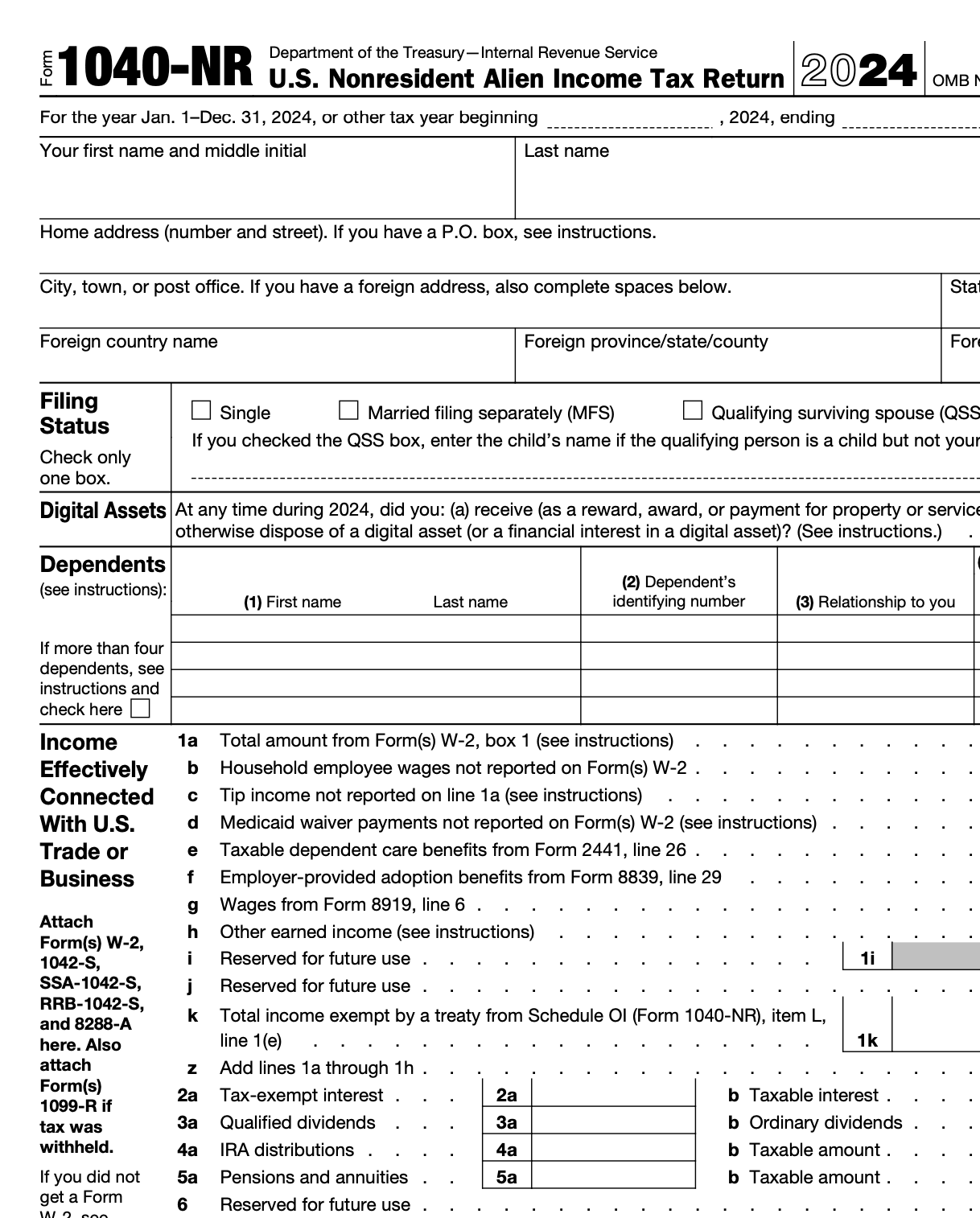

Filing taxes can be a daunting task for many individuals, but having the right tools can make the process much easier. One such tool is the Tax Form 1040 Printable, which is the standard form used by taxpayers to report their annual income and calculate their tax liability to the IRS. This form is essential for anyone who needs to file their taxes and ensure they are in compliance with the law.

With Tax Form 1040 Printable, taxpayers can easily access and fill out the necessary information required by the IRS. This form provides a comprehensive overview of an individual’s financial situation, including income, deductions, credits, and tax payments. By using this form, taxpayers can ensure they are accurately reporting their income and claiming all applicable deductions and credits to minimize their tax liability.

