When it comes to filing taxes for your non-profit organization, IRS Form 990 is a crucial document that must be completed accurately and submitted on time. This form provides the IRS with important financial information about your organization, including details about your revenue, expenses, and activities. Failing to file Form 990 can result in penalties and even the loss of your organization’s tax-exempt status, so it’s important to make sure you have all the necessary information ready to complete this form.

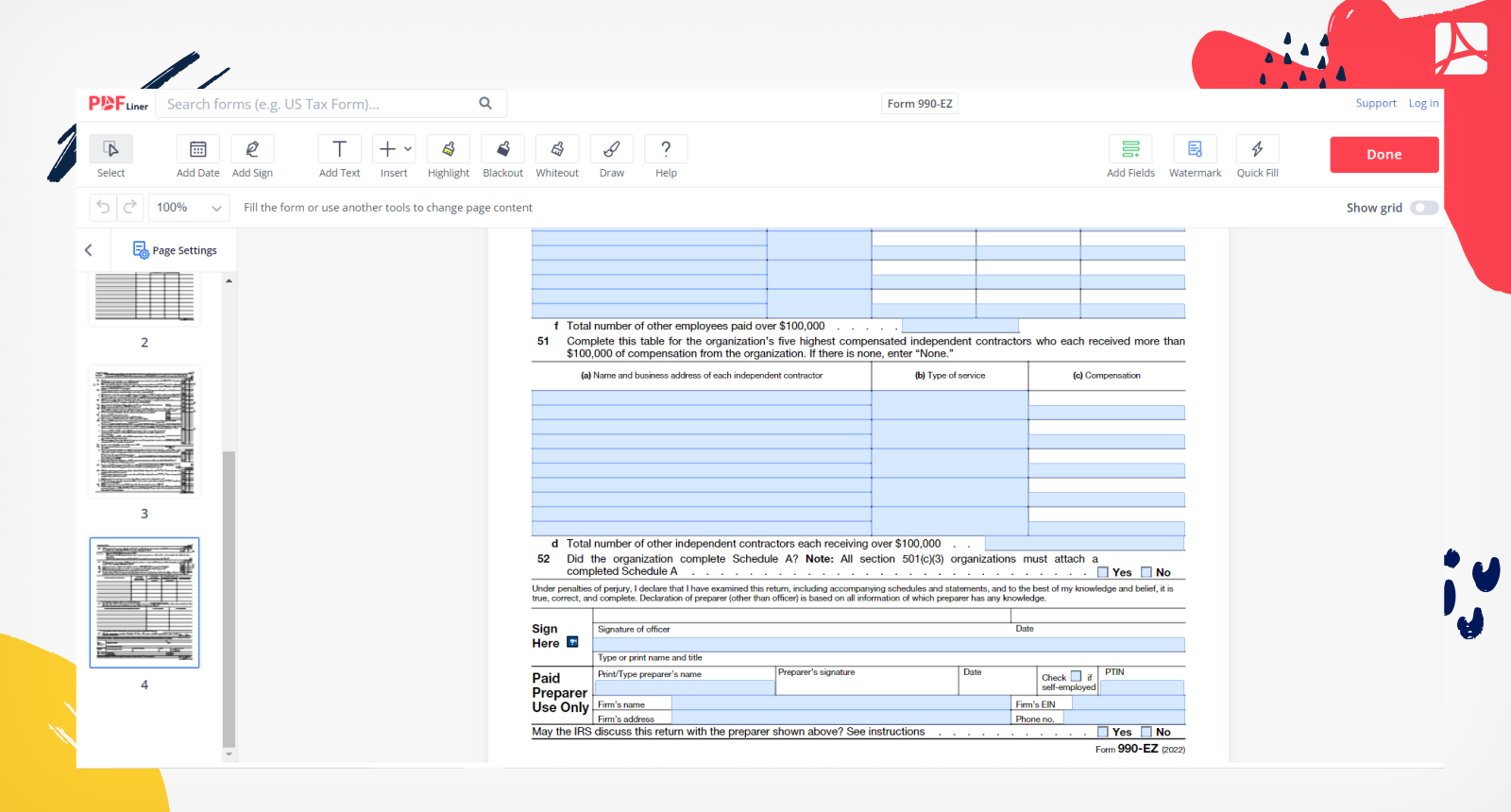

Printable IRS Form 990 is available online for non-profit organizations to download and fill out. This form is used to report the financial activities of your organization for the previous tax year. It includes sections for reporting revenue, expenses, assets, liabilities, and other important financial information. By filling out Form 990 accurately, you can demonstrate transparency and accountability to your donors, stakeholders, and the general public.

When completing Form 990, it’s important to pay attention to detail and ensure that all information is accurate and up to date. Be sure to gather all necessary financial documents, such as your organization’s income statement, balance sheet, and other relevant records. If you’re unsure about how to complete certain sections of the form, consider seeking guidance from a tax professional or accountant who is familiar with non-profit tax regulations.

Once you have completed Form 990, you can file it electronically through the IRS website or mail it to the appropriate IRS office. Be sure to keep a copy of the completed form for your records, as well as any supporting documents that may be required. Filing Form 990 on time is crucial to maintaining your organization’s tax-exempt status and avoiding any potential penalties from the IRS.

Overall, printable IRS Form 990 is an essential document for non-profit organizations to report their financial activities to the IRS. By completing this form accurately and on time, you can demonstrate transparency and accountability to your stakeholders and ensure compliance with non-profit tax regulations. Make sure to gather all necessary information and seek guidance if needed to ensure a smooth filing process.

Don’t wait until the last minute to file Form 990 – start gathering your financial documents and completing the form as soon as possible to avoid any potential issues. By staying organized and proactive, you can ensure that your organization remains in good standing with the IRS and continues to fulfill its mission effectively.