carefully to ensure that all the information is correct before submitting your taxes.

Overall, having a printable W2 form is a convenient and practical way to stay organized during tax season. Whether you prefer to file your taxes online or through the mail, having a physical copy of your W2 form ensures that you have all the necessary information at your disposal. So, don’t wait until the last minute – make sure to print out your W2 form and stay ahead of the game this tax season!