When it comes to tax season, filling out various forms is a necessary task. One such form that is commonly used is the W-9 form. This form is used by businesses to collect information from independent contractors and vendors they work with. It is essential for businesses to have this information on file for tax reporting purposes.

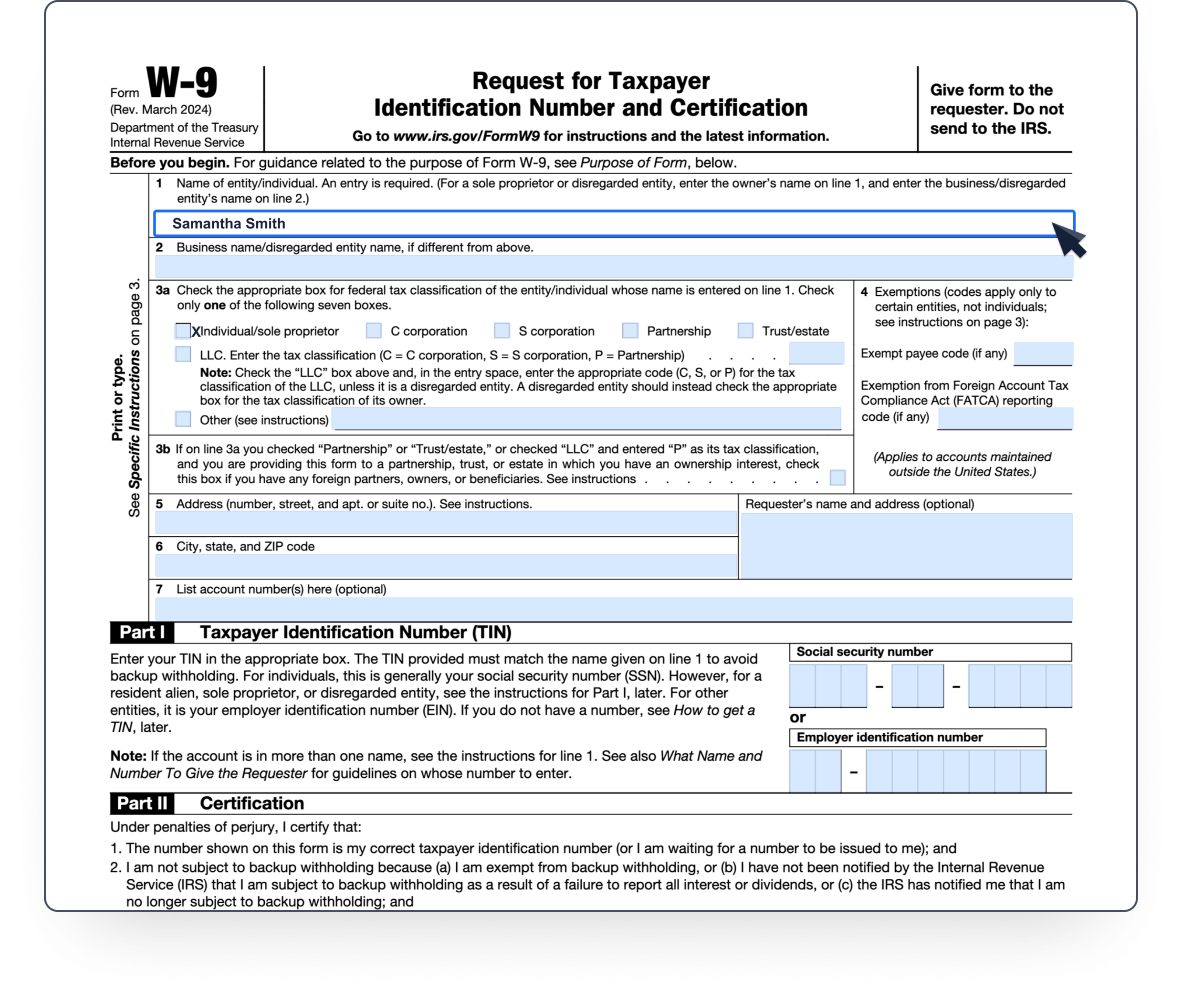

The W-9 form is a document issued by the Internal Revenue Service (IRS) that is used to gather a taxpayer’s information. This form includes details such as the taxpayer’s name, address, taxpayer identification number (TIN), and certification of exemption status. It is crucial for individuals to fill out this form accurately to ensure that their tax information is correctly reported.

When filling out the W-9 form, individuals must provide their legal name and business name (if applicable), address, and TIN. They must also certify their exemption status, which indicates whether they are subject to backup withholding or not. The completed form should be submitted to the business or entity requesting the information.

It is important to note that the W-9 form is not filed with the IRS but is kept on file by the business or entity that requested it. The information provided on this form is used for tax reporting purposes, such as issuing 1099 forms to independent contractors and vendors. Failure to provide accurate information on the W-9 form could result in penalties and fines.

Overall, the W-9 form is a vital document for both businesses and individuals during tax season. By accurately completing this form, taxpayers can ensure that their tax information is correctly reported and avoid any potential issues with the IRS. It is essential to keep this form updated and on file for future reference.

In conclusion, the W-9 printable form IRS is a necessary document for businesses and individuals to collect and report tax information accurately. By understanding the importance of this form and filling it out correctly, taxpayers can ensure compliance with IRS regulations and avoid any potential penalties. Make sure to keep your W-9 form up to date and provide accurate information to maintain smooth tax reporting processes.