Filing your taxes can be a daunting task, but having the right forms can make the process much smoother. One of the most commonly used tax forms in the United States is Form 1040. This form is used by individuals to report their annual income and calculate their tax liability.

Whether you are a first-time filer or a seasoned tax veteran, having access to a printable version of Form 1040 can be incredibly helpful. This allows you to easily fill out the form by hand or input the information into tax software for electronic filing.

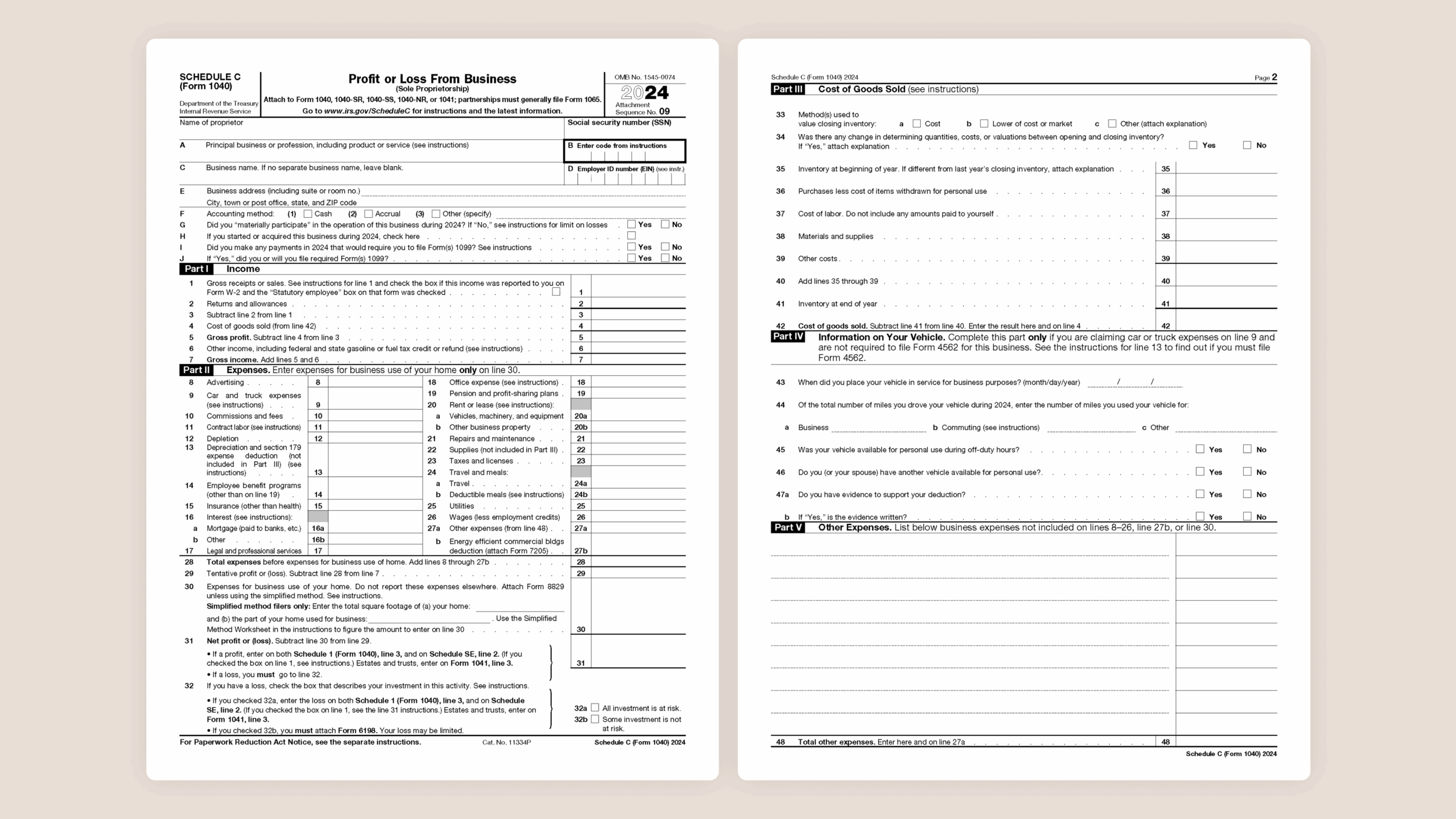

Printable Tax Form 1040

Form 1040 is divided into several sections, including income, deductions, credits, and taxes owed. The form is used to report various types of income, such as wages, interest, dividends, and capital gains. It also allows you to claim deductions for expenses like mortgage interest, charitable contributions, and medical expenses.

One of the key benefits of using a printable version of Form 1040 is that it provides a clear layout of the information needed to complete your tax return. This can help you ensure that you are reporting all relevant income and claiming all eligible deductions and credits.

Before submitting your tax return, it is important to carefully review your completed Form 1040 for accuracy. Any errors or omissions could result in delays in processing your return or even potential penalties from the IRS. Using a printable version of the form can make it easier to double-check your information before filing.

In conclusion, having access to a printable version of Tax Form 1040 can simplify the tax-filing process and help ensure that you accurately report your income and claim all eligible deductions and credits. Whether you choose to fill out the form by hand or electronically, having a clear and organized document to reference can make the task much more manageable.