When filling out Tax Form 1040 Printable, taxpayers should gather all relevant financial documents, such as W-2s, 1099s, and receipts for deductions. They should carefully review each section of the form and provide accurate information to avoid any errors or discrepancies that could lead to penalties or audits. By taking the time to complete the form correctly, taxpayers can ensure a smooth and timely tax filing process.

One of the key benefits of using Tax Form 1040 Printable is the ability to file electronically, which can expedite the processing of tax returns and refunds. Taxpayers can also save a copy of their completed form for their records and easily access it for future reference. Additionally, the form provides instructions and guidance on how to complete each section, making it easier for taxpayers to navigate the tax filing process.

In conclusion, Tax Form 1040 Printable is a valuable tool for individuals who need to file their taxes and report their annual income to the IRS. By using this form, taxpayers can ensure they are in compliance with the law and accurately report their financial information. Whether filing electronically or by mail, Tax Form 1040 Printable provides a convenient and efficient way to fulfill tax obligations and avoid potential penalties. It is essential for taxpayers to take advantage of this resource and use it to their advantage when filing their taxes each year.

Quickly Access and Print Tax Form 1040 Printable

Printable payroll form are ideal for businesses that prefer non-digital systems or need hard copies for staff files. Most forms include fields for employee name, date range, gross pay, taxes, and net pay—making them both complete and user-friendly.

Take control of your payment tracking today with a trusted payroll template. Save time, minimize mistakes, and maintain clear records—all while keeping your financial logs clear.

