Managing payroll can be a daunting task for any business, big or small. One way to streamline the process and ensure accuracy is by using printable payroll forms. These forms provide a structured way to gather and organize important information about employees’ wages, taxes, and deductions.

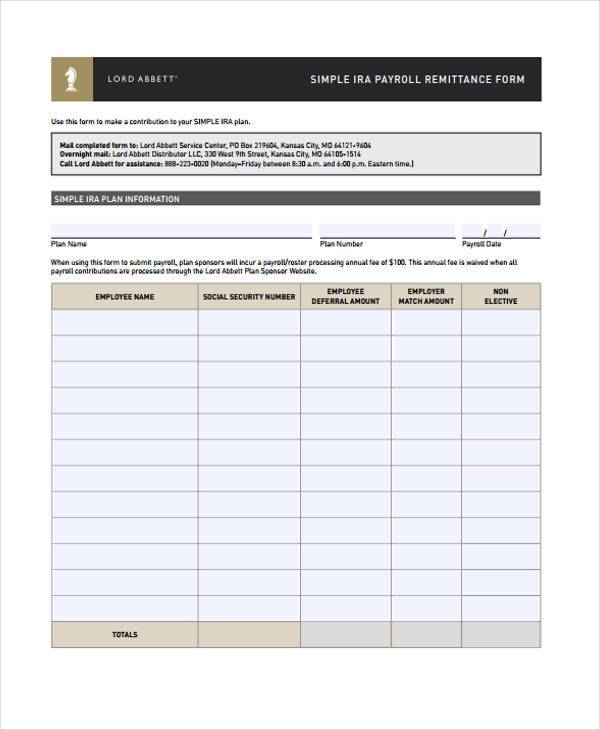

Printable payroll forms come in various formats, including timesheets, pay stubs, W-2 forms, and more. By using these forms, businesses can easily calculate employee wages, track hours worked, and withhold the correct amount for taxes. This not only saves time but also helps avoid costly errors that could result in fines or penalties.

Handling staff wages doesn’t have to be difficult. A printable payroll offers a quick, dependable, and easy-to-use method for tracking employee pay, hours, and deductions—without the need for complicated tools.

Keep Payroll in Order with a Printable Payroll Forms – Straightforward & Efficient Method!

Whether you’re a freelancer, payroll manager, or sole proprietor, using apayroll template helps ensure proper documentation. Simply get the template, produce a hard copy, and complete it by hand or type directly into the file before printing.

Printable Payroll Forms

One of the most common printable payroll forms is the timesheet. Employees use timesheets to record their hours worked each pay period, which is then used by the payroll department to calculate their wages. Timesheets can be customized to include fields for regular hours, overtime, and any other relevant information.

Another important printable payroll form is the pay stub. Pay stubs provide employees with a detailed breakdown of their earnings, deductions, and net pay for each pay period. This helps employees understand how their wages are calculated and ensures transparency in the payroll process.

In addition to timesheets and pay stubs, businesses also use printable W-2 forms to report employees’ earnings and taxes withheld to the IRS. W-2 forms are essential for tax purposes and must be distributed to employees by January 31st each year. By using printable W-2 forms, businesses can easily generate and distribute these forms in a timely manner.

Overall, printable payroll forms are essential tools for businesses to streamline their payroll processes and ensure compliance with tax regulations. By using these forms, businesses can accurately calculate employee wages, track hours worked, and report earnings to the IRS. This not only saves time and reduces errors but also helps maintain transparency and trust with employees.

In conclusion, printable payroll forms are a valuable resource for businesses looking to manage their payroll efficiently and accurately. By using timesheets, pay stubs, W-2 forms, and other printable forms, businesses can simplify the payroll process and ensure compliance with tax regulations. Whether you’re a small business or a large corporation, printable payroll forms can help you streamline your payroll operations and avoid costly mistakes.