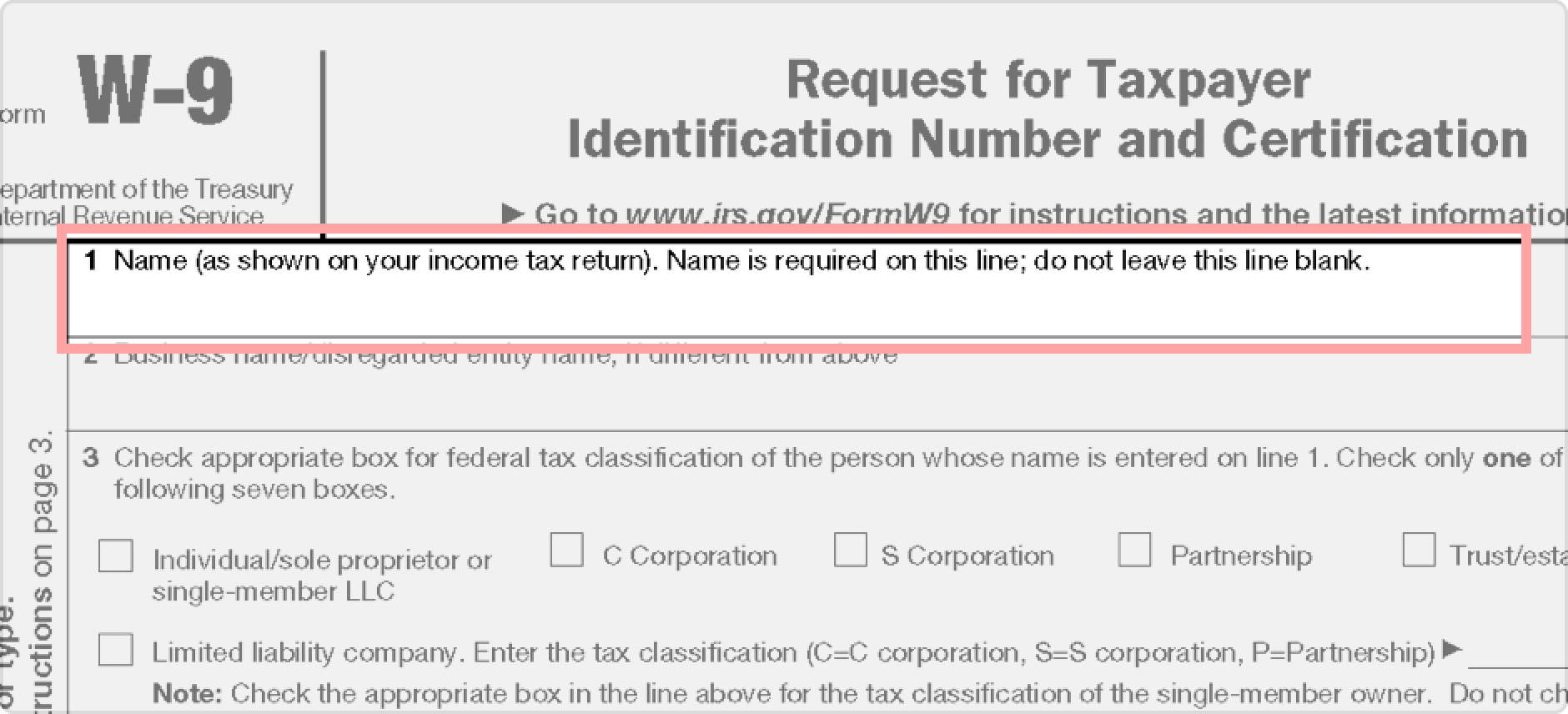

When it comes to filing taxes, one of the most important forms you may need to fill out is the W-9 form. This form is used by businesses to request taxpayer identification information from contractors and freelancers they work with. The W-9 form is crucial for reporting income to the IRS and ensuring that taxes are properly withheld.

For those who need to fill out a W-9 form in 2024, it’s important to know that you can easily access a printable version online. The IRS provides a downloadable PDF version of the W-9 form on their website, making it convenient for individuals to fill out and submit as needed.