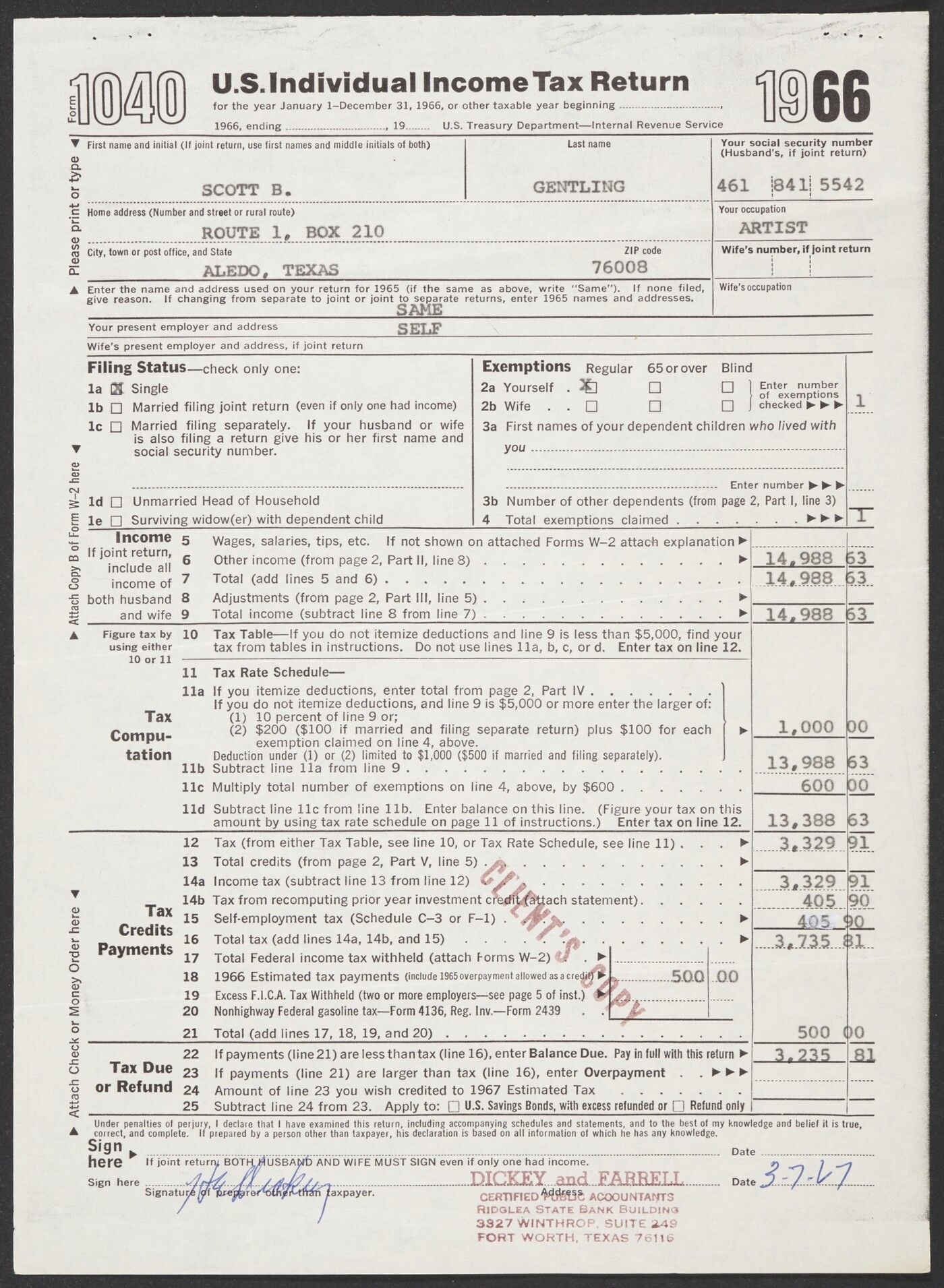

Form 1040 U S Individual Income Tax Return For Scott Gentling March 7 1967 Amon Carter Museum Of American Art

Form 1040 U S Individual Income Tax Return For Scott Gentling March 7 1967 Amon Carter Museum Of American Art

IRS Form 1040 Instructions Tax Year 2018 Form 1040 Included Irs Internal Revenue Service 9780359536269 Amazon Books

IRS Form 1040 Instructions Tax Year 2018 Form 1040 Included Irs Internal Revenue Service 9780359536269 Amazon Books

