When tax season rolls around, one of the most important tasks for individuals and businesses is filing their state income taxes. Each state has its own set of forms and requirements, making it crucial to have the right documents on hand. Printable state income tax forms are a convenient way to ensure you have everything you need to accurately file your taxes.

Printable state income tax forms can be easily accessed online through the official website of your state’s Department of Revenue or Taxation. These forms are typically available in PDF format, making it easy to download, print, and fill out. Having these forms on hand can save you time and hassle when it comes time to file your taxes.

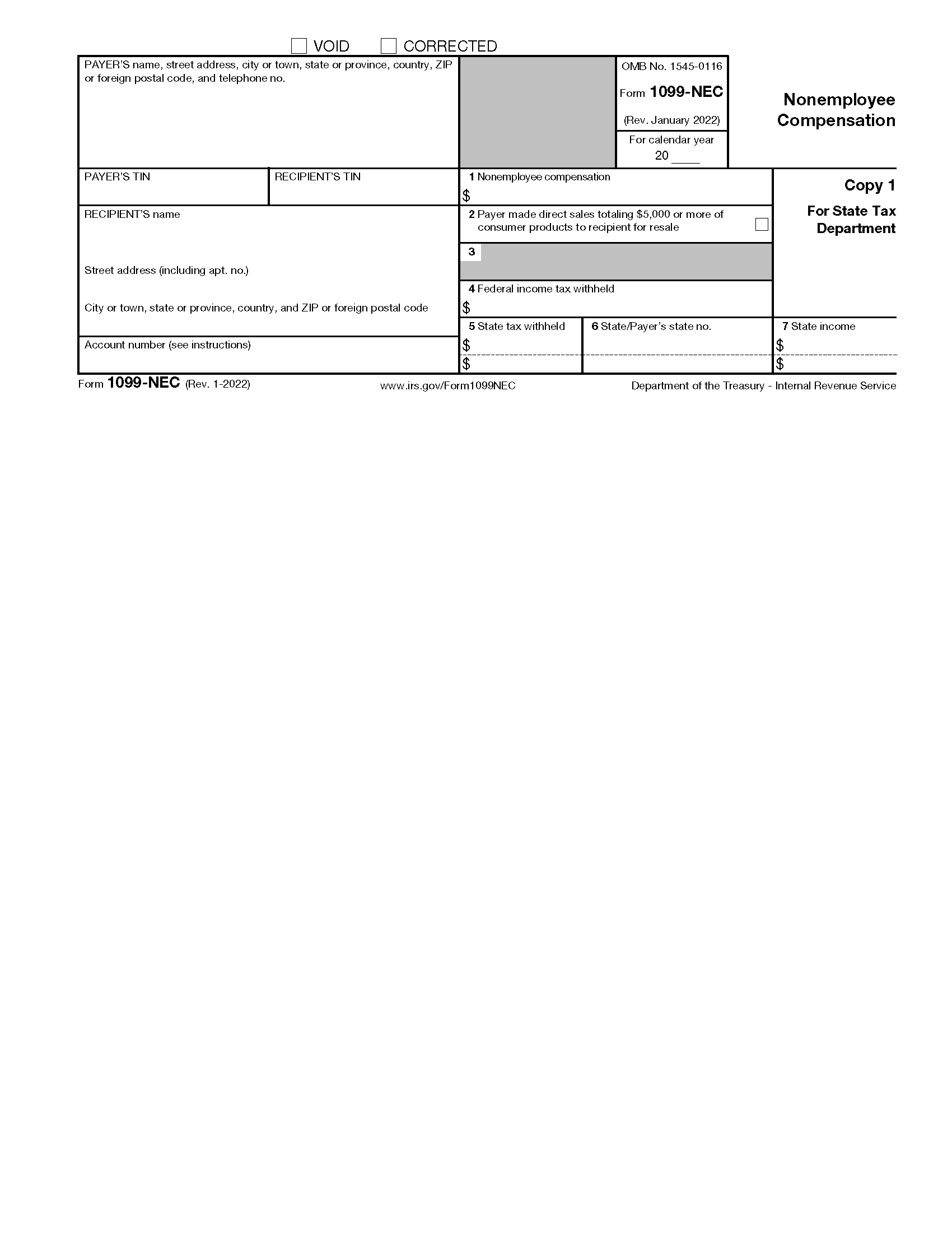

Printable State Income Tax Forms

Printable State Income Tax Forms

When using printable state income tax forms, it’s important to double-check that you are using the correct forms for your state and tax year. Each state may have different forms for different types of income or deductions, so it’s crucial to ensure you are using the right documents. Additionally, be sure to follow the instructions carefully to avoid any errors or delays in processing your tax return.

One of the benefits of printable state income tax forms is the ability to fill them out electronically before printing. Many PDF forms are interactive, allowing you to type in your information directly on the form. This can help reduce errors and ensure that your tax return is accurate and complete before submitting it to the state.

Overall, printable state income tax forms are a valuable resource for individuals and businesses looking to file their state taxes. By having these forms readily available, you can streamline the tax filing process and ensure that you meet all of your state’s requirements. So, be sure to download and print the necessary forms well in advance of the tax deadline to avoid any last-minute scrambling.

Make sure to stay organized and keep all of your tax documents in one place to make the process as smooth as possible. By taking the time to prepare and file your state income taxes accurately, you can avoid potential penalties and ensure that you are in compliance with state tax laws.