Sales income is an essential aspect of any business, as it reflects the revenue generated from selling products or services. Keeping track of sales income is crucial for monitoring the financial health of a company and making informed business decisions.

One way to organize and document sales income is through the use of a printable form. This form can help businesses record sales transactions, track income sources, and calculate total revenue. Having a printable form can make the process of managing sales income more efficient and organized.

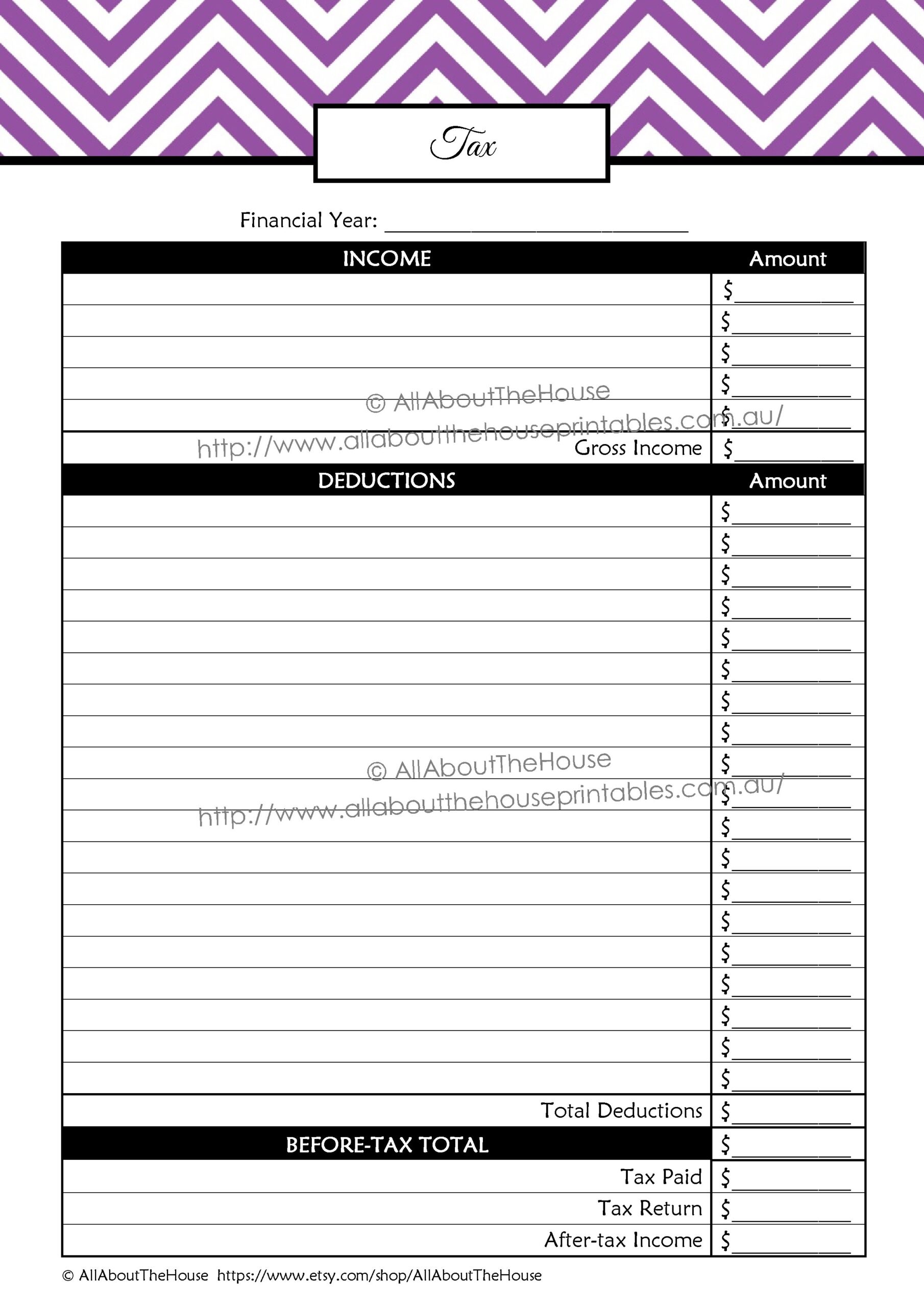

Sales Income Printable Form

A sales income printable form typically includes fields for recording information such as date of sale, customer name, product or service sold, quantity, unit price, total amount, and payment method. This form can be customized to suit the specific needs of a business, making it a versatile tool for tracking sales income.

By using a sales income printable form, businesses can easily keep track of sales transactions, identify trends in revenue generation, and analyze the performance of different products or services. This information can be invaluable for making strategic decisions, setting sales targets, and forecasting future income.

Furthermore, a sales income printable form can also serve as a useful document for tax purposes. By accurately recording sales income, businesses can ensure compliance with tax regulations and avoid potential penalties or audits. Having a well-maintained sales income form can simplify the process of preparing financial statements and filing tax returns.

In conclusion, a sales income printable form is a valuable tool for businesses to track, organize, and document sales transactions. By using this form, businesses can streamline the process of managing sales income, make informed decisions, and maintain compliance with tax regulations. Investing in a sales income printable form can contribute to the overall efficiency and success of a business.