As tax season approaches, it’s important to gather all the necessary documents to file your taxes accurately and on time. One essential document that you will need is the W-2 form, which provides information about your income and taxes withheld by your employer. While many employers provide a physical copy of the W-2 form, you can also access a printable version online for your convenience.

Printable W-2 forms are easily accessible and can be found on the website of your employer or through reputable tax preparation websites. This option allows you to quickly and conveniently obtain your W-2 form without waiting for it to arrive in the mail. It’s essential to ensure that the information on the printable form matches the information on the physical form provided by your employer to avoid any discrepancies when filing your taxes.

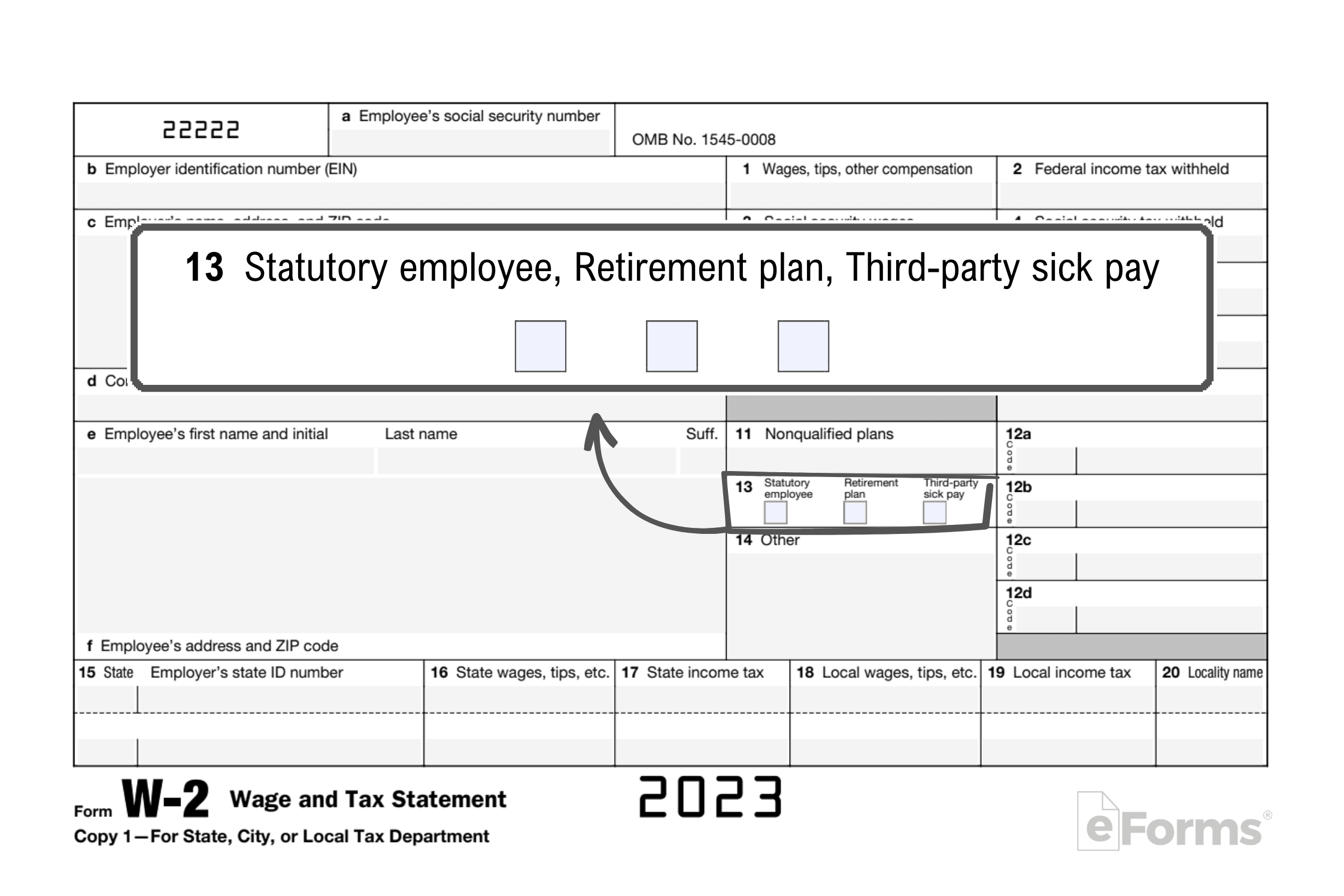

Printable W-2 Form

When using a printable W-2 form, it’s crucial to have a reliable printer and ensure that the document is printed clearly and legibly. The form typically includes your personal information, such as your name, address, and Social Security number, as well as details about your income, taxes withheld, and any other relevant information. It’s important to review the form carefully to ensure its accuracy before submitting it with your tax return.

One advantage of using a printable W-2 form is the convenience and accessibility it provides. You can easily access the form from anywhere with an internet connection and print it at your convenience. This option is especially beneficial if you need to file your taxes quickly or if you prefer to have a digital copy of your tax documents for your records.

Before using a printable W-2 form, it’s essential to verify that it is an official document and meets the requirements set by the Internal Revenue Service (IRS). Using an unofficial or incorrect form could result in delays or errors in processing your tax return. It’s recommended to download the form directly from a trusted source, such as your employer’s website or a reputable tax preparation website, to ensure its validity.

In conclusion, utilizing a printable W-2 form can streamline the tax filing process and provide you with a convenient way to access and submit important tax information. By following the necessary steps to verify the form’s accuracy and validity, you can confidently file your taxes and avoid any potential issues. Be sure to take advantage of this accessible option to stay organized and compliant during tax season.