When it comes to tax forms, the W-9 is an important document that is commonly used in the United States. This form is typically used by businesses and individuals to provide their taxpayer identification number (TIN) to the Internal Revenue Service (IRS). It is essential for various financial transactions, such as hiring independent contractors, issuing payments, and reporting income.

Whether you are a freelancer, consultant, or business owner, you may be required to fill out a W-9 form at some point. This form helps to ensure that accurate information is provided to the IRS for tax reporting purposes. Understanding how to properly fill out and submit a W-9 form is crucial to staying compliant with tax regulations.

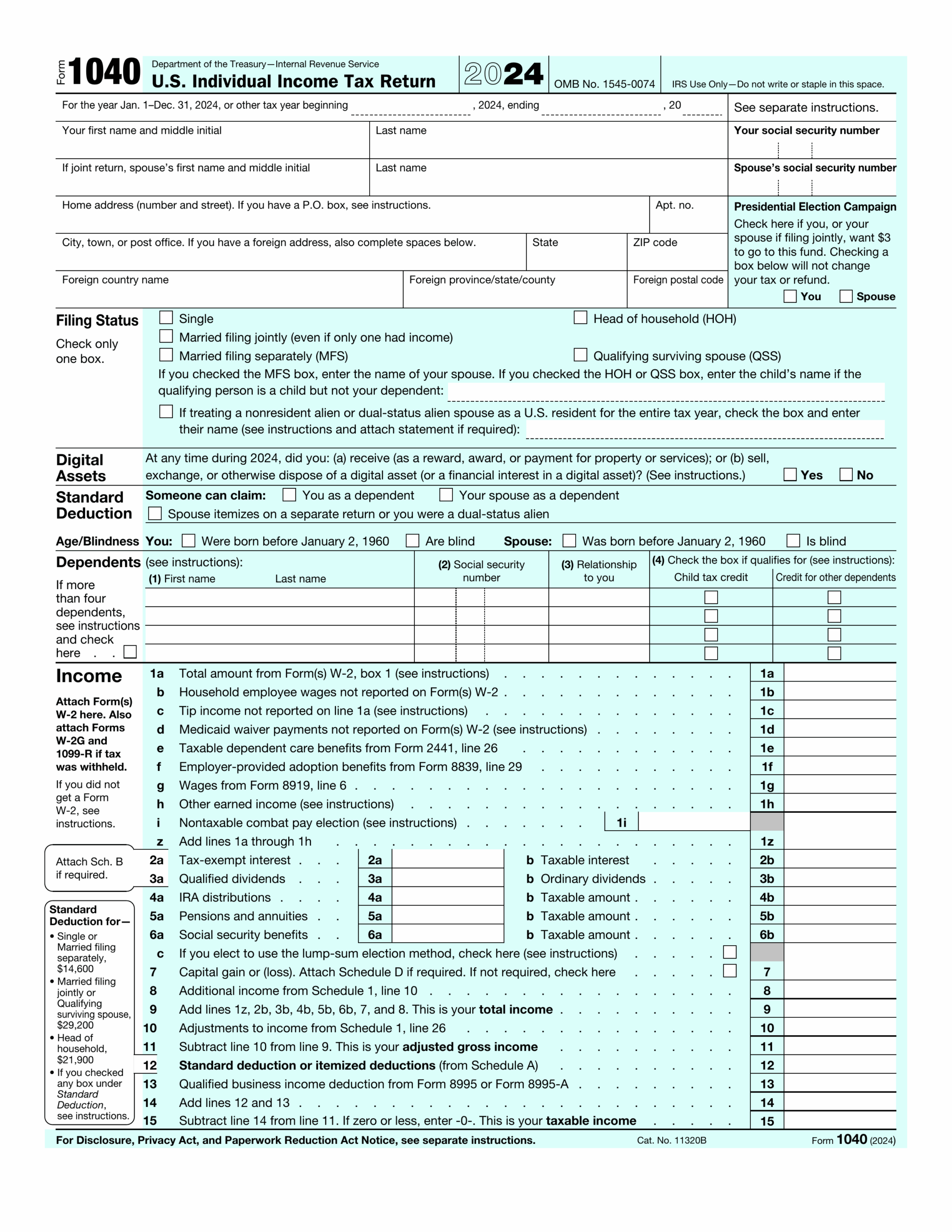

W-9 Printable Form

The W-9 form is available for download in a printable format on the IRS website. It consists of several sections that require specific information to be filled out, including the individual or business name, TIN, entity type, and signature. It is important to double-check all information before submitting the form to avoid any errors or delays in processing.

One of the key purposes of the W-9 form is to provide the IRS with the necessary information to accurately report income. By completing this form, individuals and businesses are certifying that the information provided is correct and that they are responsible for any tax obligations associated with the income received. Failure to provide accurate information on the W-9 form can result in penalties and potential legal consequences.

In addition to providing information to the IRS, the W-9 form is also used by businesses to verify the identity of individuals or entities they are working with. It helps to establish a paper trail for financial transactions and ensures that all parties are in compliance with tax laws. By maintaining accurate records of W-9 forms, businesses can demonstrate their commitment to transparency and accountability.

In conclusion, the W-9 printable form is a vital document for tax reporting and compliance purposes. Whether you are a freelancer, contractor, or business owner, it is important to understand the significance of this form and how to properly fill it out. By following the guidelines outlined in the form and submitting accurate information, you can avoid potential issues and ensure smooth financial transactions.