Managing employee payroll deductions can be a complex task for any business. One way to streamline this process is by using a printable payroll deduction form. This form allows employees to authorize specific deductions from their paychecks, such as taxes, retirement contributions, and insurance premiums. By providing employees with a standardized form to fill out, businesses can ensure accuracy and consistency in their payroll processes.

Printable payroll deduction forms are essential for both employers and employees. Employers can use these forms to track and document employee deductions, ensuring compliance with federal and state regulations. Employees benefit from having a clear understanding of the deductions being taken from their pay and can use the form as a reference for their own records.

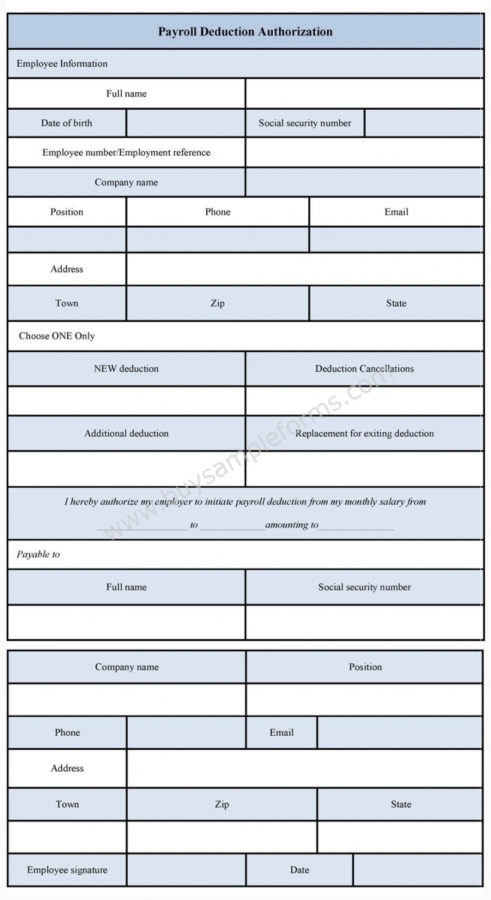

Printable Payroll Deduction Form

Printable Payroll Deduction Form

Processing payroll tasks doesn’t have to be difficult. A Printable Payroll Deduction Form offers a quick, reliable, and easy-to-use method for tracking wages, hours, and deductions—without the need for complex software.

Keep Payroll in Order with a Printable Payroll Template – Simple & Efficient Solution!

Whether you’re a small business owner, administrator, or independent contractor, using aprintable payroll helps ensure proper documentation. Simply access the template, print it, and fill it out by hand or type directly into the file before printing.

When creating a printable payroll deduction form, it is important to include key information such as employee name, employee ID number, deduction type, deduction amount, and effective date. The form should also include a section for employees to sign and date, authorizing the deductions. Additionally, businesses may choose to include a disclaimer outlining the terms and conditions of the deductions.

By using a printable payroll deduction form, businesses can streamline their payroll processes, reduce errors, and ensure compliance with regulations. These forms provide a standardized method for employees to authorize deductions and help businesses maintain accurate records of payroll deductions. Employers can easily customize these forms to meet their specific needs and requirements, making them a valuable tool for any organization.

In conclusion, printable payroll deduction forms are an essential tool for businesses looking to manage employee deductions efficiently. By providing a standardized form for employees to authorize deductions, businesses can ensure accuracy and compliance in their payroll processes. These forms benefit both employers and employees by creating a clear and consistent method for tracking and documenting deductions. Implementing a printable payroll deduction form can help businesses streamline their payroll processes and improve overall efficiency.