When it comes to tax season, filling out the necessary forms can be a daunting task. One of the most important forms to fill out is the W-4 form, which determines how much tax is withheld from your paycheck. Understanding how to properly fill out the W-4 form can save you time and money in the long run.

For the year 2024, the IRS has updated the W-4 form to make it easier for taxpayers to navigate. The new W-4 form for 2024 is available in printable format, making it convenient for individuals to fill out and submit to their employers. This updated form takes into account recent tax law changes and aims to simplify the withholding process.

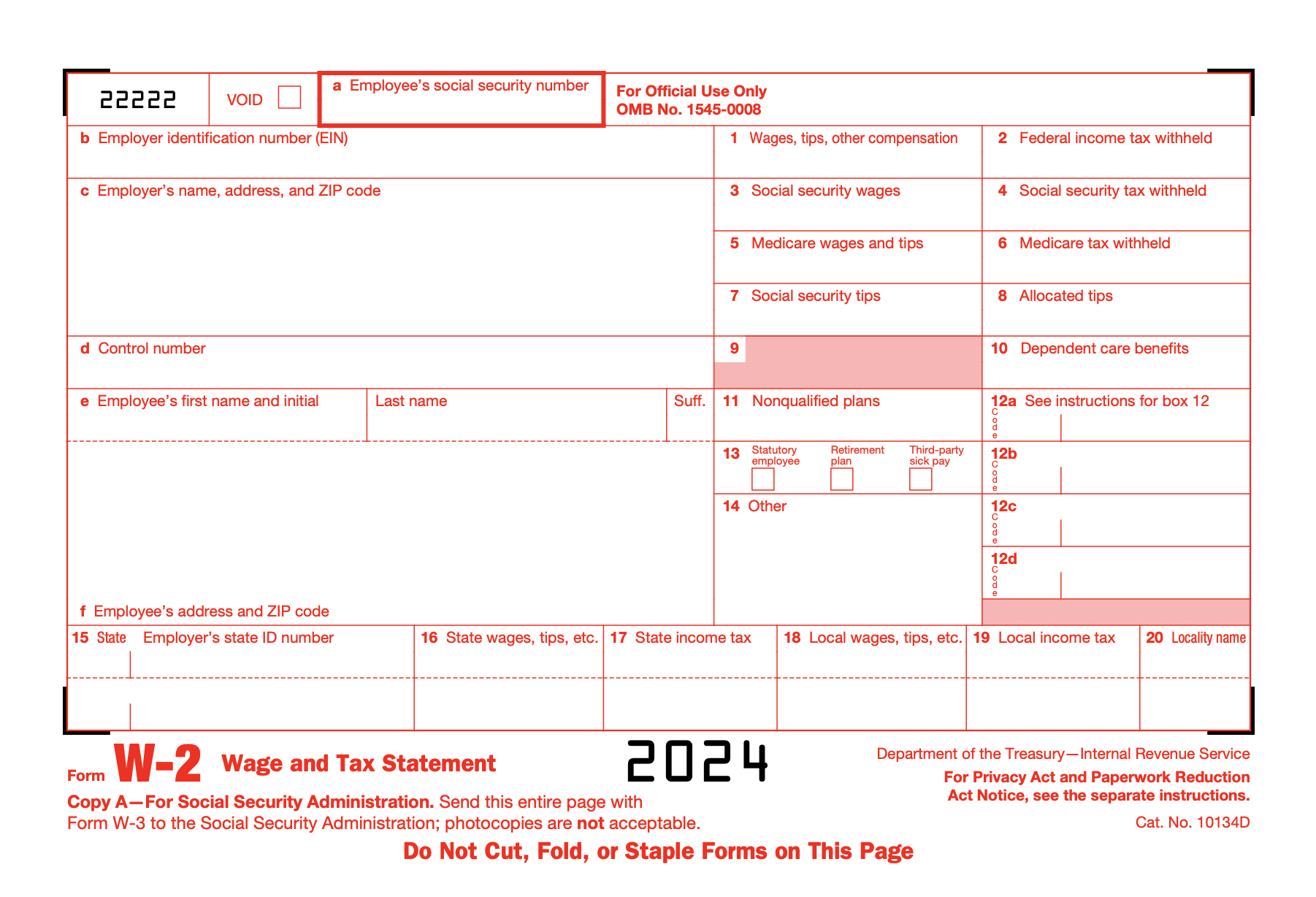

W-4 Form 2024 Printable

The W-4 form for 2024 consists of several sections that require basic information such as your name, address, filing status, and number of dependents. Additionally, there is a section where you can indicate any additional income or deductions that may affect your tax withholding. It is important to fill out this form accurately to ensure that the correct amount of tax is withheld from your paycheck.

One of the key changes to the W-4 form for 2024 is the elimination of allowances. Instead of claiming a certain number of allowances, taxpayers will now use a series of steps to calculate their withholding amount. This new method aims to make the withholding process more precise and reduce the likelihood of under or over withholding.

When filling out the W-4 form for 2024, it is important to carefully follow the instructions provided by the IRS. If you have any questions or are unsure about how to fill out the form, it is recommended to seek guidance from a tax professional. By taking the time to accurately complete the W-4 form, you can avoid any potential issues with your tax withholding.

In conclusion, the W-4 form for 2024 is an essential document that all taxpayers must fill out. The printable format of the form makes it easy to access and complete. By understanding the changes to the form and following the instructions provided, you can ensure that the correct amount of tax is withheld from your paycheck. Remember to review your W-4 form annually and make any necessary updates to reflect changes in your financial situation.