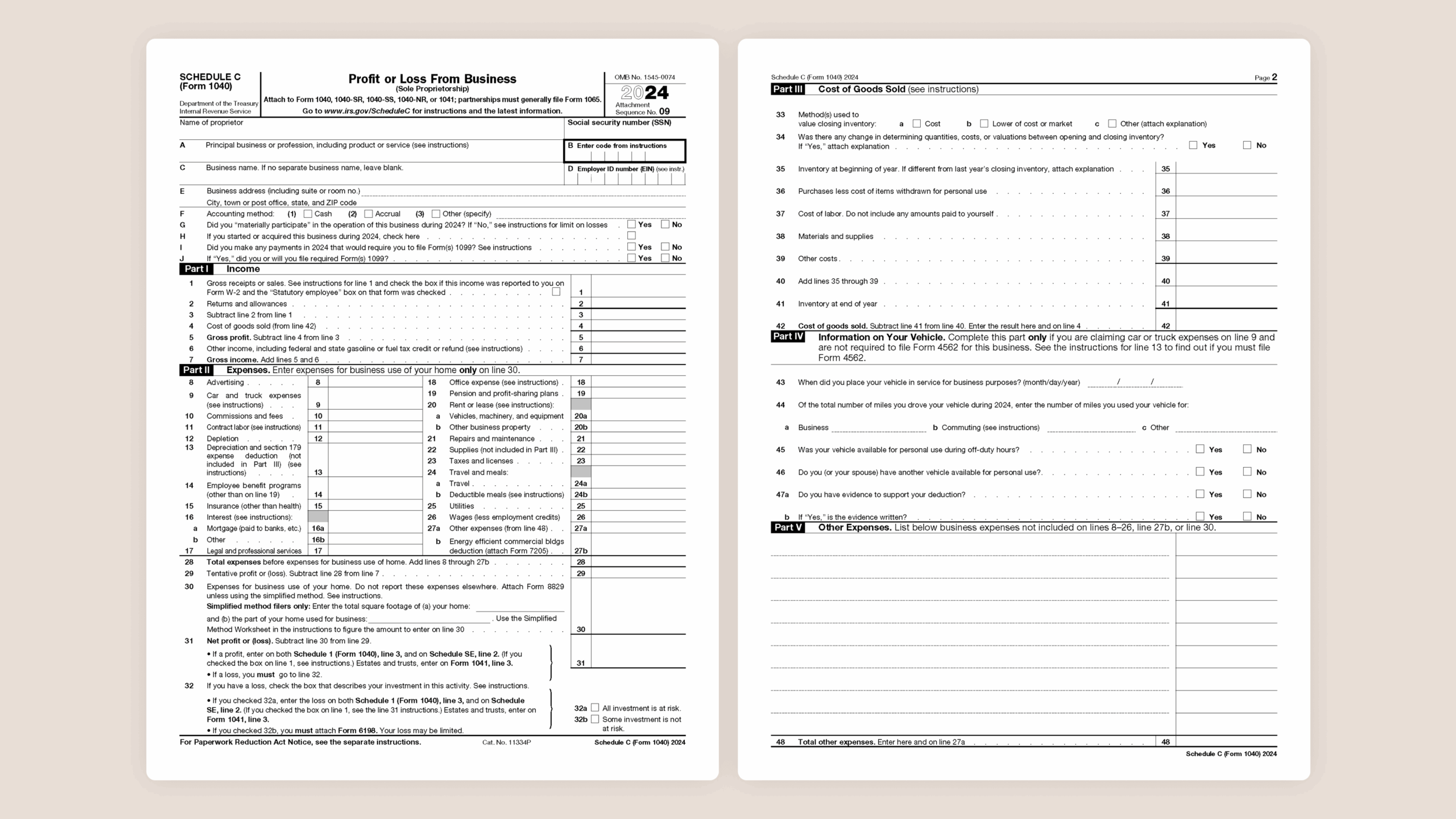

Understanding The Schedule C Tax Form

Understanding The Schedule C Tax Form

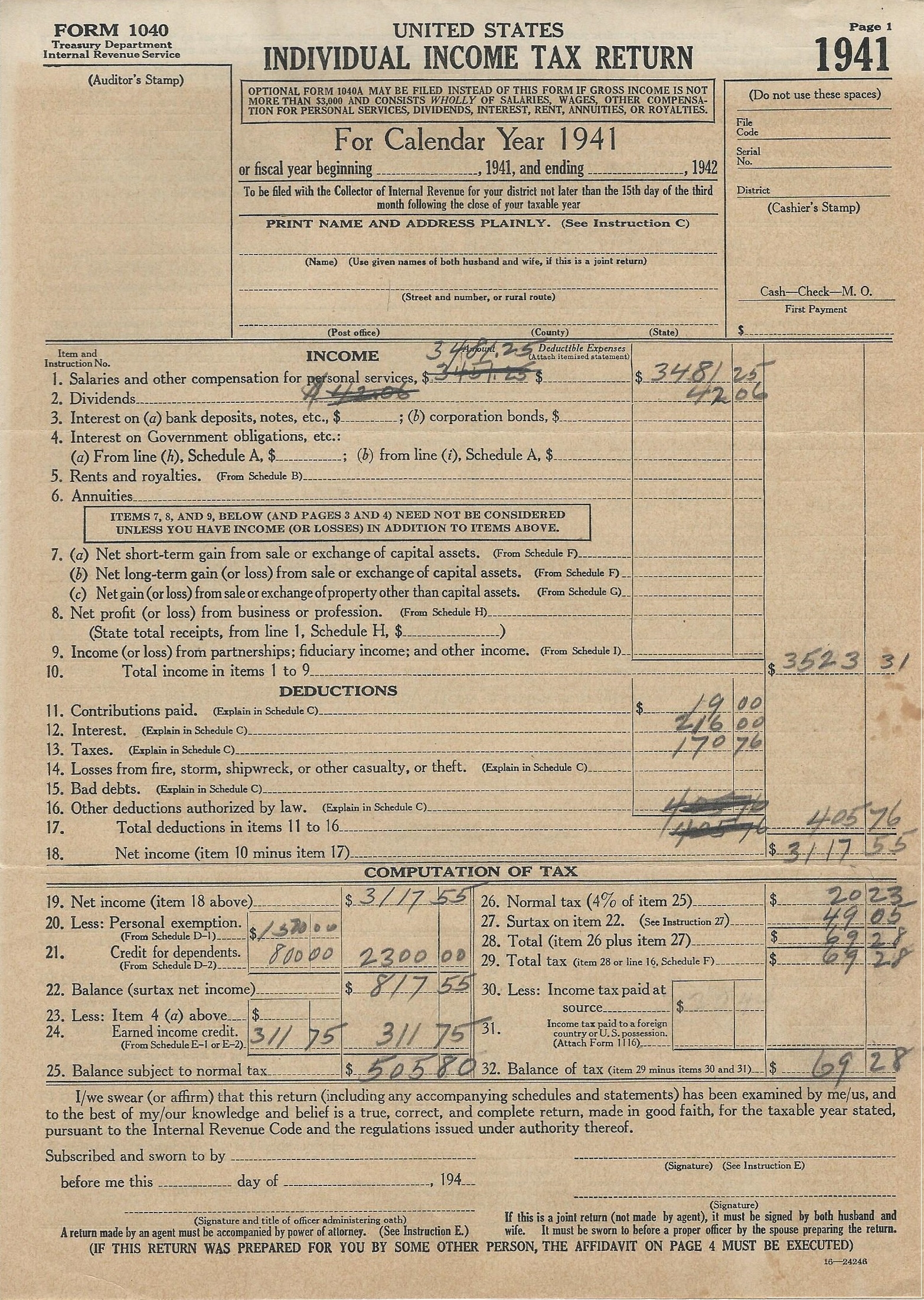

File Form 1040 1941 Jpg Wikimedia Commons

File Form 1040 1941 Jpg Wikimedia Commons

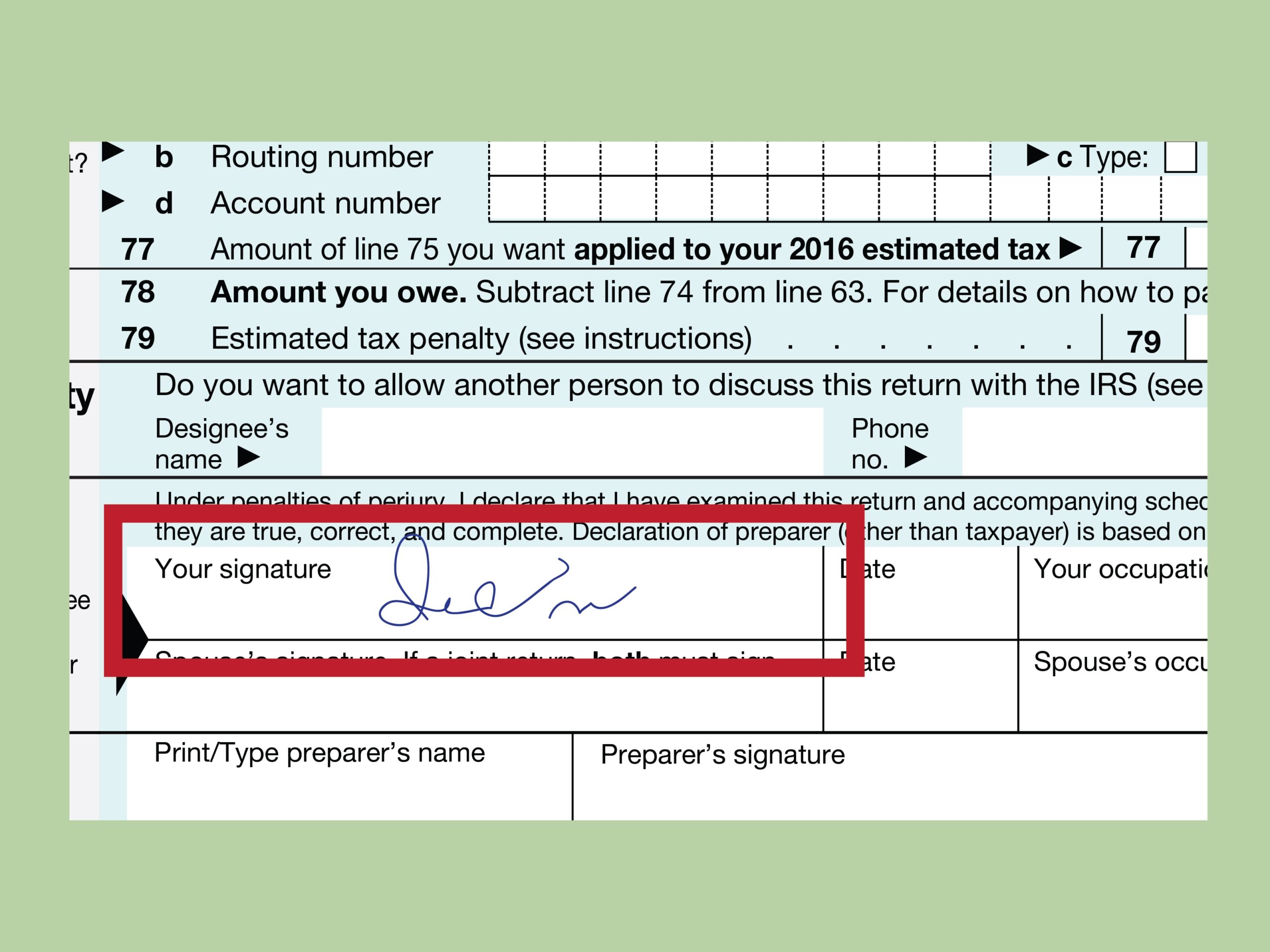

How To Fill Out IRS Form 1040 With Pictures WikiHow

How To Fill Out IRS Form 1040 With Pictures WikiHow

Processing staff wages doesn’t have to be complicated. A payroll template offers a fast, reliable, and straightforward method for tracking salaries, shifts, and taxes—without the need for complex software.

Whether you’re a startup founder, HR professional, or sole proprietor, using apayroll template helps ensure accurate record-keeping. Simply download the template, produce a hard copy, and complete it by hand or type directly into the file before printing.