Printable payroll checks stubs are an essential tool for any business to keep track of employee wages and taxes. These stubs provide a detailed breakdown of earnings, deductions, and net pay for each pay period. They serve as a record for both the employer and the employee, ensuring transparency and accuracy in payroll processing.

With printable payroll checks stubs, employers can easily generate and print out accurate pay stubs for their employees. This eliminates the need for manual calculations and reduces the risk of errors in payroll processing. Employees can also access their pay stubs online or through email, making it convenient for them to review their earnings and deductions.

Processing staff wages doesn’t have to be overwhelming. A printable payroll form offers a speedy, reliable, and user-friendly method for tracking employee pay, work time, and withholdings—without the need for complex software.

Manage Finances Efficiently with a Printable Payroll – Easy & Effective Solution!

Whether you’re a freelancer, HR professional, or independent contractor, using aprintable payroll form helps ensure accurate record-keeping. Simply get the template, produce a hard copy, and fill it out by hand or edit it digitally before printing.

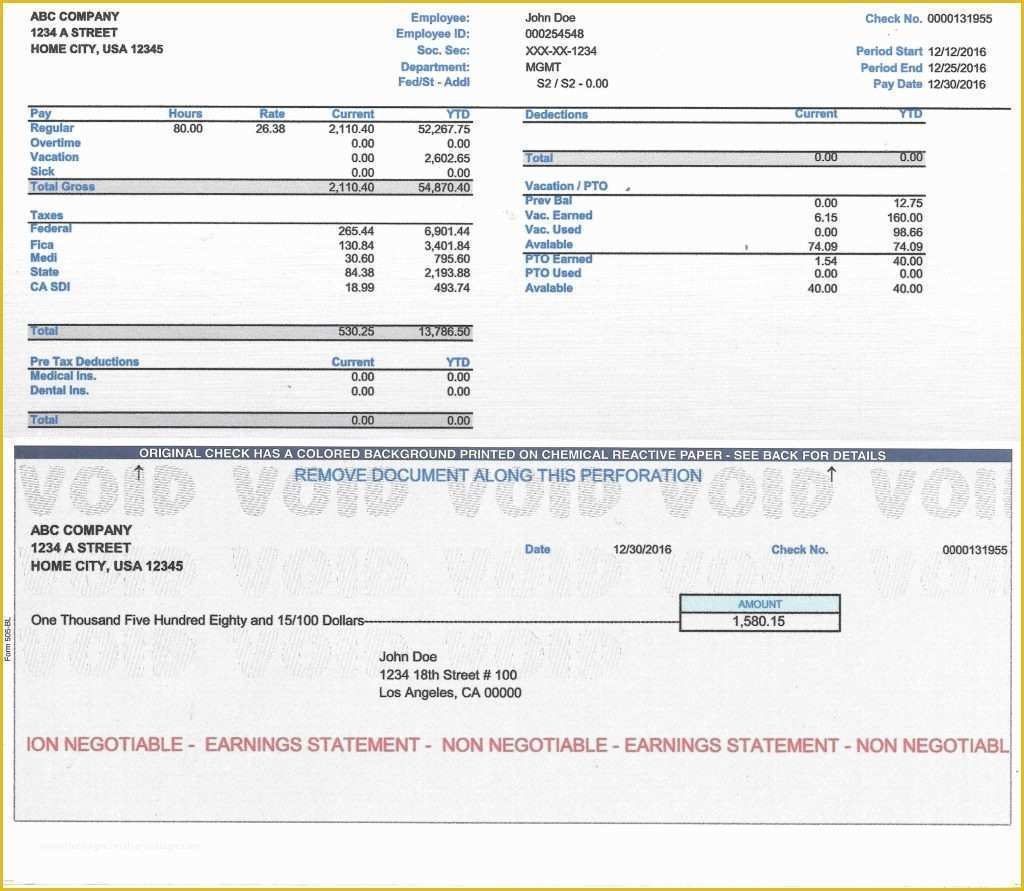

Printable payroll checks stubs typically include basic information such as employee name, pay period dates, hours worked, hourly rate, total earnings, deductions for taxes and benefits, and net pay. They also provide a year-to-date summary of earnings and deductions, allowing employees to track their income and taxes throughout the year.

Using printable payroll checks stubs can also help businesses comply with federal and state labor laws. Employers are required to provide employees with accurate pay stubs that detail their wages and deductions. By using printable payroll checks stubs, businesses can ensure that they are meeting these legal requirements and avoid potential penalties for non-compliance.

In conclusion, printable payroll checks stubs are a valuable tool for businesses to track employee wages, deductions, and net pay. They provide a detailed record of earnings and taxes for both employers and employees, ensuring transparency and accuracy in payroll processing. By using printable payroll checks stubs, businesses can streamline their payroll operations, comply with labor laws, and provide employees with an easy way to access their pay information.