When it comes to reporting suspected tax fraud or evasion, the IRS Form 3949-A is an essential tool for individuals to use. This form allows taxpayers to provide detailed information about potential tax violations, which can help the IRS investigate and take appropriate action against those who are not complying with tax laws.

It is important to note that the IRS Form 3949-A is not used for reporting simple mistakes or minor discrepancies on a tax return. Instead, it is specifically designed for reporting serious instances of tax fraud, such as intentional underreporting of income, false deductions, or other fraudulent activities. By using this form, individuals can help ensure that everyone pays their fair share of taxes and that the tax system remains fair and equitable for all.

When filling out the IRS Form 3949-A, it is important to provide as much detail as possible about the suspected tax fraud or evasion. This includes providing information about the individual or business involved, details about the specific tax violations, and any supporting documentation that can help the IRS investigate the matter further. By providing thorough and accurate information, individuals can help the IRS take swift and appropriate action against those who are not complying with tax laws.

Once the IRS Form 3949-A is completed, it can be submitted either online or by mail to the IRS. The IRS takes all reports of suspected tax fraud seriously and will investigate each report thoroughly. By using this form, individuals can play a crucial role in helping to ensure that the tax system remains fair and that everyone pays their fair share of taxes.

In conclusion, the IRS Form 3949-A is an important tool for individuals to use when reporting suspected tax fraud or evasion. By providing detailed information and supporting documentation, individuals can help the IRS investigate and take appropriate action against those who are not complying with tax laws. By using this form, individuals can help ensure that the tax system remains fair and equitable for all taxpayers.

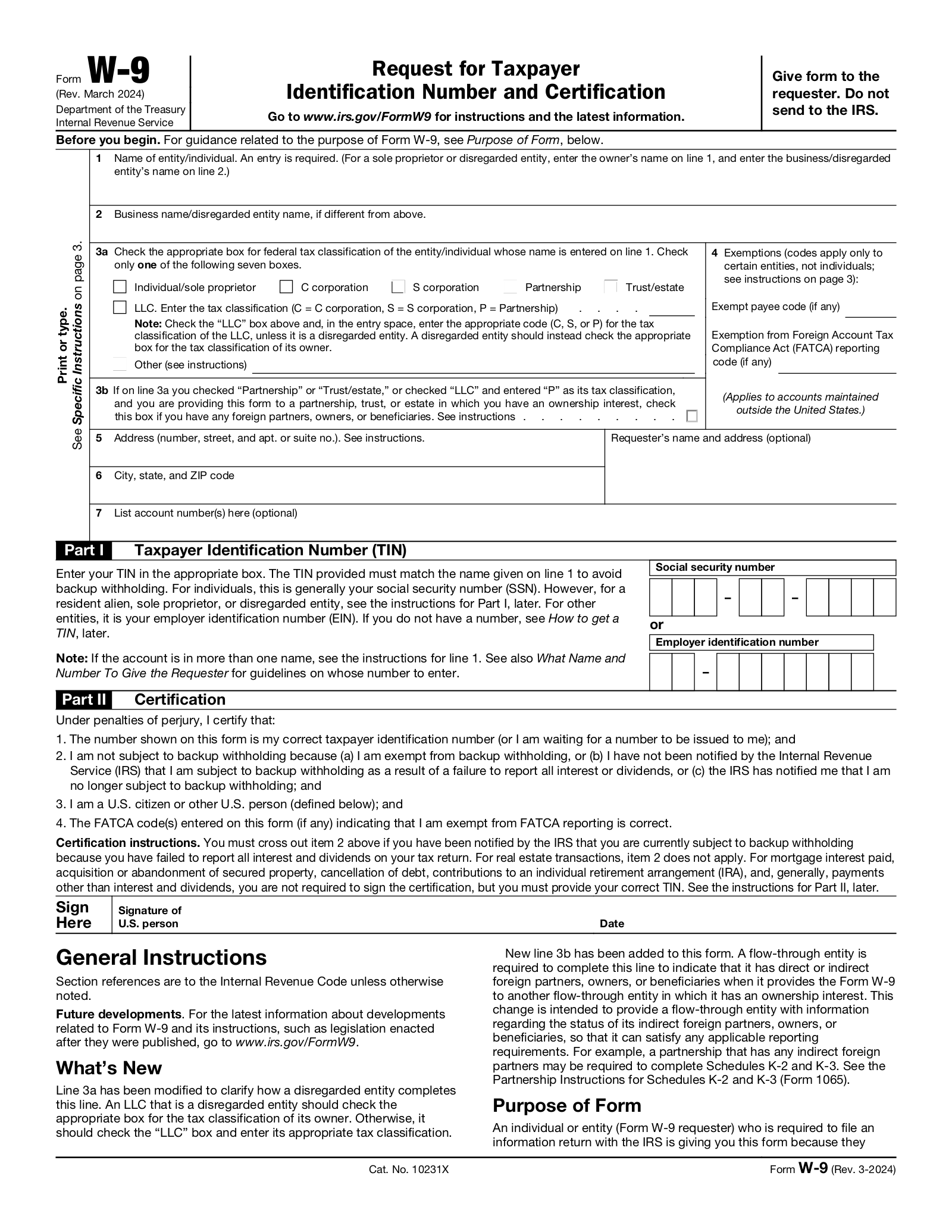

Save and Print Printable Irs Form 3949 A

Payroll printable are ideal for teams that prefer physical records or need printed versions for staff files. Most forms include fields for employee name, date range, total earnings, withholdings, and final salary—making them both comprehensive and practical.

