When it comes to tax-related documents, one form that is commonly used is the W-9 form. This form is used by businesses to collect information from independent contractors, freelancers, and vendors they work with. Understanding the purpose of the W-9 form and how to properly fill it out is essential for both parties involved.

The W-9 form is used to gather the taxpayer identification number (TIN) of individuals or entities that will receive certain types of income, such as contract payments or royalties. This information is crucial for businesses to report payments made to these individuals to the IRS. Failing to provide a completed W-9 form can result in penalties and fines for both parties.

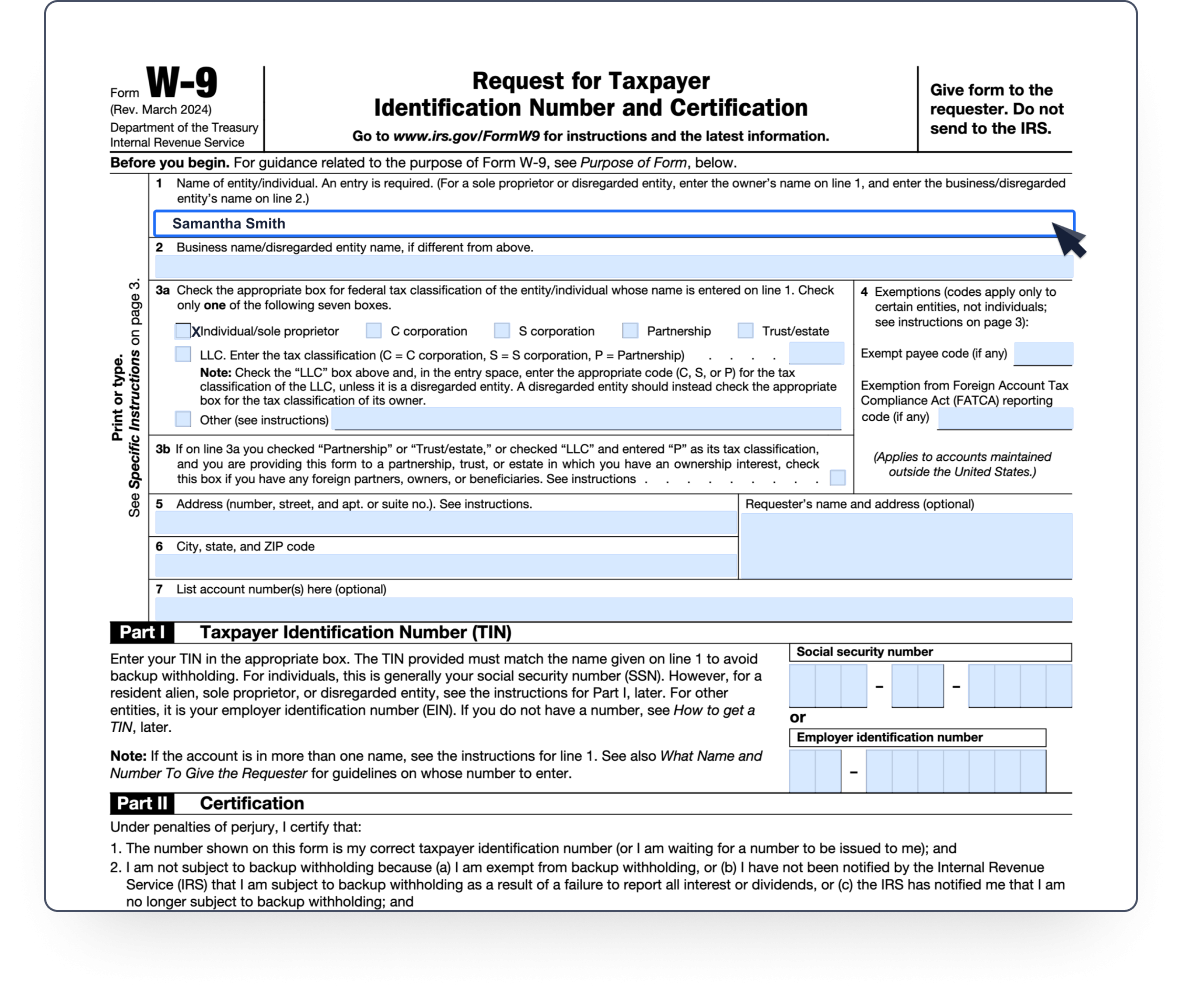

W-9 Form Printable

It is important to note that the W-9 form can easily be found online and is available in a printable format. This makes it convenient for individuals to access the form, fill it out, and submit it to the business they are working with. The form typically requires basic information such as name, address, and TIN.

When filling out the W-9 form, it is essential to provide accurate information to avoid any discrepancies when it comes time to report income to the IRS. Additionally, individuals must certify that the information provided is correct and that they are not subject to backup withholding. Once completed, the form can be submitted to the business either electronically or in person.

Businesses that receive completed W-9 forms are required to keep them on file for at least four years in case of an IRS audit. This is why it is crucial for individuals to ensure that the information provided on the form is accurate and up to date. Keeping track of all tax-related documents, including the W-9 form, is essential for both parties to stay compliant with tax laws.

In conclusion, the W-9 form is a vital document used in tax reporting for businesses and individuals alike. By understanding the purpose of the form and how to properly fill it out, both parties can ensure compliance with IRS regulations. Accessing the W-9 form in a printable format makes it easy for individuals to provide the necessary information to businesses they work with, ultimately streamlining the tax reporting process.