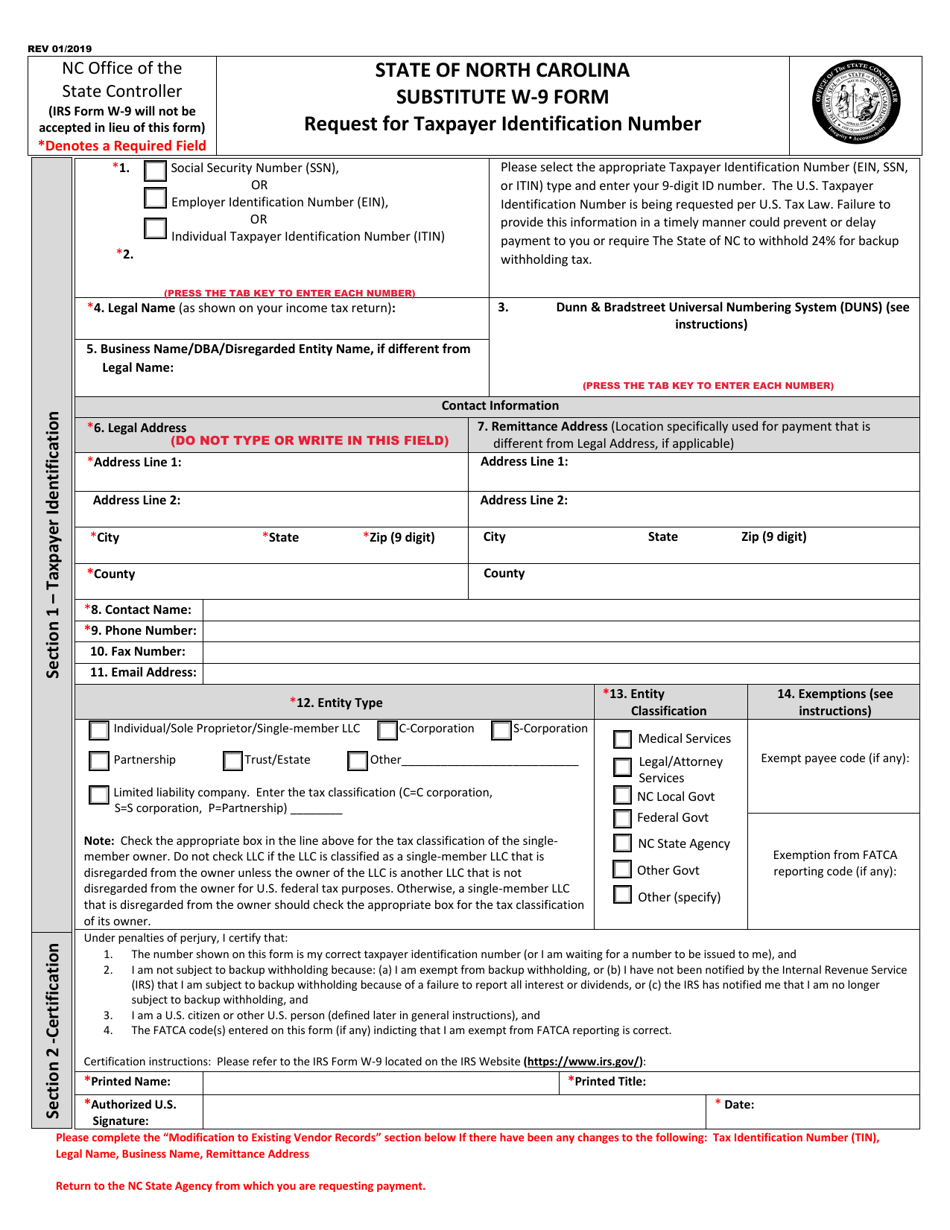

A W-9 tax form is an official document that is used by businesses to collect important information from independent contractors, freelancers, and other non-employees who provide services to them. This form is used to gather the individual’s taxpayer identification number (TIN) or social security number for tax purposes.

If you are a business owner or a contractor looking to fill out a W-9 form, you can easily find printable versions online. Simply search for “Printable W-9 Tax Form” on your preferred search engine, and you will find several reputable websites that offer free downloads of the form.

Once you have downloaded the form, carefully read the instructions provided to ensure that you fill it out correctly. Make sure to provide your legal name, address, and taxpayer identification number accurately to avoid any issues with the IRS in the future.

After filling out the form, you will need to sign and date it before submitting it to the requesting business or client. Keep a copy of the completed form for your records, as you may need it for tax purposes or in case of an audit.

It is important to note that the information provided on the W-9 form is used by businesses to report payments made to you to the IRS. Failure to provide accurate information on the form could result in penalties or other consequences, so it is essential to take the time to fill it out correctly.

Closing Thoughts

In conclusion, the W-9 tax form is a crucial document for businesses and contractors to ensure compliance with IRS regulations. By utilizing printable versions of the form, you can easily gather and provide the necessary information required for tax purposes. Be sure to complete the form accurately and submit it in a timely manner to avoid any potential issues in the future.