Supplemental Security Income (SSI) is a federal program that provides financial assistance to individuals with disabilities, blind, or aged who have limited income and resources. It is designed to help meet basic needs such as food, clothing, and shelter. In order to receive SSI benefits, recipients are required to report their wages periodically to the Social Security Administration.

One way to report wages to the Social Security Administration is by using the Supplemental Security Income Printable Wage Reporting Form. This form allows recipients to easily document their earnings and submit it to the SSA for review. It is important to accurately report wages in order to ensure that SSI benefits are calculated correctly.

Supplemental Security Income Printable Wage Reporting Form

Supplemental Security Income Printable Wage Reporting Form

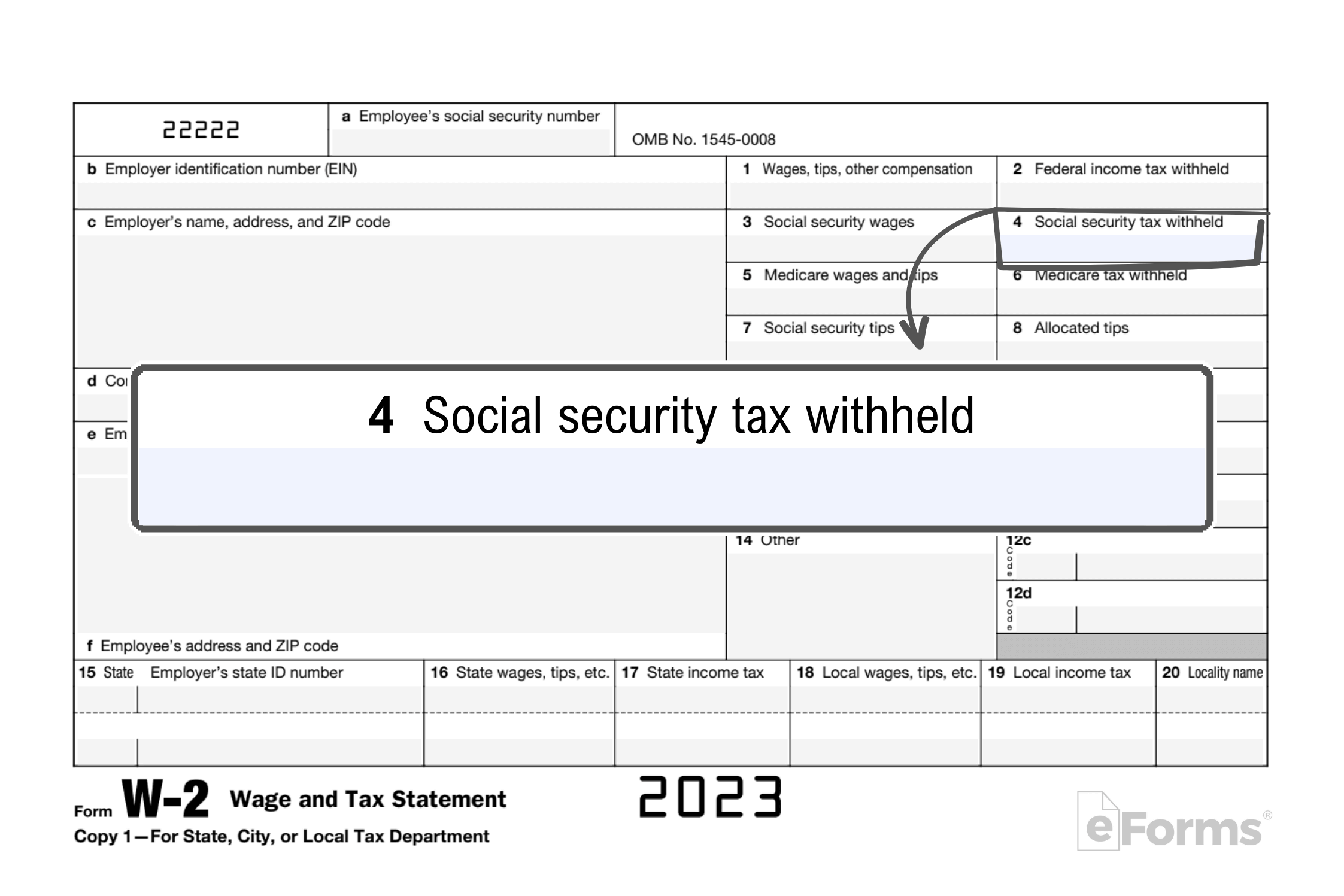

When filling out the Supplemental Security Income Printable Wage Reporting Form, recipients will need to provide details such as their name, address, Social Security number, employer information, and the amount of wages earned. It is crucial to include all sources of income, including wages, tips, bonuses, and any other earnings. Failure to report wages accurately can result in overpayment or underpayment of SSI benefits.

Recipients can download the Supplemental Security Income Printable Wage Reporting Form from the official Social Security Administration website or request a copy from their local SSA office. Once the form is completed, it can be submitted online, by mail, or in person. It is recommended to keep a copy of the form for personal records and to ensure that all information is accurately reported.

Overall, the Supplemental Security Income Printable Wage Reporting Form is a valuable tool for SSI recipients to report their earnings and maintain eligibility for benefits. By accurately documenting wages and submitting the form on time, recipients can avoid potential issues with their SSI benefits. It is important to stay informed about reporting requirements and to seek assistance from the SSA if needed.

In conclusion, the Supplemental Security Income Printable Wage Reporting Form is essential for SSI recipients to report their wages and maintain eligibility for benefits. By following the guidelines and accurately documenting earnings, recipients can ensure that their SSI benefits are calculated correctly. It is crucial to stay informed about reporting requirements and to seek assistance from the SSA if needed.