When it comes to tax filings and documentation, the W-9 form is a crucial document that plays a significant role. The W-9 form is used by businesses to collect information from independent contractors or vendors they work with. It helps in reporting payments made to these individuals to the Internal Revenue Service (IRS).

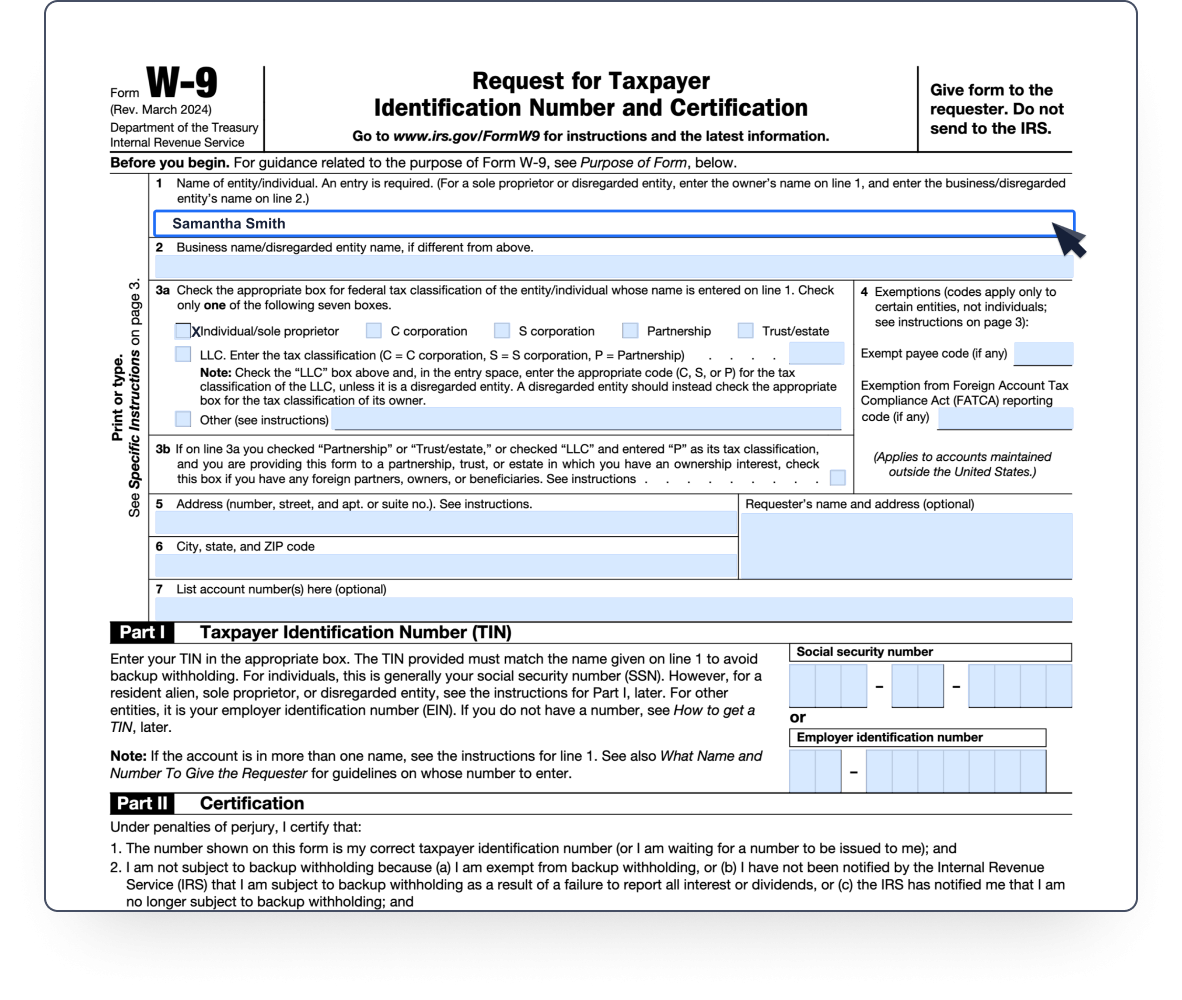

Having a printable version of the W-9 form readily available is essential for both parties involved. It ensures that the necessary information can be easily filled out and submitted in a timely manner. This form includes details such as the individual’s name, address, Social Security number, and tax classification, which are all vital for tax reporting purposes.

W 9 Form Printable

With the convenience of technology, printable versions of the W-9 form can be easily found online. This allows businesses and individuals to access the form whenever needed, without having to rely on physical copies or visits to government offices. The printable format also makes it easier to fill out the form neatly and legibly.

It is important to ensure that the W-9 form is accurately completed to avoid any issues with tax reporting or potential penalties. By utilizing the printable version of the form, individuals can take their time to review the information entered and make any necessary corrections before submitting it to the relevant parties.

Furthermore, having a digital copy of the W-9 form can also serve as a convenient reference for future transactions or tax reporting needs. It allows for easy access to the information provided and helps in maintaining organized records for both parties involved.

In conclusion, the availability of a printable W-9 form is a valuable resource for businesses and individuals alike. It simplifies the process of collecting and submitting important tax information, ensuring compliance with IRS regulations. By utilizing the printable version of the form, both parties can streamline their tax reporting procedures and maintain accurate records for future reference.