April 15th can be a stressful day for many individuals and businesses as it marks the deadline for filing taxes. However, if you find yourself needing more time to gather your financial documents or simply need an extension, the IRS Form 4868 can be a lifesaver. This form allows you to request an automatic extension of time to file your tax return, giving you an additional six months to get your finances in order.

Whether you’re a procrastinator or simply overwhelmed with your tax responsibilities, the IRS Form 4868 offers a simple solution to avoid penalties for late filing. By submitting this form, you can buy yourself some extra time without having to worry about facing unnecessary fines or fees. It’s important to note that while Form 4868 extends the deadline for filing your return, it does not extend the deadline for paying any taxes owed. So, be sure to estimate your tax liability and make a payment with your extension request to avoid interest charges.

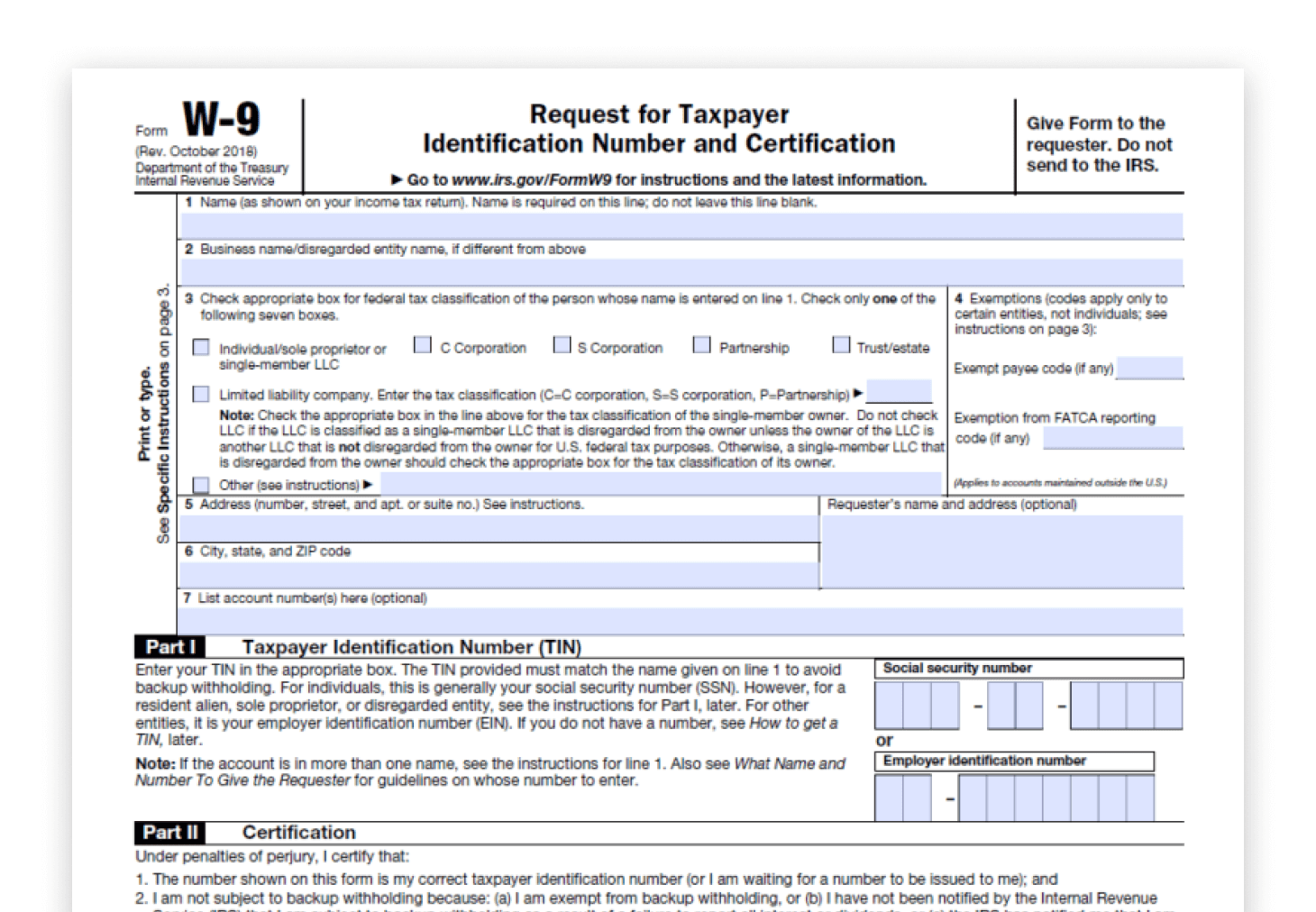

Printable IRS Form 4868

Obtaining a printable IRS Form 4868 is quick and easy. Simply visit the IRS website and search for Form 4868. You can download the form as a PDF file, fill it out electronically, and then print it for submission. Alternatively, you can choose to print the form and fill it out by hand. Be sure to provide accurate information, including your name, address, Social Security number, estimated tax liability, and the amount you are paying with your extension request.

Once you have completed the form, you can submit it electronically through IRS e-file or mail it to the appropriate address listed on the form. It’s crucial to submit Form 4868 by the original due date of your tax return to avoid any penalties. If approved, you will receive a confirmation from the IRS granting you the six-month extension. Remember, filing for an extension does not exempt you from paying any taxes owed by the original due date.

Overall, the IRS Form 4868 provides a convenient way to request an extension for filing your tax return. Whether you need additional time to gather documents or simply want to avoid late filing penalties, this form can be a valuable tool in managing your tax responsibilities. By utilizing the printable version of Form 4868, you can easily navigate the extension process and ensure compliance with IRS regulations. Don’t let the stress of tax season get the best of you – take advantage of the IRS Form 4868 and give yourself the time you need to file your return accurately and on time.