Take control of your payroll process today with a trusted payroll printable. Save time, reduce errors, and stay organized—all while keeping your employee payment data clear.

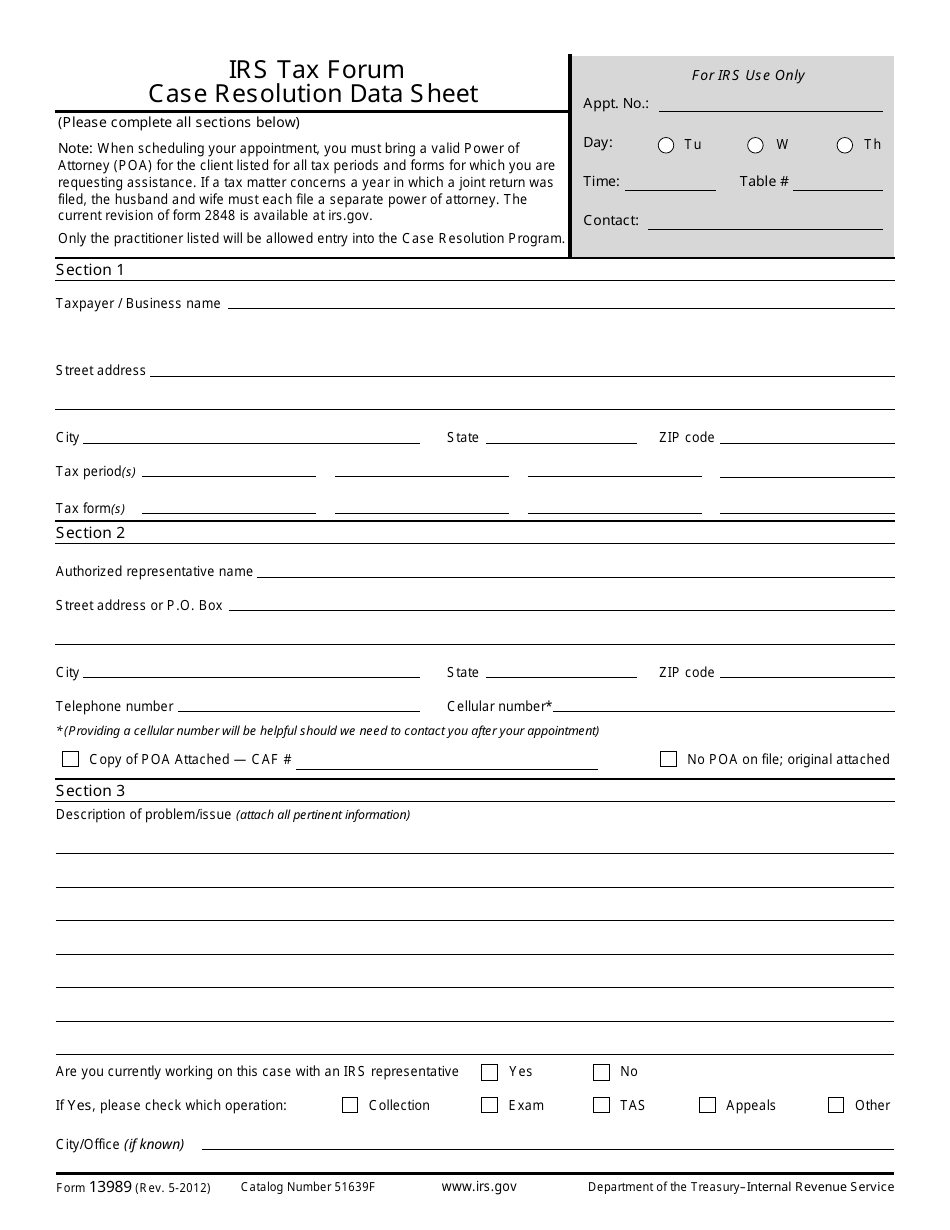

IRS Form 13989 Fill Out Sign Online And Download Fillable PDF Templateroller

IRS Form 13989 Fill Out Sign Online And Download Fillable PDF Templateroller

Fillable Form 3949 A Edit Sign U0026 Download In PDF PDFRun

Fillable Form 3949 A Edit Sign U0026 Download In PDF PDFRun

Form 3949 A 2024 2025 How To Fill U0026 Edit Online PDF Guru

Form 3949 A 2024 2025 How To Fill U0026 Edit Online PDF Guru

Fillable Form 3949 A Edit Sign U0026 Download In PDF PDFRun

Fillable Form 3949 A Edit Sign U0026 Download In PDF PDFRun

Form 3949 A 2024 2025 How To Fill U0026 Edit Online PDF Guru

Form 3949 A 2024 2025 How To Fill U0026 Edit Online PDF Guru

Processing staff wages doesn’t have to be complicated. A payroll template offers a fast, accurate, and straightforward method for tracking employee pay, hours, and taxes—without the need for complicated tools.

Whether you’re a freelancer, administrator, or sole proprietor, using aprintable payroll template helps ensure proper documentation. Simply download the template, produce a hard copy, and complete it by hand or type directly into the file before printing.