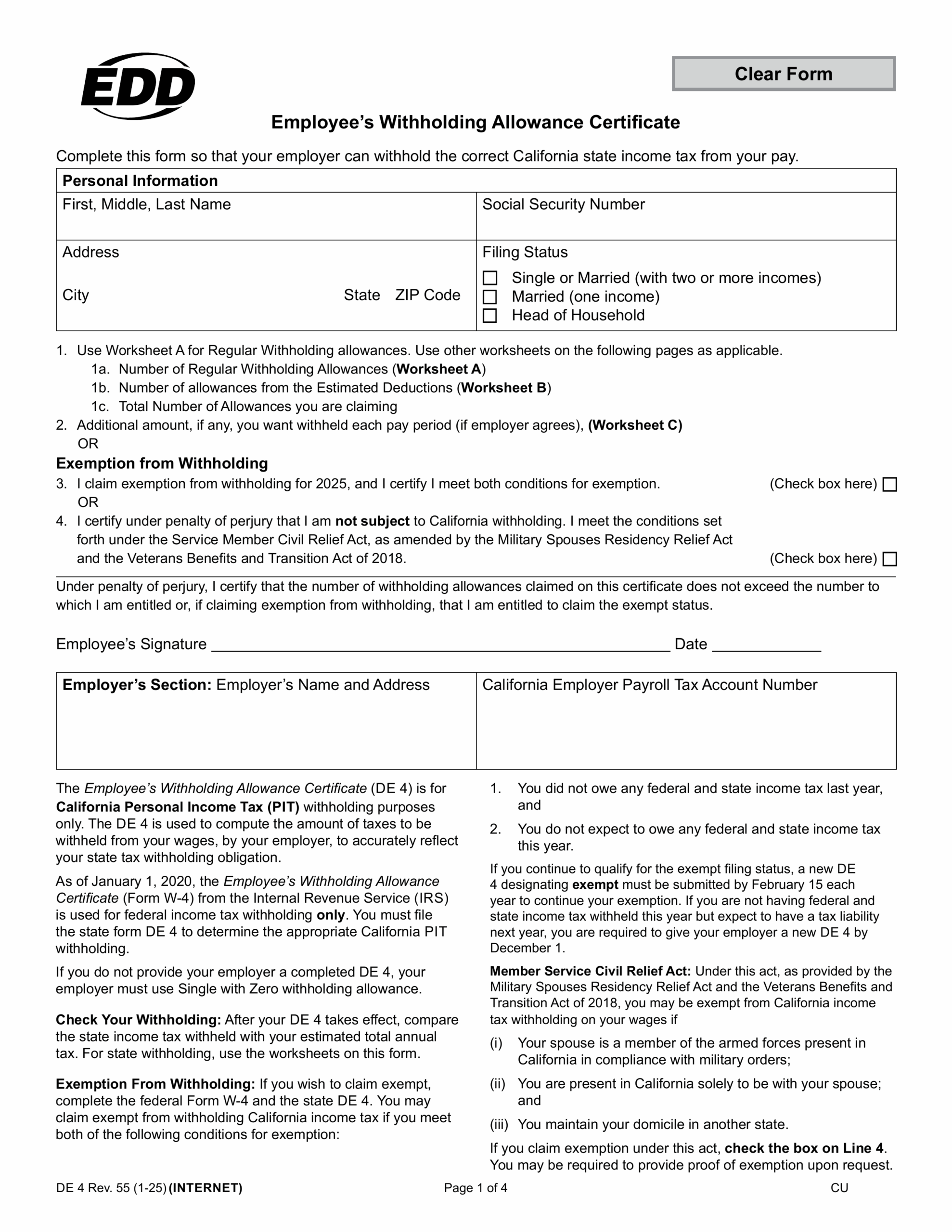

When it comes to taxes, one of the most important forms that individuals need to fill out is the W-4 form. This form is used by employers to determine how much federal income tax should be withheld from an employee’s paycheck. It’s crucial to fill out this form accurately to avoid any surprises come tax time.

