Filing your local income tax return is an important task that all Pennsylvania residents must complete each year. The Pennsylvania Department of Revenue provides a printable form that makes it easy for individuals to report their income and calculate the amount of local tax owed.

By using the printable Pa local income tax return form, taxpayers can ensure that they are accurately reporting their income and avoiding any potential penalties for underpayment. This form also allows individuals to claim any deductions or credits that they may be eligible for, helping them to reduce their tax liability.

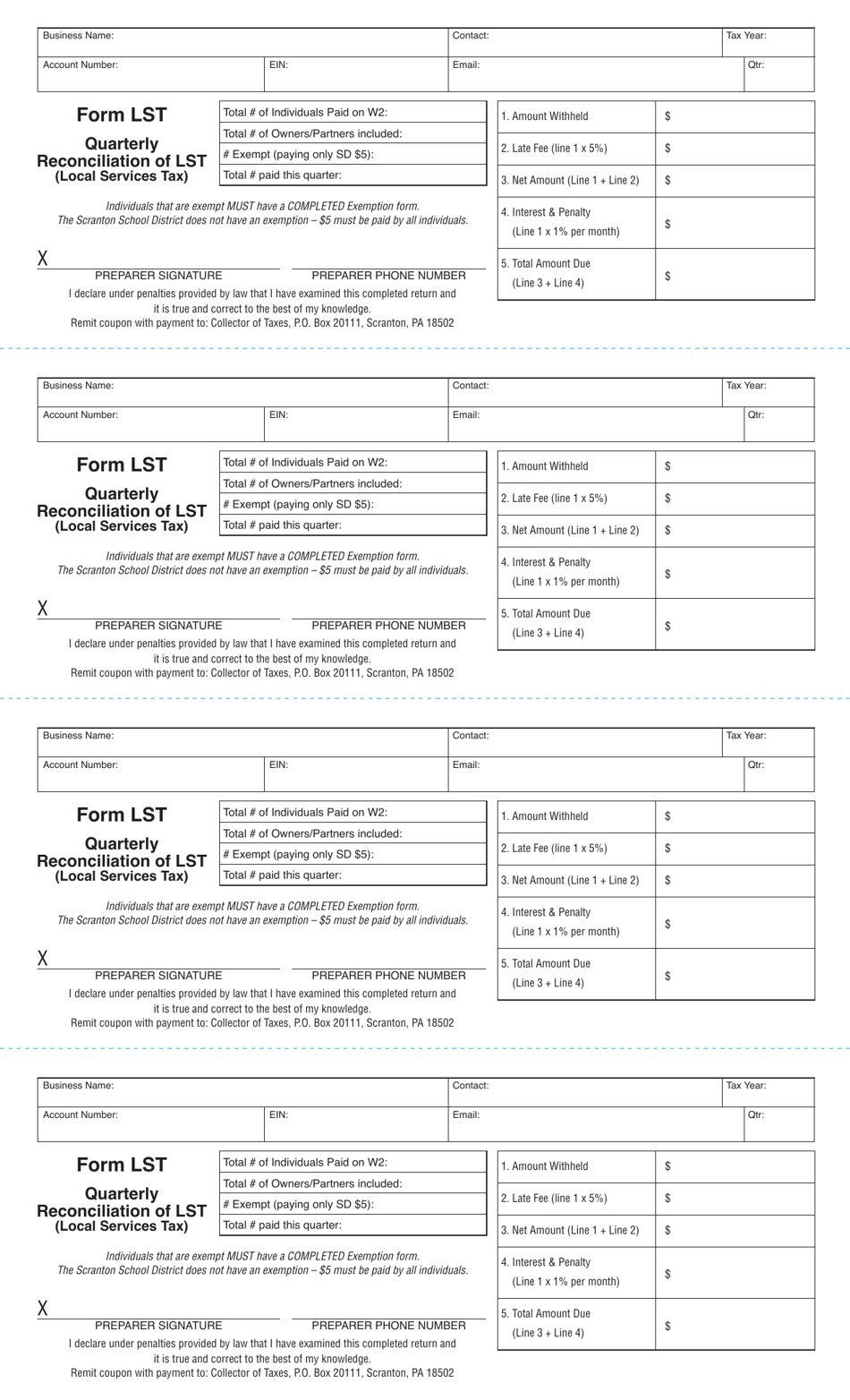

Printable Pa Local Income Tax Return Form

Printable Pa Local Income Tax Return Form

When completing the form, taxpayers will need to gather information such as their total income, deductions, and any tax payments that have already been made. By carefully following the instructions provided on the form, individuals can ensure that they are correctly filling out all sections and avoiding any errors that could delay processing.

Once the form has been completed, taxpayers can either mail it to the Pennsylvania Department of Revenue or file it electronically through the department’s website. By submitting the form before the deadline, individuals can avoid any late filing penalties and ensure that their tax return is processed in a timely manner.

Overall, the printable Pa local income tax return form provides an easy and convenient way for Pennsylvania residents to fulfill their tax obligations. By taking the time to accurately report their income and claim any deductions or credits, individuals can minimize their tax liability and avoid any potential issues with the Department of Revenue.

So, if you are a Pennsylvania resident who needs to file your local income tax return, be sure to use the printable form provided by the Department of Revenue. By doing so, you can ensure that your taxes are filed accurately and on time, helping you to stay in compliance with state tax laws.