When it comes to filing your income taxes in Puerto Rico, having the right forms is essential. Whether you are a resident or non-resident, there are specific forms that must be filled out in order to comply with Puerto Rico tax laws. Fortunately, there are a variety of printable forms available online to make the process easier for taxpayers.

Printable Puerto Rico income tax forms can be easily accessed online from the Puerto Rico Department of Treasury website or other reputable tax preparation websites. These forms are typically available in PDF format, making it simple to download, print, and fill out at your convenience. Having access to printable forms can save you time and hassle when it comes to filing your taxes.

Printable Puerto Rico Income Tax Forms

Printable Puerto Rico Income Tax Forms

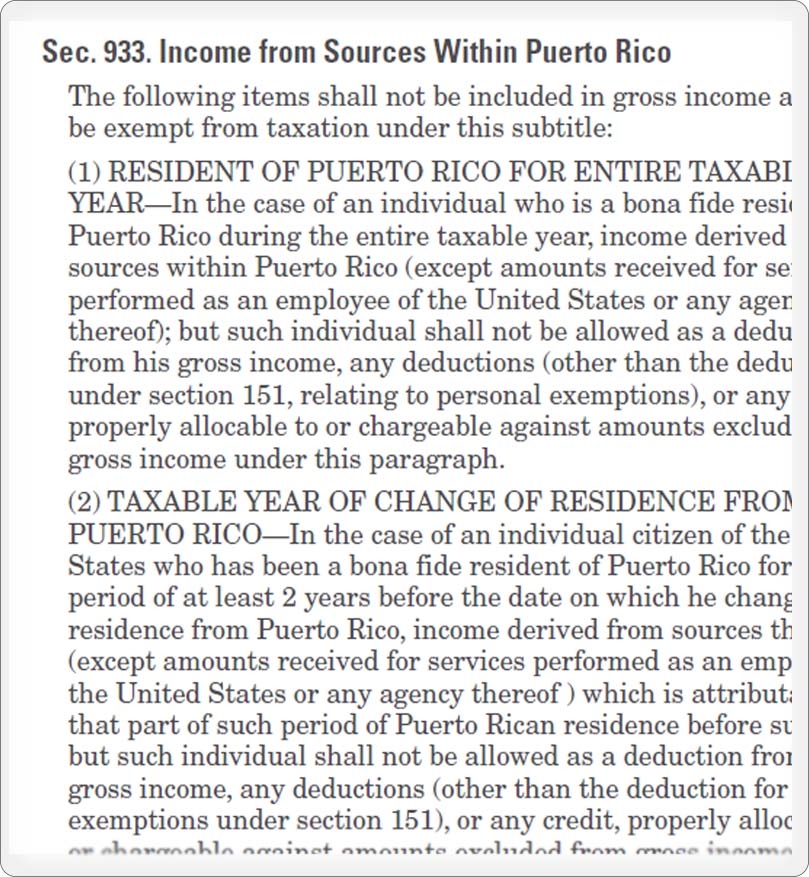

Some of the most common Puerto Rico income tax forms that taxpayers may need to fill out include the Individual Income Tax Return form (Form 1040-PR), the Self-Employment Tax form (Form 1040-SS), and the Corporate Income Tax Return form (Form 1120-PR). These forms require detailed information about your income, deductions, and credits, so it is important to fill them out accurately.

When using printable Puerto Rico income tax forms, be sure to carefully read the instructions provided with each form to ensure that you are completing them correctly. If you have any questions or need assistance, you can always reach out to the Puerto Rico Department of Treasury or consult with a tax professional for guidance. Filing your taxes accurately and on time is crucial to avoid penalties and ensure compliance with Puerto Rico tax laws.

Overall, having access to printable Puerto Rico income tax forms can make the process of filing your taxes much more convenient. By using these forms, you can easily gather the necessary information, fill out the required details, and submit your tax return in a timely manner. Remember to keep copies of all forms and documents for your records to stay organized and prepared for future tax filings.

Make sure to take advantage of printable Puerto Rico income tax forms to simplify the tax filing process and ensure compliance with Puerto Rico tax laws. By being proactive and thorough in your tax preparations, you can avoid any potential issues and set yourself up for financial success in the future.