New York State requires businesses to collect sales tax on certain goods and services sold within the state. To report and remit this tax, businesses must file Form ST-100 with the New York State Department of Taxation and Finance. This form is used to report sales and use tax collected, as well as any credits or refunds due.

Businesses can easily access and download the Printable Nys Sales Tax Form St-100 online from the official website of the New York State Department of Taxation and Finance. The form is available in a printable PDF format, making it convenient for businesses to fill out and submit their sales tax information.

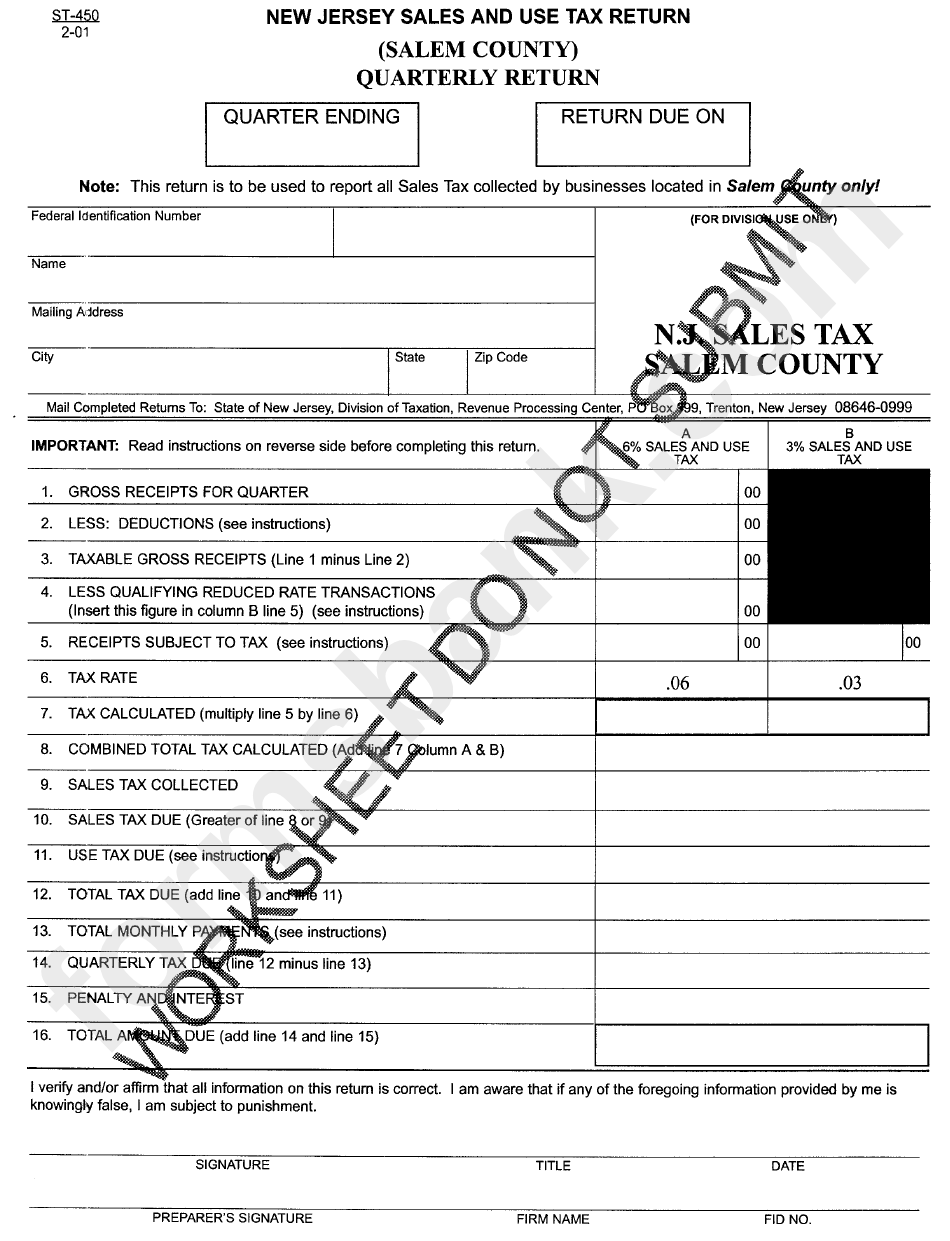

Printable Nys Sales Tax Form St-100

Printable Nys Sales Tax Form St-100

When filling out Form ST-100, businesses must provide details about their sales and use tax collected during the reporting period. This includes information such as total sales, taxable sales, exempt sales, and any credits or refunds claimed. Businesses must also calculate the amount of sales tax due and remit payment along with the completed form.

It is important for businesses to accurately report their sales tax information on Form ST-100 to avoid any penalties or fines from the New York State Department of Taxation and Finance. By using the printable form, businesses can easily keep track of their sales tax obligations and ensure compliance with state tax laws.

Overall, the Printable Nys Sales Tax Form St-100 is a valuable resource for businesses operating in New York State to report and remit their sales tax obligations. By completing and submitting this form on time, businesses can avoid any potential issues with the state tax authorities and maintain good standing in their tax obligations.

For businesses in New York State, it is essential to stay informed about their sales tax responsibilities and use resources like Form ST-100 to ensure compliance with state tax laws. By utilizing the printable form, businesses can simplify the process of reporting and remitting their sales tax obligations, ultimately helping them avoid any potential penalties or fines.