When it comes to tax season, staying organized is key. One important document that you may need to fill out is the IRS W9 form. This form is used by businesses to request information from vendors and independent contractors for tax purposes. It’s essential to have a clear understanding of what this form is and how to properly fill it out.

Whether you’re a freelancer, consultant, or small business owner, you may be required to fill out a W9 form at some point. Having a printable version of this form can make the process much easier. With the ability to download and print the form from the IRS website, you can quickly provide the necessary information to your clients or employers.

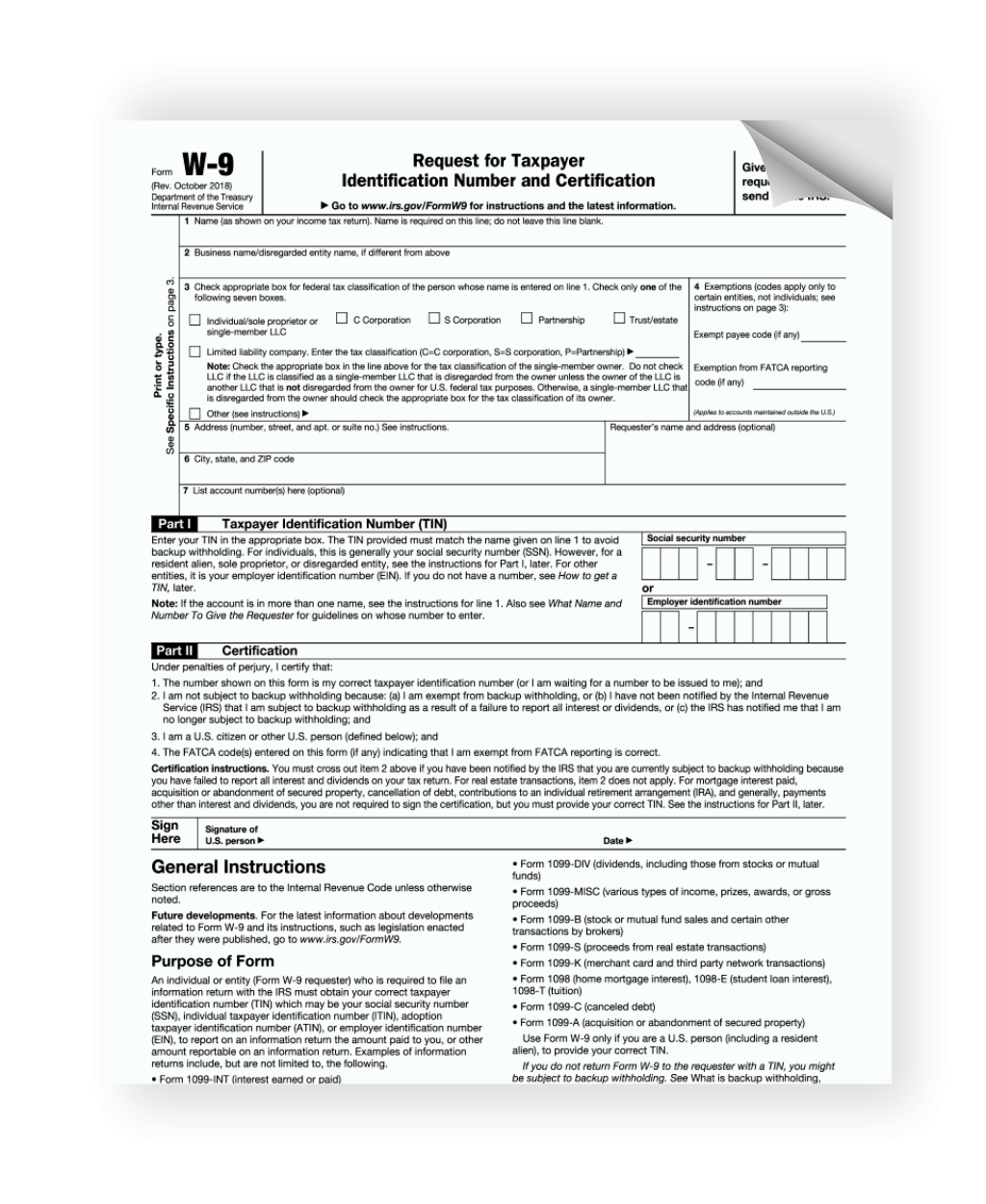

Printable IRS W9 Form

When filling out the W9 form, you’ll need to provide your name, address, tax classification, and taxpayer identification number. It’s crucial to fill out the form accurately to avoid any issues with the IRS down the line. By using the printable version of the W9 form, you can easily follow the instructions and ensure that all the required fields are completed.

It’s important to note that the W9 form is not submitted to the IRS. Instead, it is kept on file by the business that requested the information. This form is used to report payments made to vendors and independent contractors, which helps the IRS track income and ensure that taxes are being paid appropriately.

By having a printable IRS W9 form on hand, you can streamline the process of providing necessary information to businesses that you work with. This can help you avoid delays in payments and ensure that your tax information is accurately reported to the IRS. It’s a simple yet essential document that can make a big difference in your tax compliance.

In conclusion, the printable IRS W9 form is a valuable tool for vendors and independent contractors to provide necessary tax information to businesses. By filling out this form accurately and keeping it on file, you can ensure smooth transactions and proper tax reporting. Make sure to have a printable version of the W9 form ready whenever you need to provide this information to clients or employers.