Are you feeling stressed about filing your taxes on time? Do you need more time to gather all your financial documents and information? If so, you may want to consider filing for a tax extension with the IRS. By doing so, you can get an additional six months to file your tax return, giving you more time to ensure everything is accurate and complete.

One way to request a tax extension from the IRS is by using the printable IRS Tax Extension Form. This form, officially known as Form 4868, allows you to request an extension of time to file your individual tax return. By filling out and submitting this form, you can avoid any late filing penalties as long as you pay any estimated taxes owed by the original filing deadline.

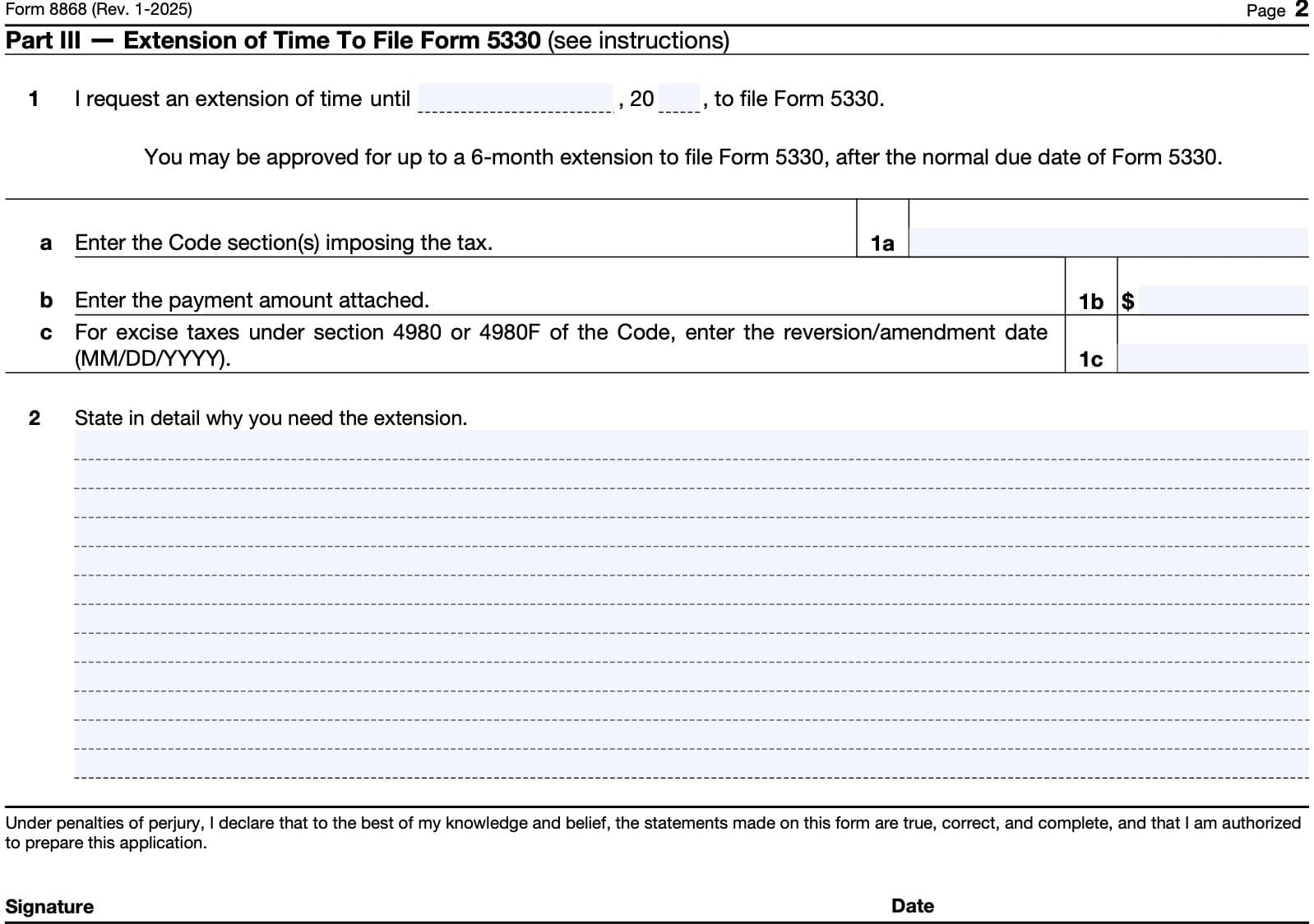

Printable Irs Tax Extension Form

Printable Irs Tax Extension Form

When completing the Printable IRS Tax Extension Form, you will need to provide basic information such as your name, address, Social Security number, and estimated tax liability. You can choose to pay any estimated taxes owed electronically or by check, and you must submit the form by the original filing deadline to avoid penalties.

It’s important to note that filing for a tax extension does not give you more time to pay any taxes owed. You are still required to pay any estimated taxes by the original filing deadline to avoid interest and penalties. However, by filing for an extension, you can avoid the failure-to-file penalty, which is typically higher than the failure-to-pay penalty.

Overall, the Printable IRS Tax Extension Form can be a useful tool for individuals who need more time to file their taxes accurately. By submitting this form, you can avoid costly penalties and ensure that your tax return is complete and correct. So, if you find yourself running out of time to file your taxes, consider filing for an extension with the IRS using Form 4868.

Don’t let the stress of tax season overwhelm you. Take advantage of the Printable IRS Tax Extension Form and give yourself the extra time you need to file your taxes accurately and on time.