When it comes to tax season, one of the most important forms that taxpayers need to fill out is the W-4 form. This form helps employers determine how much federal income tax to withhold from an employee’s paycheck. It’s crucial to fill out this form accurately to avoid any discrepancies in tax withholding and to ensure that you are paying the correct amount of taxes throughout the year.

For the year 2025, the W-4 form has been updated to reflect any changes in tax laws and regulations. It’s essential for taxpayers to be familiar with the new form and understand how to fill it out correctly to avoid any issues with their taxes.

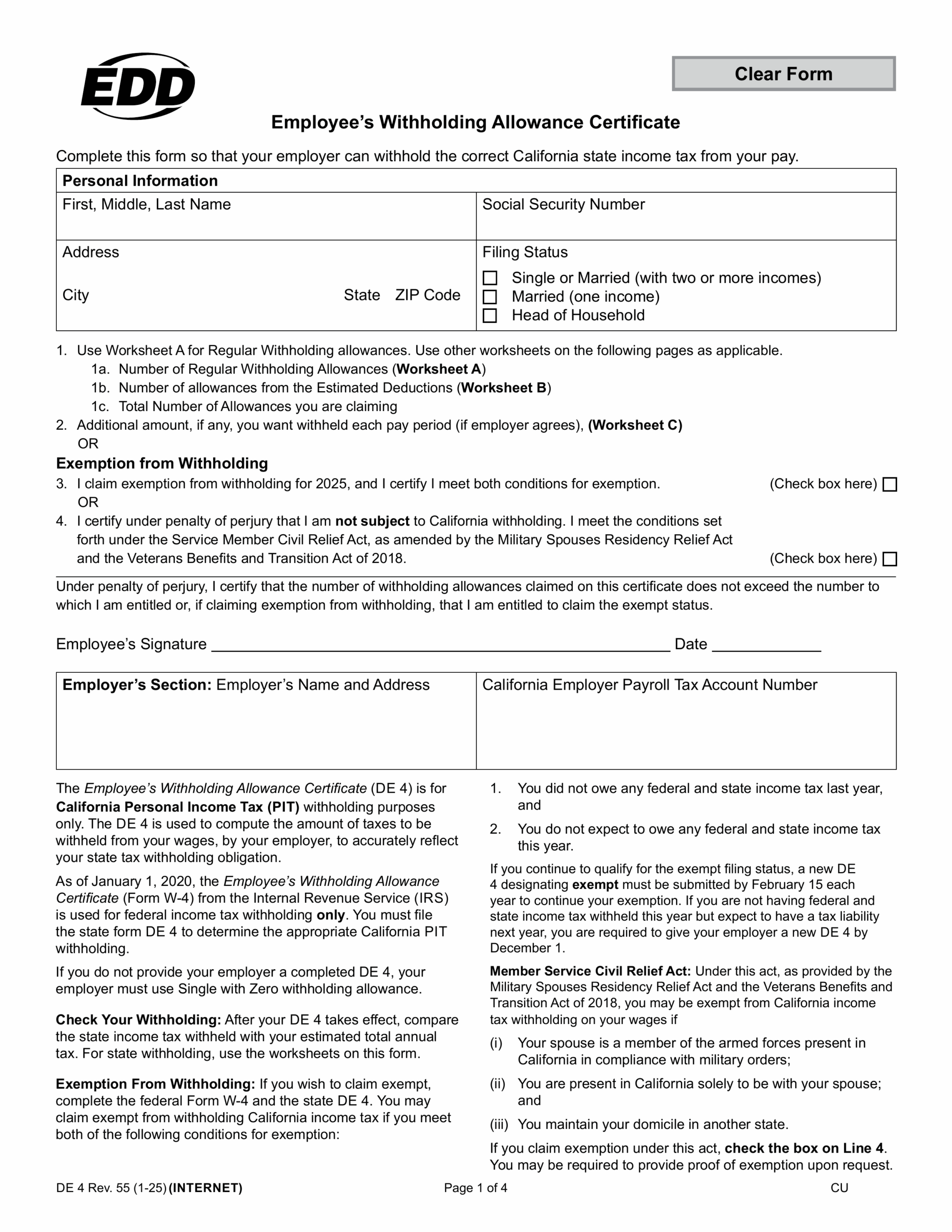

W-4 Form 2025 Printable

The W-4 form for 2025 is available in a printable format, making it easy for taxpayers to access and fill out. This form includes sections for personal information, such as your name, address, and Social Security number, as well as sections for indicating your filing status and any additional income or deductions you may have.

One of the significant changes to the 2025 W-4 form is the elimination of allowances. Instead of claiming a certain number of allowances, taxpayers will now use a worksheet to calculate their withholding based on their income, filing status, and other factors. This new system aims to simplify the process and make it more accurate.

It’s crucial for taxpayers to review their W-4 form each year, especially if their financial or personal situation has changed. By updating this form regularly, you can ensure that you are withholding the correct amount of taxes and avoid any surprises when it comes time to file your tax return.

Overall, the W-4 form for 2025 is an essential document for both employees and employers. By understanding how to fill out this form correctly and staying informed about any changes to tax laws, taxpayers can ensure that they are meeting their tax obligations and avoiding any penalties or fines.

As tax season approaches, be sure to download and fill out your W-4 form for 2025 to stay ahead of the game and ensure a smooth filing process. By taking the time to fill out this form accurately, you can set yourself up for financial success and avoid any headaches come tax time.