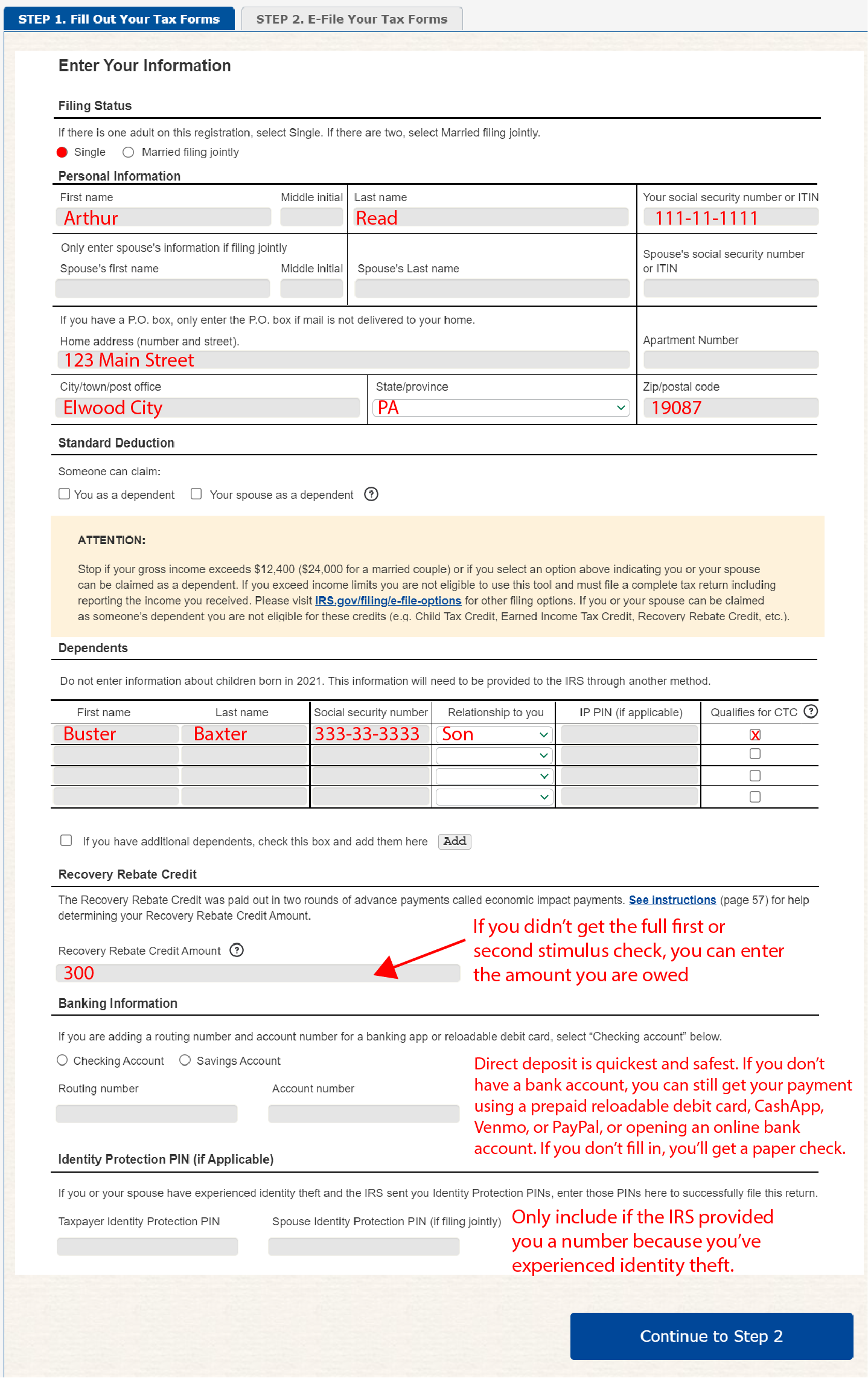

The Recovery Rebate Credit is a tax credit provided by the government to help individuals who did not receive the full amount of the Economic Impact Payments (stimulus checks) they were entitled to. If you were eligible for the payments but did not receive them, you can claim the Recovery Rebate Credit on your tax return to get the money you are owed.

One way to claim the Recovery Rebate Credit is by using the printable form provided by the IRS. This form allows you to easily calculate the amount of credit you are eligible for and include it in your tax return. By filling out this form, you can ensure that you receive the full amount of the credit you are entitled to.

Recovery Rebate Credit Printable Form

Recovery Rebate Credit Printable Form

When filling out the Recovery Rebate Credit Printable Form, make sure to have all the necessary information on hand, including any Economic Impact Payment amounts you did receive, your filing status, and any dependents you may have. You will also need to calculate the amount of credit you are eligible for based on your income and other factors.

It is important to note that the Recovery Rebate Credit Printable Form is only for individuals who did not receive the full amount of the Economic Impact Payments they were entitled to. If you received the full amount or more, you do not need to claim the credit on your tax return. However, if you believe you are eligible for additional funds, be sure to fill out the form and include it with your tax return.

By using the Recovery Rebate Credit Printable Form, you can ensure that you receive the full amount of the credit you are entitled to. It is a simple and straightforward way to claim any missing stimulus payments and get the money you need during these challenging times. Be sure to check the IRS website for the most up-to-date form and instructions on how to claim the credit on your tax return.

Overall, the Recovery Rebate Credit Printable Form is a valuable tool for individuals who did not receive the full amount of the Economic Impact Payments they were entitled to. By filling out this form and including it with your tax return, you can ensure that you receive the full amount of the credit you are owed. Take advantage of this opportunity to claim any missing stimulus payments and get the financial support you need.