When it comes to taxes, staying organized is key. One important form that you may come across is the W-9 form. This form is used by businesses to collect information from independent contractors, freelancers, and other non-employees for tax purposes. It is crucial to have this form filled out correctly to ensure that your tax filings are accurate and up to date.

Many people prefer to have a printable version of the W-9 form on hand for convenience. This allows them to easily access the form whenever it is needed and fill it out at their own pace. Having a printable W-9 form can save time and make the tax preparation process much smoother.

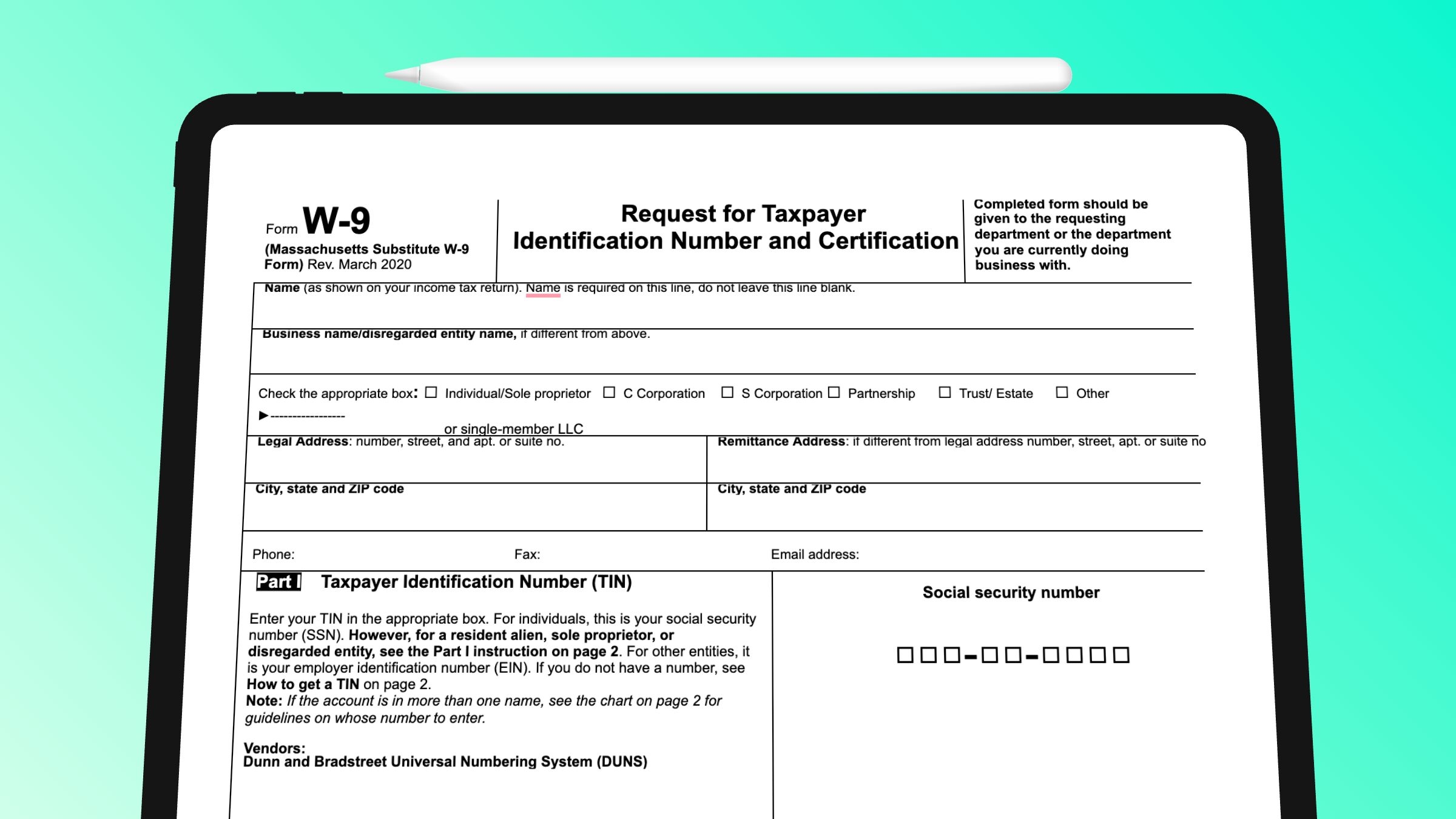

Printable W 9 Form

There are many websites that offer a printable version of the W-9 form that you can easily download and print. These forms typically come in a PDF format that can be filled out electronically or printed and filled out by hand. It is important to make sure that you are using the most current version of the form to avoid any discrepancies or issues with your tax filings.

When filling out the W-9 form, you will need to provide your name, address, taxpayer identification number (such as a Social Security number or employer identification number), and certification of exemption, if applicable. It is important to fill out the form accurately and completely to avoid any delays in payment or issues with the IRS.

Once the form is filled out, you will need to submit it to the business or entity that is requesting the information. They will use the information provided on the form to prepare and file 1099 forms at the end of the year. It is important to keep a copy of the completed form for your records in case you need to reference it in the future.

In conclusion, having a printable W-9 form on hand can make the tax preparation process much easier and more convenient. By ensuring that the form is filled out accurately and completely, you can avoid any issues with your tax filings and ensure that everything is in order. So, be sure to have a printable W-9 form ready whenever you need it!