When it comes to tax season, one of the most important forms that individuals and businesses need to be familiar with is the W-9 form. This form is used to request the taxpayer identification number (TIN) of a U.S. person, which is typically an individual or business entity. The information provided on the W-9 form is used by the entity requesting it to report income paid to the IRS.

For the year 2025, the IRS has released an updated version of the W-9 form, known as the Printable W-9 Form 2025. This form includes all the necessary fields for individuals and businesses to fill out, including name, address, taxpayer identification number, and certification.

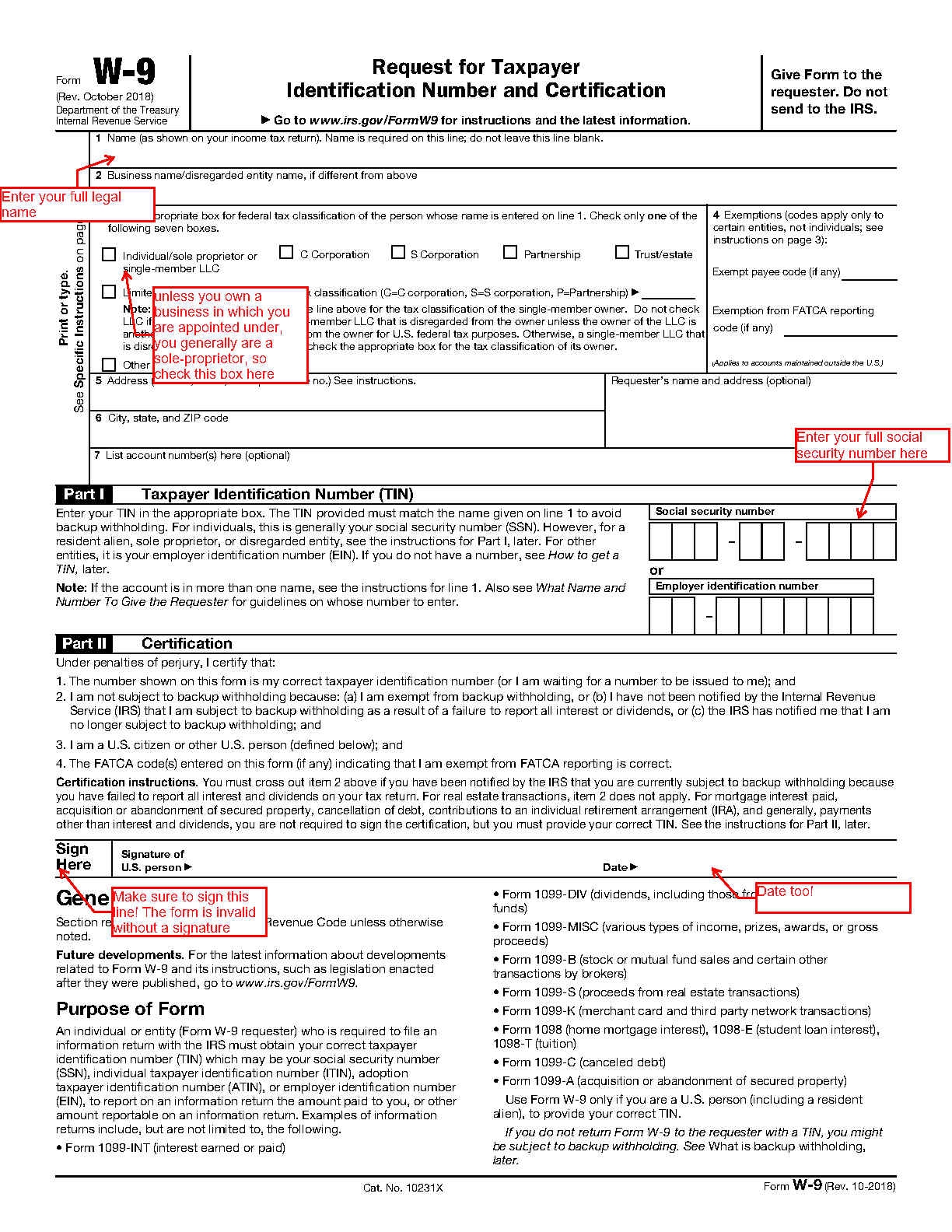

Printable W-9 Form 2025

The Printable W-9 Form 2025 is a crucial document for both individuals and businesses to have on hand during tax season. This form ensures that the correct taxpayer identification number is provided to the IRS, which helps to prevent any potential issues or delays in processing tax returns.

When filling out the Printable W-9 Form 2025, it’s important to ensure that all information is accurate and up to date. Any errors or discrepancies on the form could lead to complications with tax filings, so it’s essential to double-check all information before submitting the form.

Once the Printable W-9 Form 2025 is completed, it should be kept on file for future reference. This form may be requested by employers, clients, or other entities that need to report income paid to the IRS. Having a copy of the form readily available can help streamline the tax reporting process and ensure that all necessary information is accurately reported.

In conclusion, the Printable W-9 Form 2025 is a vital document for individuals and businesses to have on hand during tax season. By accurately completing and retaining this form, taxpayers can ensure that their taxpayer identification number is correctly reported to the IRS, helping to avoid any potential issues with tax filings. Be sure to download and fill out the Printable W-9 Form 2025 to stay organized and compliant with IRS regulations.