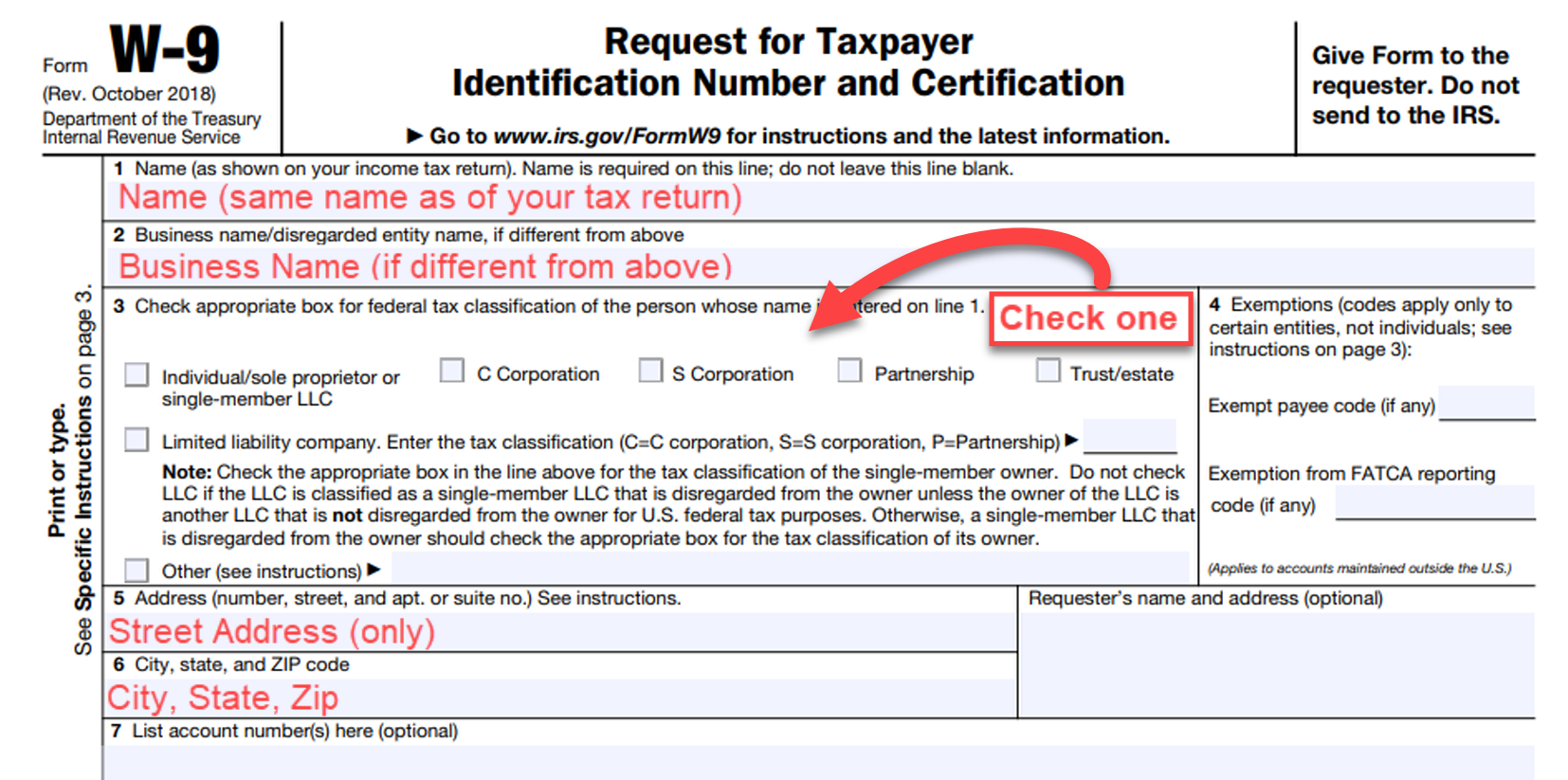

When filling out the W-9 form, you will need to provide your name, address, taxpayer identification number (such as your Social Security number or employer identification number), and certify that the information you are providing is correct. It’s important to fill out the form accurately to avoid any issues with your tax reporting.

Once you have completed the W-9 form, you can submit it to the business or individual requesting the information. They will use the information provided on the form to prepare and file 1099 forms with the IRS, which report the income you have earned throughout the year. By completing the W-9 form promptly, you can ensure that your income is properly reported to the IRS.

It’s important to note that the information provided on the W-9 form is confidential and should only be shared with the business or individual requesting it. Be sure to keep a copy of the completed form for your records and do not share your taxpayer identification number with anyone who does not have a legitimate need for it.

In conclusion, the W-9 form is a vital document for individuals who work as contractors or freelancers and need to report their income to the IRS. By accessing the printable version of the W-9 form on the IRS website, you can easily fill out and submit this important document. Make sure to provide accurate information on the form and keep it confidential to ensure proper tax reporting.

Easily Download and Print W 9 Form 2024 Printable Irs

Payroll printable are ideal for companies that prefer non-digital systems or need hard copies for employee records. Most forms include fields for employee name, date range, total earnings, withholdings, and final salary—making them both complete and user-friendly.

Take control of your payment tracking today with a trusted printable payroll form. Save time, reduce errors, and maintain clear records—all while keeping your employee payment data organized.

