When it comes to tax season, it’s important to have all the necessary forms ready to ensure a smooth filing process. One of the most commonly used forms is the W-9, which is used to request taxpayer identification information from individuals or businesses. The IRS requires this form to be filled out by anyone who is hired to perform services, as well as for other various purposes.

Having a printable W-9 IRS form handy can make the process much easier for both parties involved. It allows for easy access to the form whenever it is needed, whether it’s for a new job, a contractor agreement, or any other situation that requires taxpayer information to be provided.

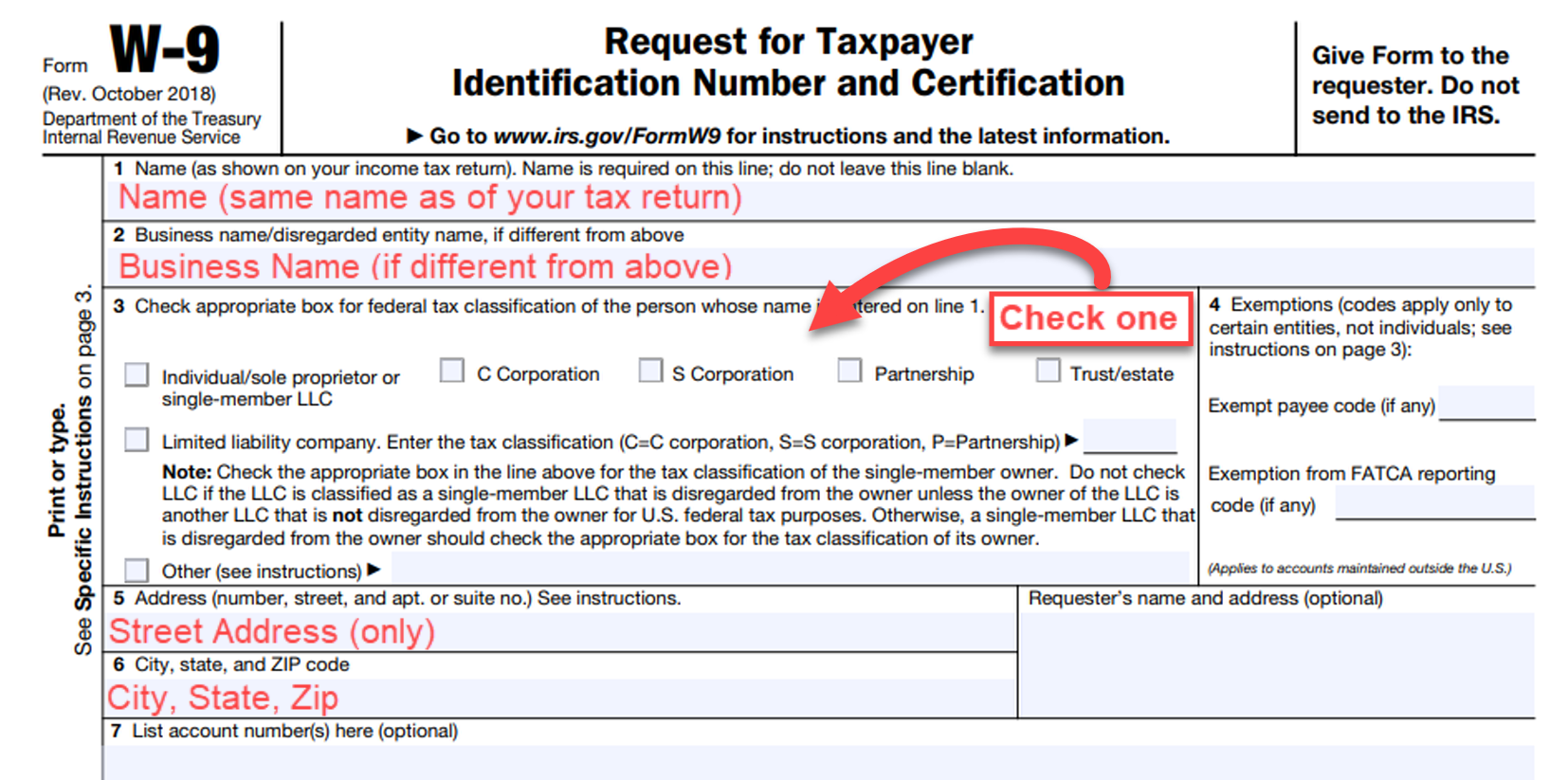

When filling out the W-9 form, it’s important to ensure that all the information provided is accurate and up to date. This includes providing the correct name, address, and taxpayer identification number (TIN). Failure to provide accurate information could result in penalties or other consequences, so it’s crucial to double-check all information before submitting the form.

Having a printable W-9 form on hand can also save time and effort when working with multiple clients or employers. Instead of having to fill out a new form each time, simply print out a copy of the form and have it ready to go whenever needed. This can streamline the process and make it easier to keep track of all the necessary paperwork.

Overall, having a printable W-9 IRS form is a convenient and efficient way to ensure that all necessary taxpayer information is provided accurately and on time. By keeping a copy of the form readily available, both individuals and businesses can simplify the process of requesting and providing taxpayer information, making tax season a little less stressful for everyone involved.

Make sure to download and print out a copy of the W-9 IRS form to have on hand for whenever it is needed. Having this form readily available can save time and effort when it comes to providing taxpayer information, and ensure that all necessary information is accurately and efficiently provided.