When starting a new job, one of the first tasks you’ll need to complete is filling out a W4 form. This form, issued by the Internal Revenue Service (IRS), is used by employers to determine how much federal income tax to withhold from your paycheck. It’s important to fill out this form accurately to ensure you’re not overpaying or underpaying your taxes.

For those who prefer to fill out their W4 form by hand rather than online, printable versions of the form are available on the IRS website. These printable forms can be downloaded and printed at home, making it easy to fill out the form at your convenience.

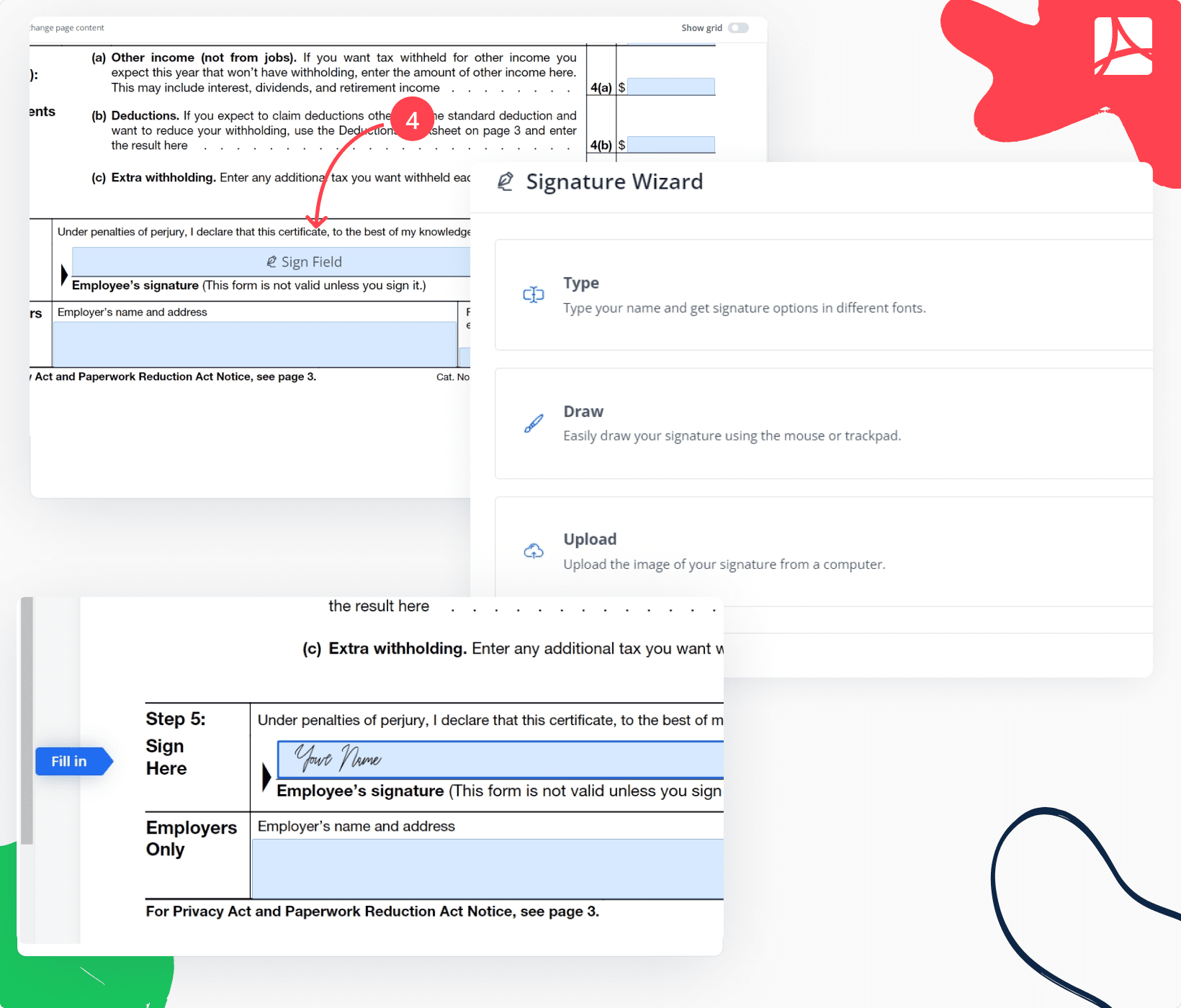

When filling out the W4 form, you’ll need to provide basic information such as your name, address, social security number, and filing status. You’ll also need to indicate the number of allowances you’re claiming, which will impact how much tax is withheld from your paycheck. Additionally, you can choose to have additional tax withheld if you anticipate owing taxes at the end of the year.

It’s important to review and update your W4 form regularly, especially if you experience major life changes such as getting married, having a child, or getting a new job. By keeping your W4 form up to date, you can ensure that the correct amount of tax is being withheld from your paycheck.

Once you’ve completed your W4 form, you’ll need to submit it to your employer for processing. Your employer will use the information on the form to calculate how much federal income tax to withhold from your paycheck. If you have any questions or need assistance filling out the form, you can always reach out to your employer or a tax professional for guidance.

Overall, the W4 form is a crucial document that ensures you’re paying the right amount of federal income tax throughout the year. By utilizing the printable W4 form provided by the IRS, you can easily and accurately fill out this important document and avoid any issues with your tax withholding.