As tax season approaches, it’s important to have all the necessary forms and documents ready to file your taxes accurately and on time. The Internal Revenue Service (IRS) provides a variety of forms that individuals and businesses need to report their income and expenses for the year. One of the easiest ways to access these forms is through printable versions that can be easily downloaded and filled out.

Printable IRS Forms 2016 are readily available online for individuals to access and use for their tax filings. These forms cover a range of tax-related topics, including income, deductions, credits, and more. By having these forms in a printable format, taxpayers can conveniently fill them out at their own pace and have a hard copy for their records.

When using Printable IRS Forms 2016, it’s important to ensure that you are using the correct form for your specific tax situation. Whether you are an individual taxpayer, a small business owner, or a self-employed individual, there are different forms that apply to each scenario. Make sure to carefully review the instructions provided with each form to ensure accurate completion.

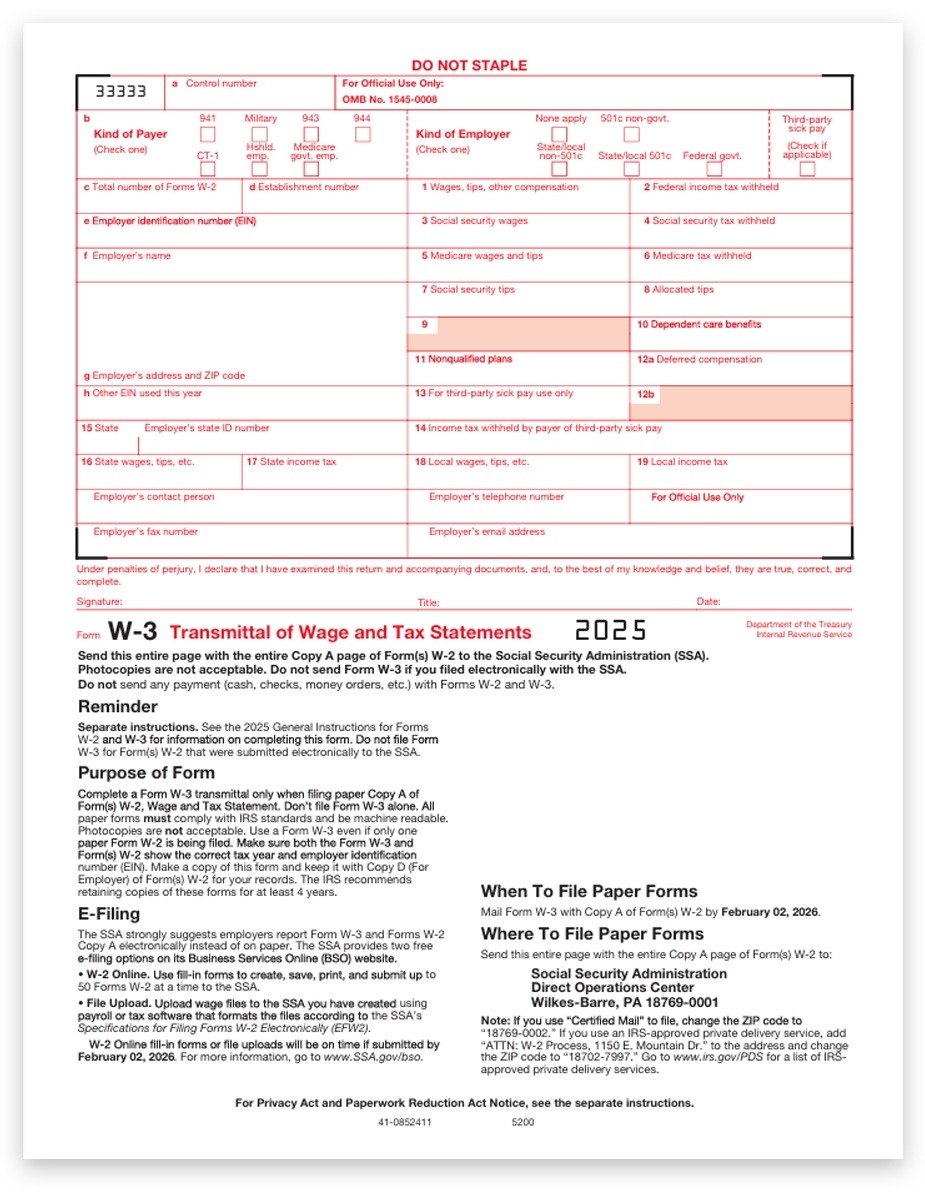

Some of the most commonly used IRS forms for the 2016 tax year include Form 1040 for individual income tax returns, Form 1099 for reporting various types of income, and Form W-2 for reporting wages and salaries. These forms, along with many others, can be easily accessed and printed from the IRS website or other trusted sources.

By utilizing Printable IRS Forms 2016, taxpayers can simplify the process of preparing and filing their taxes. These forms provide a structured format for reporting financial information and ensure that all necessary details are included. With the convenience of printing these forms from home, taxpayers can take control of their tax filings and stay organized throughout the process.

Overall, Printable IRS Forms 2016 offer a convenient and accessible way for individuals and businesses to prepare and file their taxes accurately. By taking advantage of these printable forms, taxpayers can ensure that they have all the necessary documentation to meet their tax obligations and avoid any potential penalties or issues with the IRS.