Dealing with tax debt can be overwhelming, but the IRS offers options to help taxpayers manage their payments. One such option is IRS Form 9465, also known as the Installment Agreement Request. This form allows taxpayers to request a monthly payment plan if they are unable to pay their tax bill in full.

IRS Form 9465 is a simple and straightforward document that can be easily filled out and submitted. By requesting an installment agreement, taxpayers can avoid penalties and interest charges that may accrue on unpaid taxes. This form is especially useful for individuals and businesses who are struggling to make ends meet and need more time to pay off their tax debt.

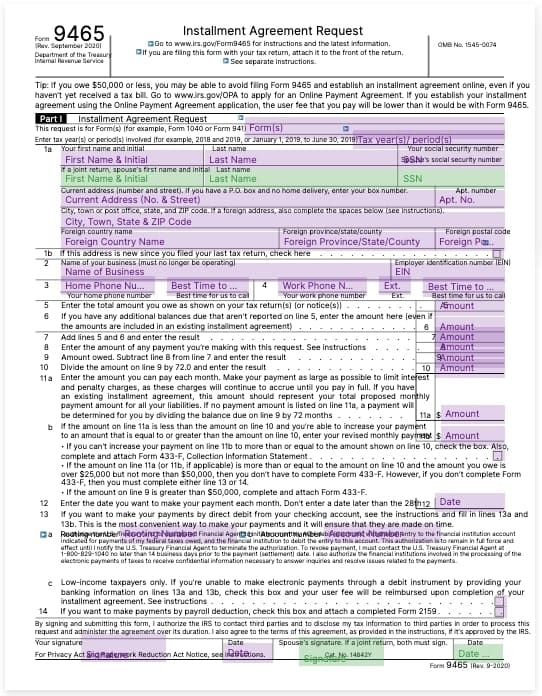

Printable IRS Form 9465

Printable IRS Form 9465 can be easily found on the IRS website or through authorized tax preparation services. This form includes sections for personal information, tax debt details, proposed payment amounts, and bank account information for automatic withdrawals. Taxpayers can choose to make monthly payments on a specific day of the month that works best for them.

It is important to accurately fill out IRS Form 9465 to avoid any delays or complications with the installment agreement request. Taxpayers should carefully review their financial situation and propose a monthly payment amount that they can realistically afford. The IRS will review the request and notify the taxpayer if the installment agreement is approved.

Once the installment agreement is approved, taxpayers must make timely monthly payments to the IRS to avoid defaulting on the agreement. It is crucial to stay current on payments and communicate with the IRS if any financial difficulties arise. Failure to comply with the terms of the installment agreement can result in additional penalties and possible collection actions by the IRS.

In conclusion, Printable IRS Form 9465 is a valuable tool for taxpayers who are unable to pay their tax debt in full. By requesting an installment agreement, individuals and businesses can spread out their payments over time and avoid unnecessary penalties and interest charges. It is important to carefully fill out the form, propose a realistic payment plan, and stay current on payments to successfully manage tax debt with the IRS.