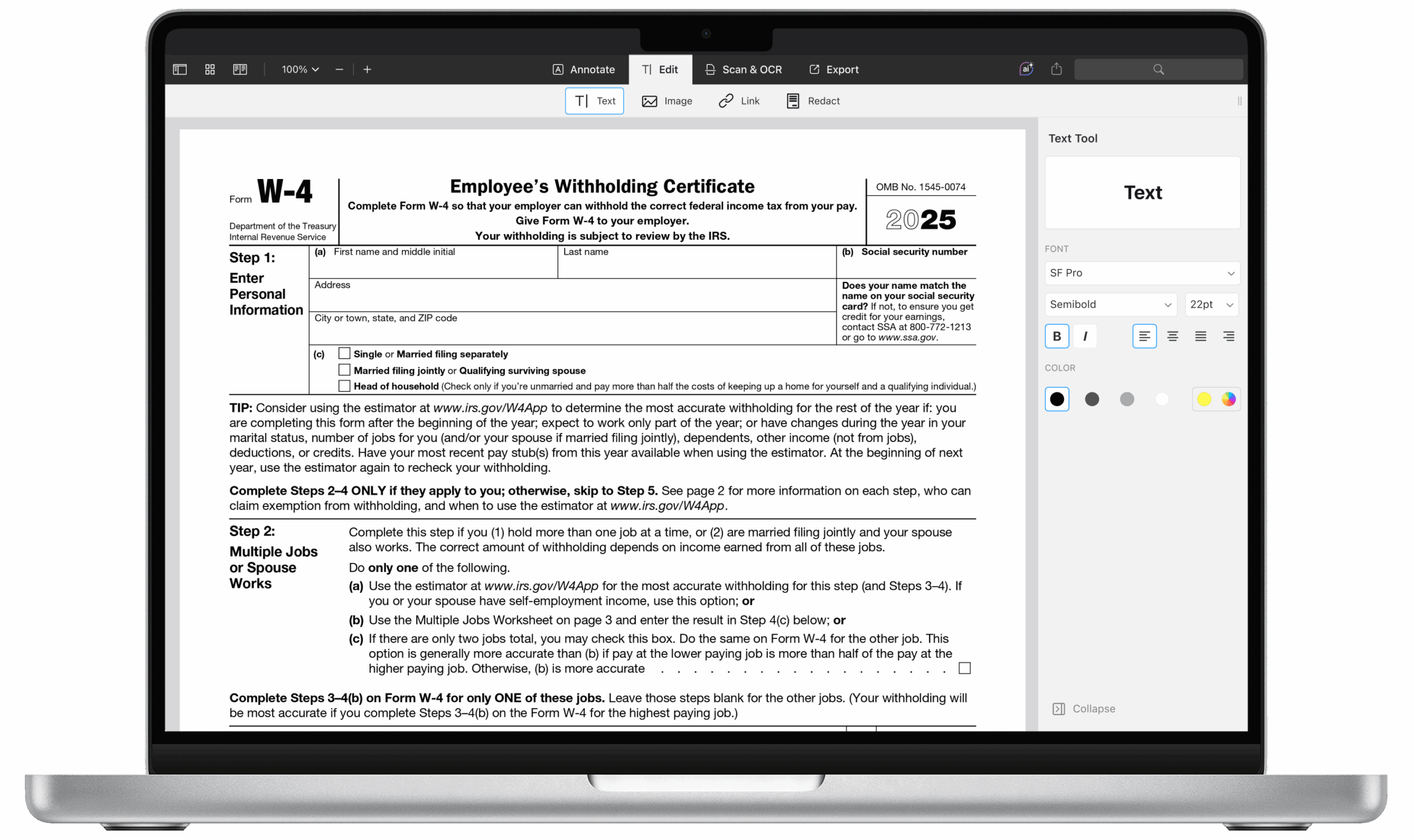

For the year 2025, the IRS has made some updates to the W-4 form to make it more user-friendly and efficient. The new W-4 form for 2025 is now available in a printable format, making it easier for individuals to fill out and submit to their employers.

