Managing your finances is an essential part of staying organized and on top of your expenses. One tool that can help you keep track of your spending and ensure you don’t overspend is a check register. While online banking and mobile apps are popular ways to monitor your accounts, a simple printable check register can also be a useful and convenient method to record your transactions.

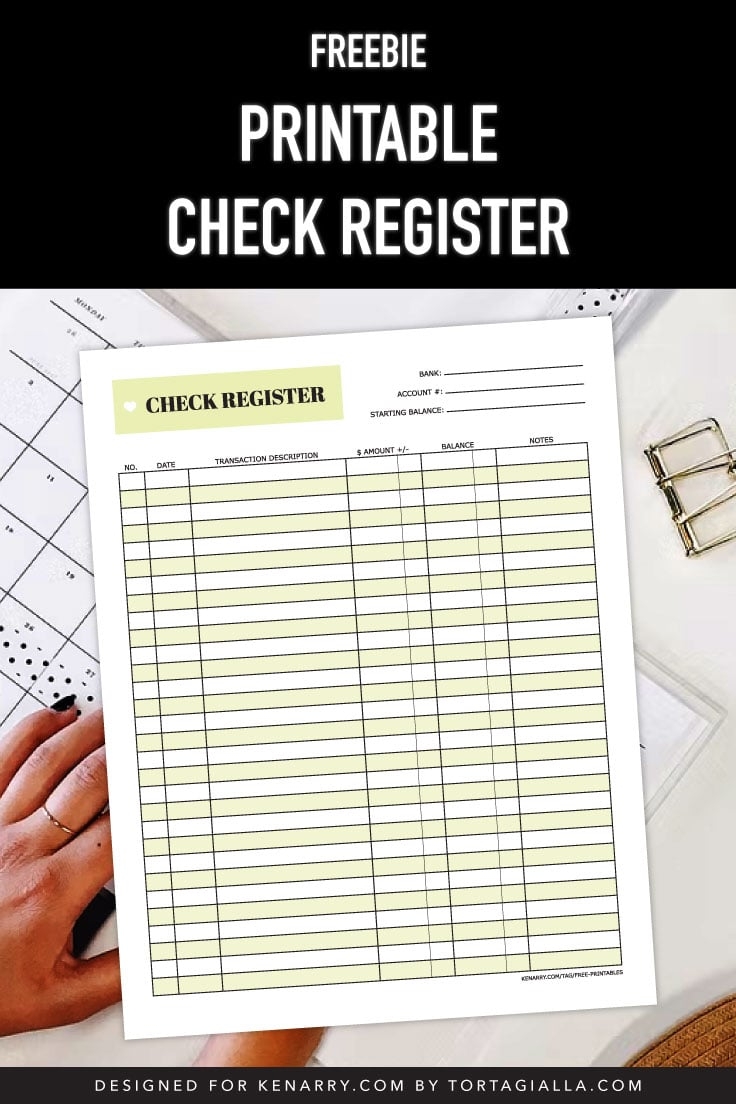

A simple printable check register is a basic document that allows you to record all of your transactions, including checks written, deposits made, and other withdrawals or payments. It typically includes columns for the date, description of the transaction, check number (if applicable), debit or credit amount, and running balance. By filling out this register each time you make a transaction, you can easily keep track of your account balance and monitor your spending habits.

Simple Printable Check Register

Simple Printable Check Register

Handling staff wages doesn’t have to be difficult. A payroll printable offers a fast, accurate, and easy-to-use method for tracking employee pay, hours, and withholdings—without the need for complicated tools.

Stay Organized with a Payroll Printable – Easy & Efficient Tool!

Whether you’re a startup founder, administrator, or sole proprietor, using apayroll template helps ensure proper documentation. Simply download the template, print it, and complete it by hand or type directly into the file before printing.

One of the benefits of using a printable check register is that it provides a physical record of your transactions that you can refer back to at any time. This can be especially helpful if you need to dispute a charge or reconcile your account. Additionally, having a written record of your spending can help you identify areas where you may be overspending and make adjustments to your budget.

Another advantage of a simple printable check register is that it doesn’t require any special software or technology to use. All you need is a printer and a basic understanding of how to fill out the register. You can customize the register to fit your specific needs and preferences, making it a personalized tool for managing your finances.

In conclusion, a simple printable check register is a valuable resource for anyone looking to take control of their finances and stay organized with their spending. By using this tool to record your transactions and monitor your account balance, you can make more informed decisions about your money and work towards your financial goals. So why not give it a try and see how it can benefit your financial management?