Completing your W-4 form correctly is crucial as it determines how much tax will be withheld from your paycheck. The W-4 form is a form that an employer uses to determine how much federal income tax to withhold from an employee’s paycheck. It’s important to fill out this form accurately to avoid any issues with your taxes.

For those who prefer a hard copy of the W-4 form instead of completing it online, a printable version is available. This option allows you to easily fill out the form at your convenience and submit it to your employer. Here is everything you need to know about the printable W-4 form.

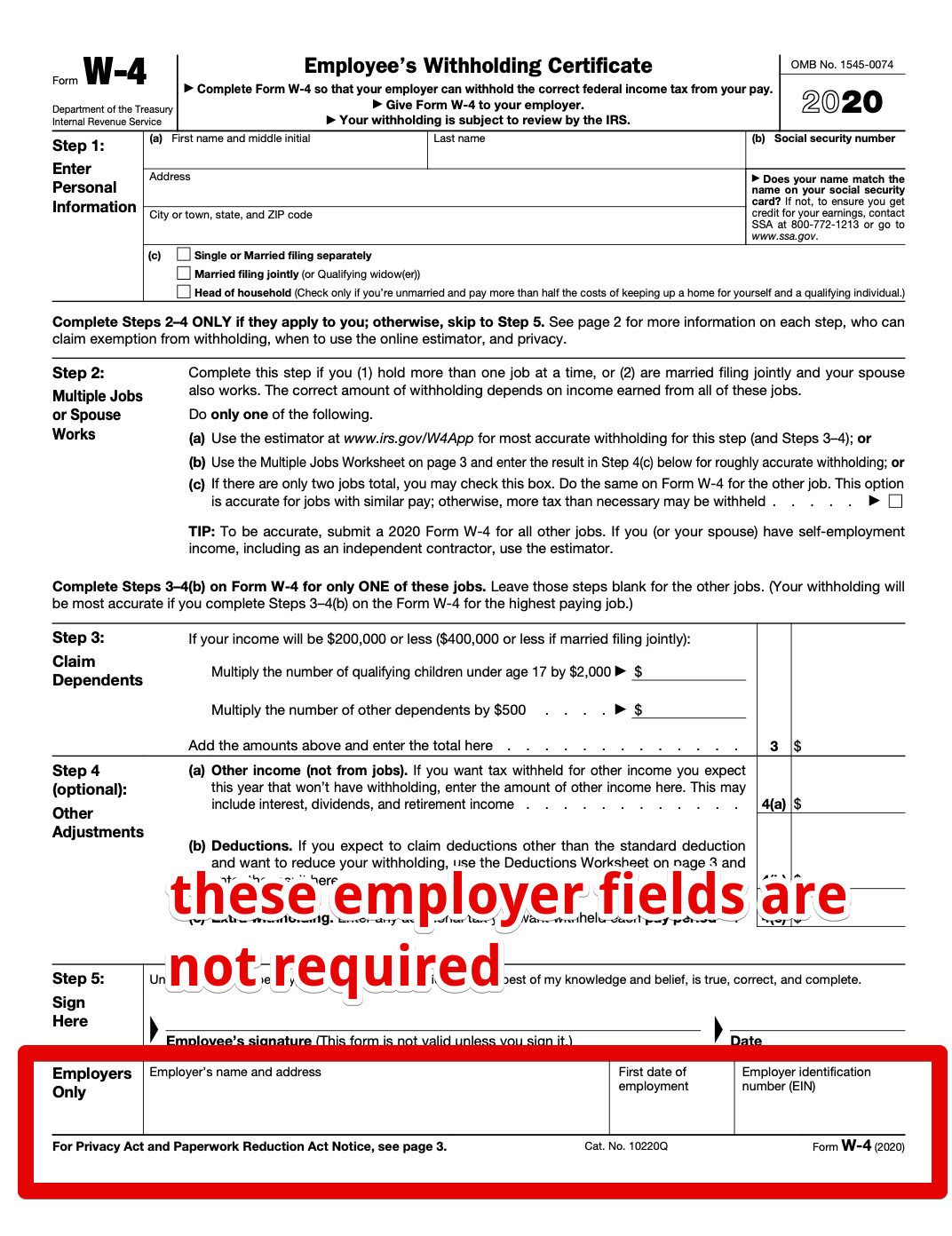

Printable W-4 Form

The printable W-4 form is available on the IRS website and can be easily downloaded and printed for your use. It contains sections where you will need to provide personal information such as your name, address, social security number, and filing status. Additionally, there are sections where you will need to indicate any additional income, deductions, and credits that may affect your tax withholding.

When filling out the printable W-4 form, it’s important to follow the instructions carefully to ensure accuracy. If you have any questions or are unsure about how to fill out a particular section, it’s recommended to seek guidance from a tax professional or your employer. Once you have completed the form, you can submit it to your employer for processing.

It’s important to review your W-4 form regularly and make any necessary changes if your financial situation changes. For example, if you get married, have a child, or experience a change in income, you may need to update your W-4 form to reflect these changes. By keeping your W-4 form up to date, you can avoid any surprises when it comes time to file your taxes.

In conclusion, the printable W-4 form is a convenient option for those who prefer a hard copy of the form. By accurately completing this form and keeping it up to date, you can ensure that the correct amount of tax is withheld from your paycheck. Remember to consult with a tax professional if you have any questions or concerns about filling out your W-4 form.