When it comes to tax season, one of the most important forms you may need to fill out is the W-9 form. This form is used by businesses to request taxpayer identification numbers from contractors, freelancers, and other non-employees. It is essential for businesses to have this information on file in order to report payments made to these individuals to the IRS. Having a printable version of the W-9 form readily available can make the process much easier for both parties involved.

Printable W-9 forms can be easily found online through various websites, including the IRS official website. These forms are typically available in PDF format, making it easy to download and print for your convenience. Having a physical copy of the form allows you to fill it out accurately and submit it to the requesting party in a timely manner. It is important to ensure that all information provided on the form is accurate to avoid any potential issues with tax reporting.

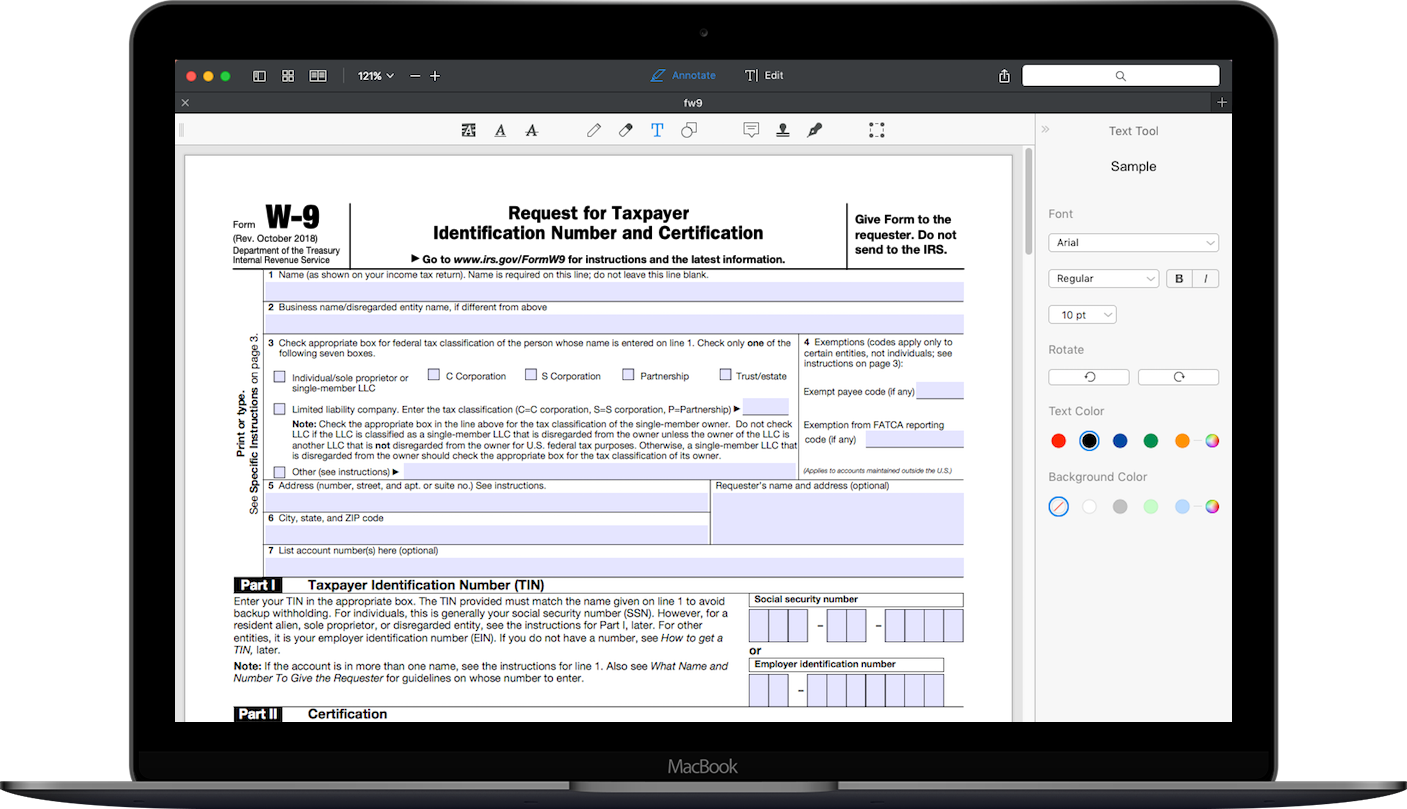

When filling out the W-9 form, you will be required to provide your name, address, taxpayer identification number (usually your Social Security number or employer identification number), and certification that the information you have provided is correct. Once completed, you can sign and date the form before submitting it to the business or individual requesting it. It is important to keep a copy of the form for your records.

Having a printable W-9 form readily available can save you time and hassle during tax season. It allows you to quickly provide the necessary information to businesses that require it, ensuring that you receive accurate and timely payment for your services. By being proactive and keeping your paperwork organized, you can streamline the process and avoid any potential delays or issues.

In conclusion, having access to printable W-9 forms is essential for contractors, freelancers, and other non-employees who need to provide their taxpayer identification numbers to businesses. By utilizing these forms, you can ensure that your tax reporting is accurate and up to date. Be sure to keep copies of all completed forms for your records and stay organized throughout the tax season.