When it comes to filing your taxes, one of the important forms that you may need to use is IRS Form 8949. This form is used to report capital gains and losses from the sale of stocks, bonds, mutual funds, and other investments. It is important to accurately report this information to ensure that you are complying with tax laws and regulations.

Printable IRS Form 8949 can be easily found online on the IRS website or through other tax preparation software. Having a printable version of this form can make it easier for you to fill out the necessary information and keep track of your capital gains and losses throughout the year. It is important to keep accurate records of all your investment transactions to avoid any potential issues with the IRS.

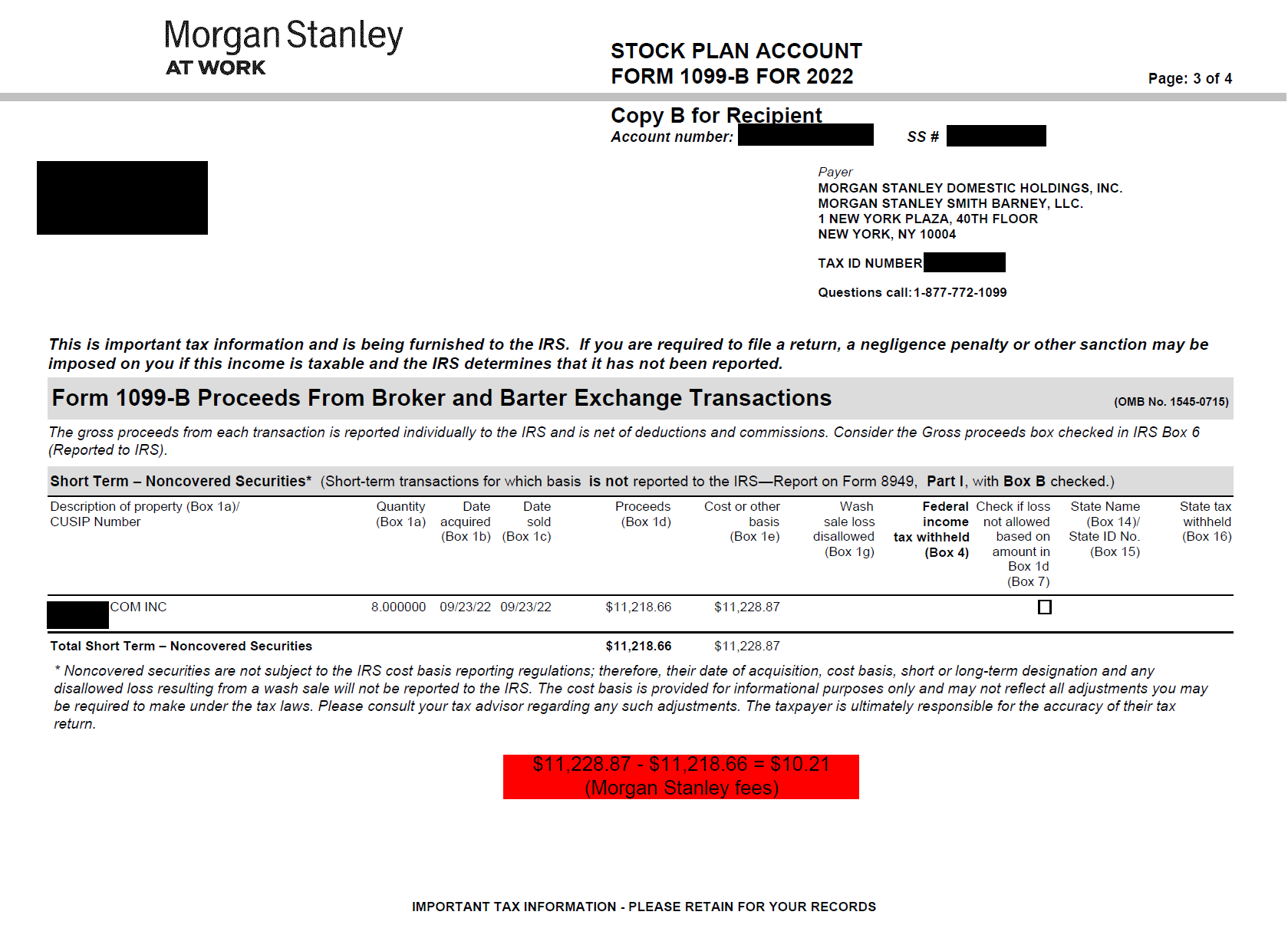

When filling out IRS Form 8949, you will need to provide details about each investment transaction, including the date of sale, purchase price, sale price, and any related expenses. You will also need to categorize each transaction as either short-term or long-term, depending on how long you held the investment before selling it. This information will help determine the amount of capital gains or losses that you need to report on your tax return.

It is important to carefully review all of your investment transactions and ensure that you are accurately reporting them on IRS Form 8949. Any errors or discrepancies could result in penalties or additional taxes owed. If you are unsure about how to fill out this form or have complex investment transactions, it may be helpful to consult with a tax professional for guidance.

By using a printable IRS Form 8949, you can easily keep track of your investment transactions and accurately report them on your tax return. Taking the time to properly fill out this form can help you avoid any potential issues with the IRS and ensure that you are in compliance with tax laws. Make sure to keep all of your investment records organized and up-to-date to make the tax filing process smoother and more efficient.

Overall, having a printable IRS Form 8949 can be a valuable tool for managing your investment transactions and ensuring that you are properly reporting them on your tax return. By staying organized and accurate with your records, you can make the tax filing process easier and avoid any potential issues with the IRS.