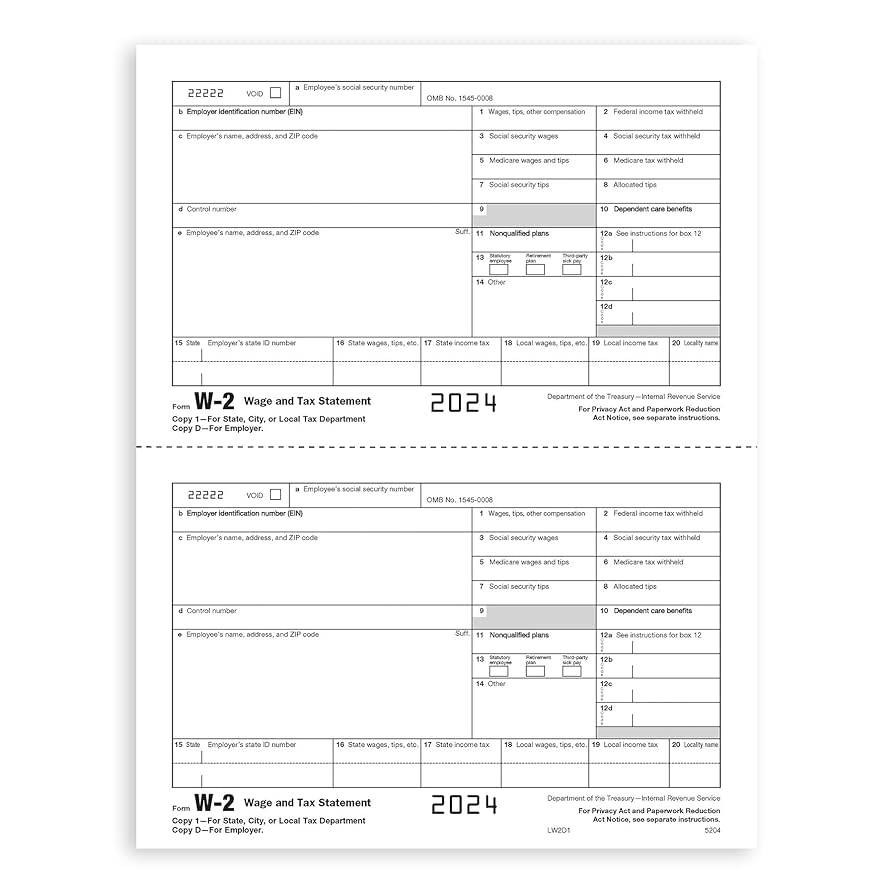

When tax season comes around, it’s essential to have all the necessary documents in order to accurately file your taxes. One of the most important forms you’ll need is the W-2 form, also known as the Wage and Tax Statement.

The W-2 form is a crucial document that provides information about your earnings and taxes withheld by your employer throughout the year. It shows how much you earned, how much was withheld for federal and state taxes, as well as Social Security and Medicare contributions.

W 2 Printable Form

The W-2 form is typically provided by your employer by the end of January each year. It is important to review this form carefully to ensure that all the information is accurate. If you find any discrepancies, you should contact your employer immediately to have them corrected before filing your taxes.

One of the conveniences of the W-2 form is that it can be easily accessed online and printed out if needed. This printable form is useful for individuals who may have misplaced the original document or need additional copies for tax purposes.

When filling out your tax return, you will need to include information from your W-2 form, such as your total earnings, taxes withheld, and other relevant details. Failing to include this information accurately can result in delays in processing your return or even potential penalties from the IRS.

It’s important to keep your W-2 form in a secure place after filing your taxes, as you may need it for future reference or in case of an audit. Make sure to store it in a safe location where you can easily access it if needed.

In conclusion, the W-2 printable form is a vital document that provides essential information for filing your taxes accurately. Be sure to review it carefully, keep it secure, and reach out to your employer if you have any concerns about its accuracy. By staying organized and informed, you can navigate tax season with confidence.