W 9 Form 2024 2025 How To Fill Out And Download PDF Guru

W 9 Form 2024 2025 How To Fill Out And Download PDF Guru

2024 W 9 Form Fillable Printable Downloadable 2024 Instructions

2024 W 9 Form Fillable Printable Downloadable 2024 Instructions

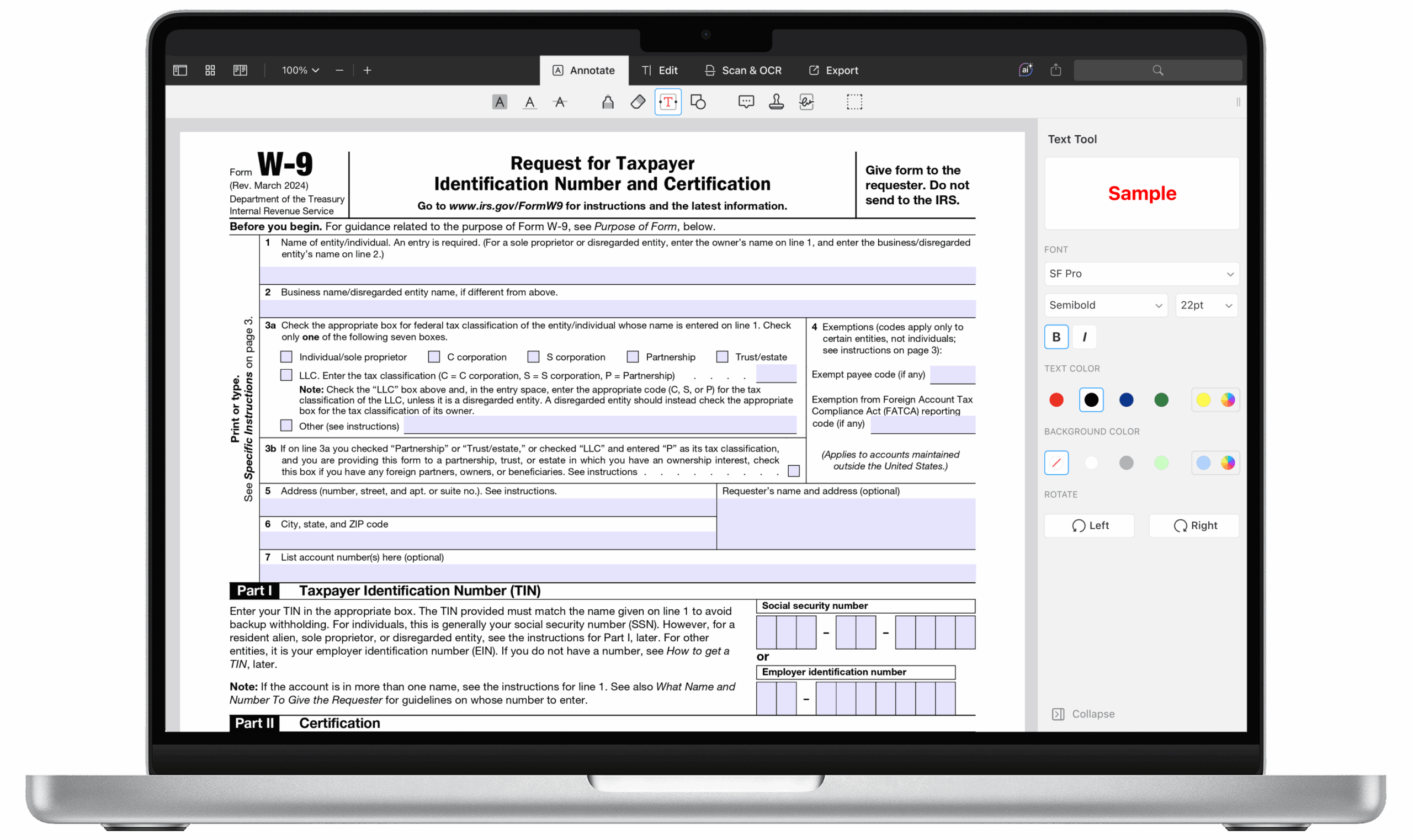

How To Fill Out IRS W9 Form 2024 2025 PDF PDF Expert

How To Fill Out IRS W9 Form 2024 2025 PDF PDF Expert

Free IRS Form W9 2025 PDF EForms

Free IRS Form W9 2025 PDF EForms

Handling employee payments doesn’t have to be difficult. A payroll template offers a speedy, accurate, and user-friendly method for tracking wages, hours, and deductions—without the need for complicated tools.

Whether you’re a startup founder, administrator, or independent contractor, using aprintable payroll helps ensure compliance with regulations. Simply access the template, produce a hard copy, and complete it by hand or type directly into the file before printing.