When starting a new job or experiencing a change in your financial situation, you may need to fill out a W-4 form. This form is used by employers to determine how much federal income tax to withhold from your paycheck. It’s important to fill it out accurately to avoid any potential issues with your taxes.

While many employers provide a physical copy of the W-4 form for you to fill out, you can also find a printable version online. This can be especially helpful if you prefer to fill out forms electronically or if you need to make changes to your withholdings quickly.

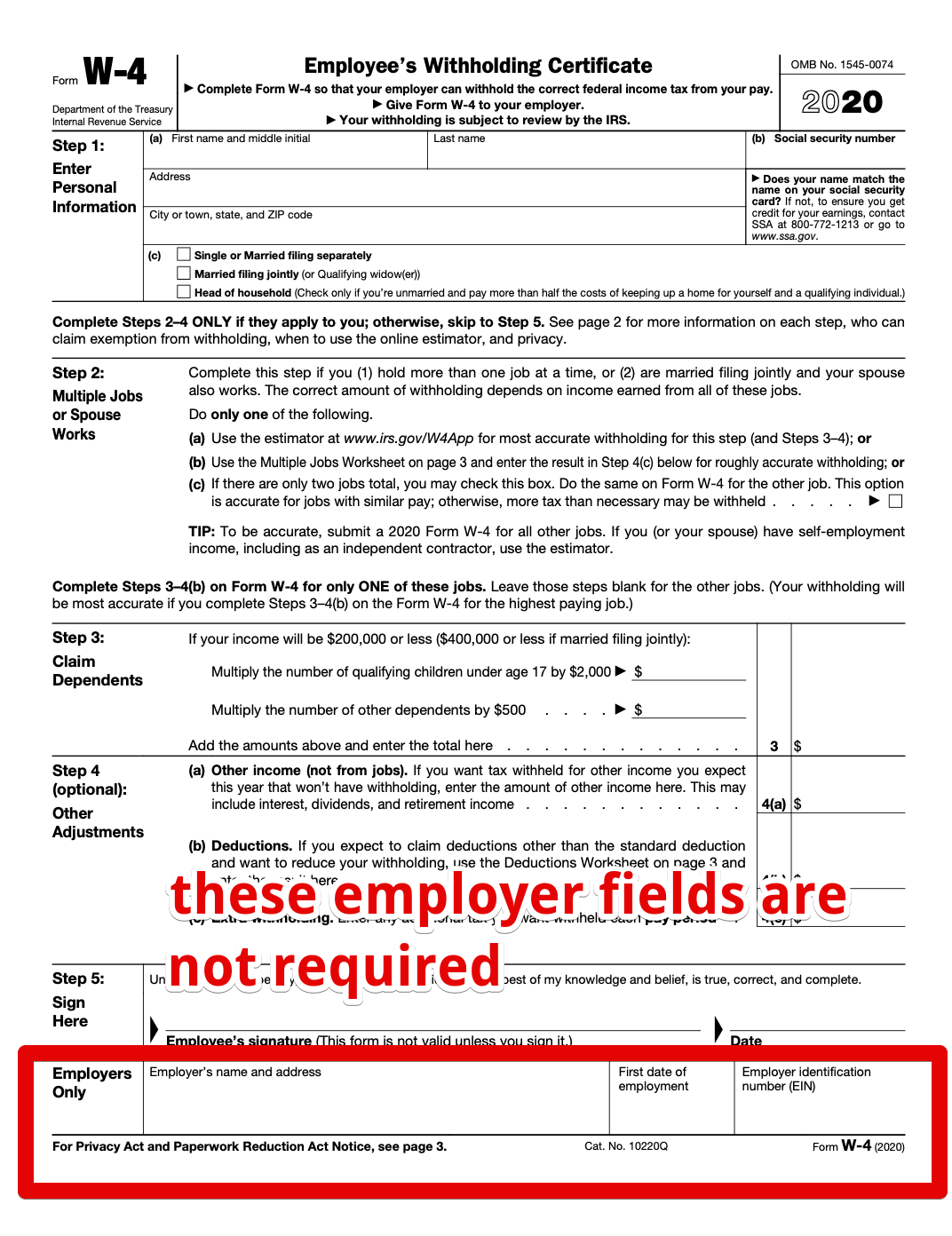

Printable W 4 Form

When using a printable W-4 form, make sure to carefully follow the instructions provided. You will need to provide information such as your name, address, filing status, and the number of allowances you are claiming. It’s important to be honest and accurate with this information to avoid any discrepancies in your tax withholding.

Additionally, you may need to make adjustments to your withholdings if you experience a significant life event, such as getting married, having a child, or purchasing a home. These changes can impact how much tax is withheld from your paycheck, so it’s important to update your W-4 form accordingly.

After completing the printable W-4 form, you will need to submit it to your employer for processing. They will use the information provided to calculate the appropriate amount of federal income tax to withhold from your paycheck. If you have any questions or concerns about filling out the form, don’t hesitate to ask your employer or a tax professional for assistance.

Remember, it’s important to review your W-4 form periodically and make any necessary updates to ensure that your tax withholdings are accurate. By staying on top of this form, you can avoid any surprises come tax season and ensure that you are meeting your tax obligations.

In conclusion, the printable W-4 form is a valuable tool for managing your federal income tax withholdings. By filling it out accurately and making any necessary updates, you can ensure that you are meeting your tax obligations and avoiding any potential issues with your taxes. Be sure to take the time to review and update your W-4 form as needed to stay on top of your financial responsibilities.