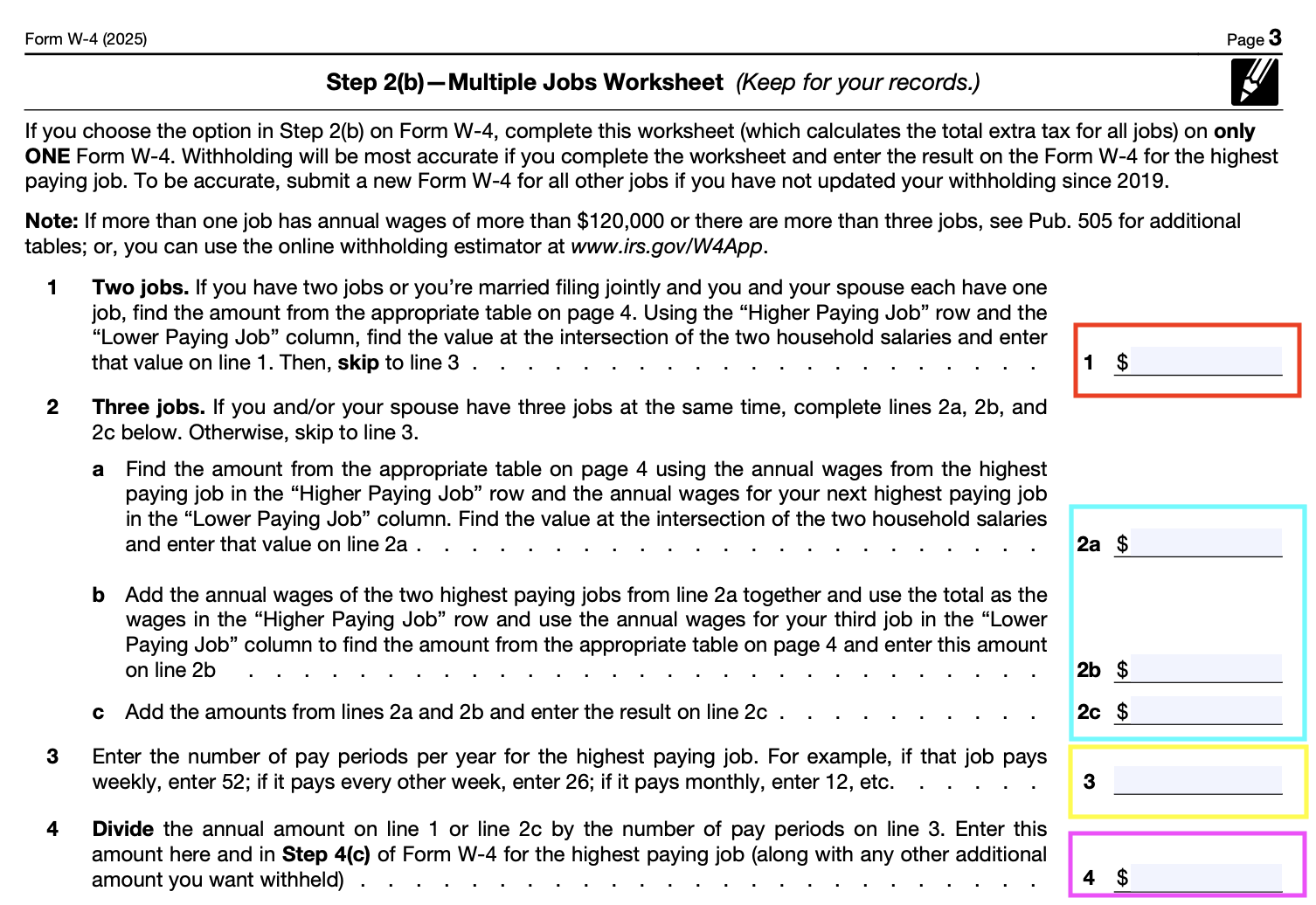

One of the key changes to the W-4 form for 2025 is the removal of the withholding allowances section. Instead, individuals will now simply need to provide their personal information, such as their name, address, filing status, and dependents. This streamlined approach aims to make the form less confusing and more straightforward for taxpayers.

Another important update to the W-4 form for 2025 is the addition of a new section for other income. This section allows individuals to specify any additional income they may have, such as interest, dividends, or retirement income. By including this information, taxpayers can ensure that the correct amount of federal income tax is withheld from their paycheck.

It’s important for individuals to review and update their W-4 form regularly, especially if there are any significant changes in their personal or financial situation. By doing so, taxpayers can avoid underpaying or overpaying their federal income tax throughout the year.

In conclusion, the new W-4 form for 2025 is now available in a printable format, making it easier for individuals to fill out and submit to their employers. With the updated form, taxpayers can provide accurate information to ensure the correct amount of federal income tax is withheld from their paycheck. Remember to review and update your W-4 form regularly to avoid any surprises at tax time.

Save and Print W-4 Form 2025 Printable

Printable payroll are ideal for teams that prefer non-digital systems or need hard copies for audit purposes. Most forms include fields for staff name, pay period, total earnings, withholdings, and net pay—making them both complete and easy to use.

Take control of your payroll process today with a trusted printable payroll form. Save time, reduce errors, and stay organized—all while keeping your payroll records organized.

How To Complete The 2025 W 4 Form A Simple Guide For Household

How To Complete The 2025 W 4 Form A Simple Guide For Household

2025 W 4 Form Step By Step Guide To Get Your Withholding Right

2025 W 4 Form Step By Step Guide To Get Your Withholding Right

How To Fill Out IRS W4 Form 2025 PDF PDF Expert

How To Fill Out IRS W4 Form 2025 PDF PDF Expert

Handling staff wages doesn’t have to be difficult. A W-4 Form 2025 Printable offers a quick, dependable, and straightforward method for tracking wages, hours, and deductions—without the need for complex software.

Whether you’re a startup founder, administrator, or independent contractor, using aW-4 Form 2025 Printable helps ensure proper documentation. Simply download the template, produce a hard copy, and fill it out by hand or edit it digitally before printing.