IRS Form 3911, also known as the Taxpayer Statement Regarding Refund, is a document that taxpayers can use to track the status of their tax refunds. This form is especially useful if you haven’t received your refund within a reasonable amount of time or if there has been an issue with your refund. By filling out Form 3911, you can provide the IRS with the necessary information to investigate the status of your refund.

It’s important to note that Form 3911 is only for individuals who have already filed their tax return and are expecting a refund. If you have not yet filed your tax return, you will need to do so before you can use this form.

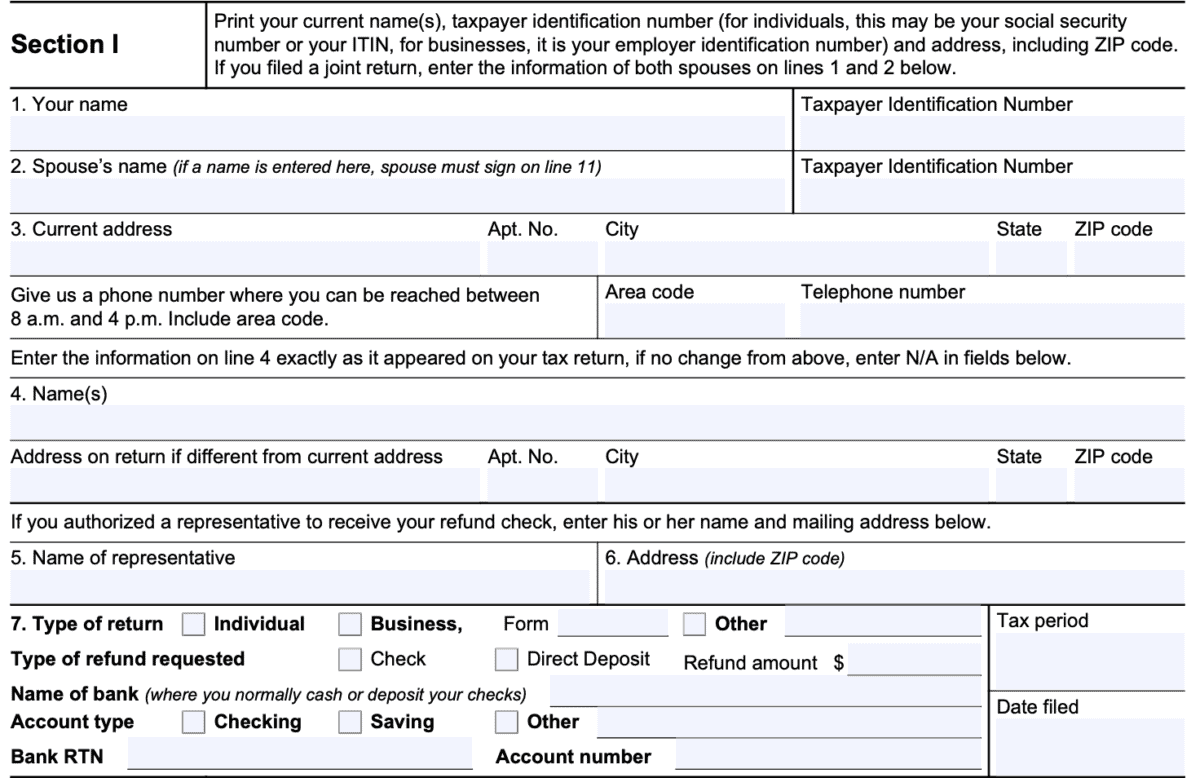

When filling out Form 3911, be sure to provide accurate and detailed information about your refund, including the amount you are expecting, the tax year in question, and any relevant details about your filing status. Once you have completed the form, you can mail it to the IRS for processing.

After submitting Form 3911, it may take some time for the IRS to investigate the status of your refund. Be patient and be sure to follow up with the IRS if you have not heard back within a reasonable amount of time. You can also check the status of your refund online using the IRS’s “Where’s My Refund?” tool.

In conclusion, IRS Form 3911 is a valuable tool for taxpayers who are experiencing issues with their tax refunds. By providing the IRS with the necessary information through this form, you can help expedite the process of resolving any refund-related issues. If you find yourself in need of assistance with your tax refund, don’t hesitate to utilize Form 3911 to get the help you need.