As tax season approaches, many individuals and businesses in Kansas are looking for printable income tax forms to file their taxes. Fortunately, the Kansas Department of Revenue provides a variety of forms that can be easily downloaded and printed from their website. These forms cover a range of tax-related activities, from individual income tax returns to business tax filings.

Whether you are a resident of Kansas or have income sourced from the state, it is important to ensure that you are filing your taxes correctly and on time. By using the printable Kansas income tax forms provided by the state government, you can easily navigate the tax filing process and avoid any potential penalties or fines.

Printable Kansas Income Tax Forms

Printable Kansas Income Tax Forms

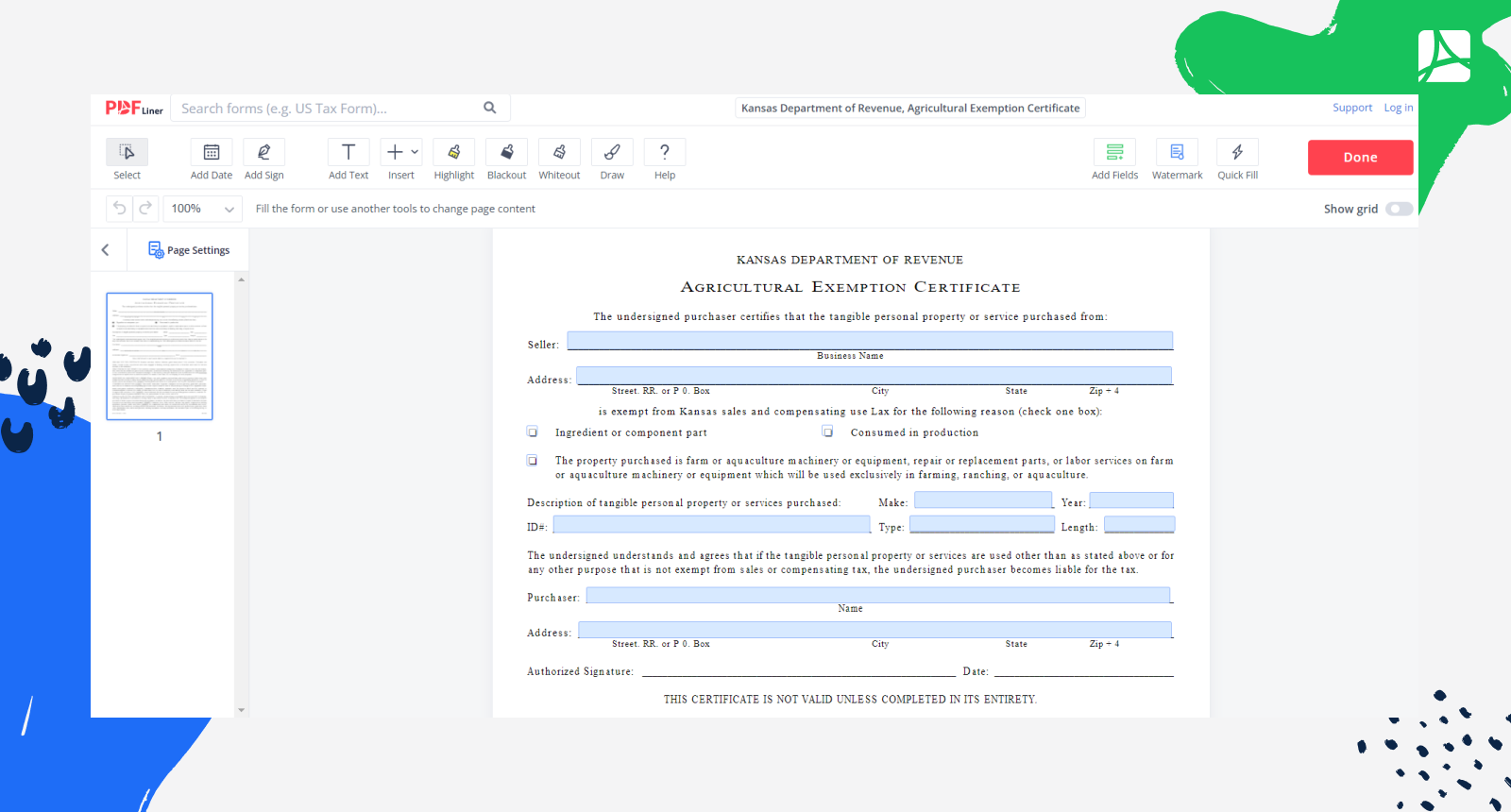

When accessing the Kansas Department of Revenue website, you will find a section dedicated to tax forms. Here, you can search for and download the specific forms you need based on your tax situation. From Form K-40 for individual income tax returns to Form K-120 for corporate income tax returns, there are a variety of forms available for different types of taxpayers.

In addition to income tax forms, the Kansas Department of Revenue website also provides instructions and guidelines for filling out the forms correctly. This can be especially helpful for individuals and businesses who may be new to the tax filing process or have questions about specific deductions or credits they may be eligible for.

By utilizing the printable Kansas income tax forms and resources provided by the state government, you can ensure that your taxes are filed accurately and in compliance with state laws. Remember to keep copies of all forms and documentation for your records, and consider consulting with a tax professional if you have any questions or concerns about your tax situation.

In conclusion, accessing and using printable Kansas income tax forms is a convenient and efficient way to file your taxes in the state. By taking advantage of the resources provided by the Kansas Department of Revenue, you can navigate the tax filing process with confidence and ensure that you are meeting your tax obligations. Remember to file your taxes on time and accurately to avoid any potential issues with the IRS. Happy filing!