Filing taxes can be a daunting task, but having the right forms can make the process much easier. The IRS provides a variety of forms that taxpayers can use to report their income, deductions, and credits. While many people choose to file their taxes online, some still prefer to fill out and mail in paper forms. This is where printable tax forms from the IRS come in handy.

Printable tax forms from the IRS are easily accessible on their website. Taxpayers can simply visit the IRS website, navigate to the forms and publications section, and search for the specific form they need. Once they find the form, they can download and print it out to fill in by hand. This option is especially useful for those who may not have access to a computer or prefer to file their taxes offline.

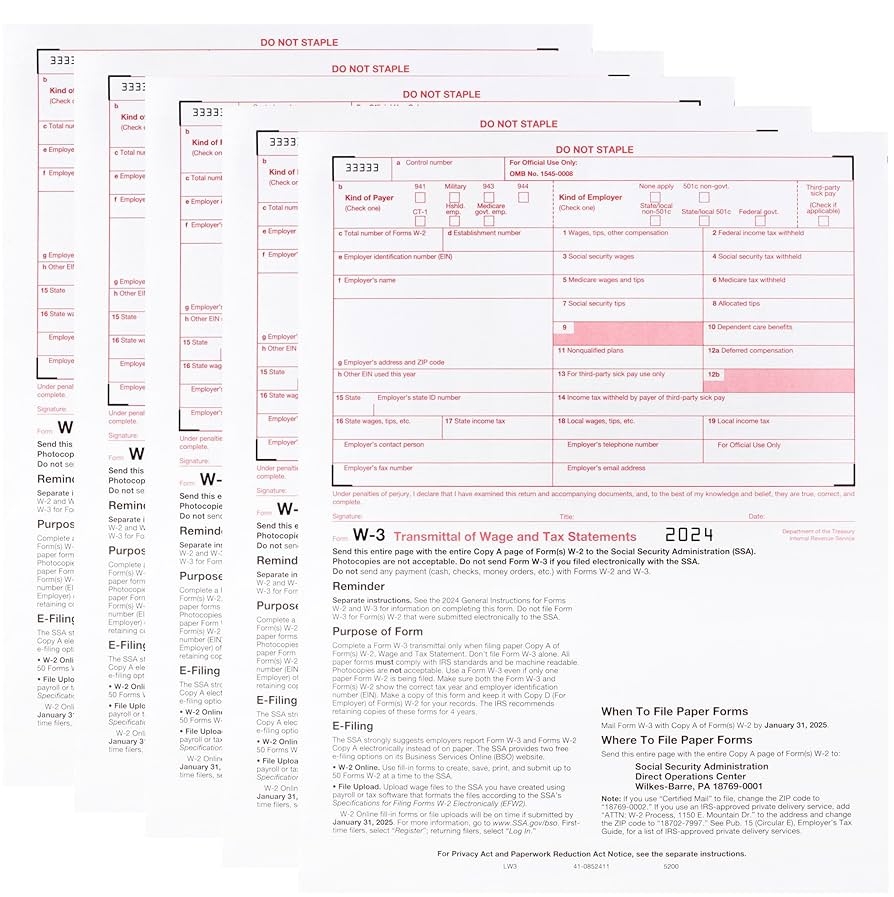

One of the most commonly used printable tax forms from the IRS is the Form 1040. This form is used by individuals to report their income, deductions, and credits for the tax year. Other common forms include the W-2, 1099, and various schedules for reporting specific types of income or deductions. Taxpayers can also find instructions for each form on the IRS website to help them accurately fill out the forms.

Using printable tax forms from the IRS can help taxpayers ensure that they are reporting their income and deductions correctly. By following the instructions provided with each form, taxpayers can avoid errors that could delay their tax refund or result in penalties. Additionally, having a physical copy of the form allows taxpayers to keep a record of their tax return for their own records.

In conclusion, printable tax forms from the IRS are a valuable resource for taxpayers who prefer to file their taxes on paper. These forms are easily accessible on the IRS website and cover a wide range of tax situations. By using printable tax forms, taxpayers can ensure that they are accurately reporting their income, deductions, and credits, and avoid costly mistakes in their tax return.