If you are a self-employed individual or a freelancer, you may be familiar with the IRS Form 1099 NEC. This form is used to report nonemployee compensation, such as payments made to independent contractors or vendors. It is important to accurately file this form to avoid any penalties from the IRS.

The IRS Form 1099 NEC is now used to report nonemployee compensation, which was previously reported on Form 1099 MISC. This form must be filed by businesses that have paid $600 or more to a nonemployee for services rendered during the tax year. The deadline to file this form is January 31st of the following year.

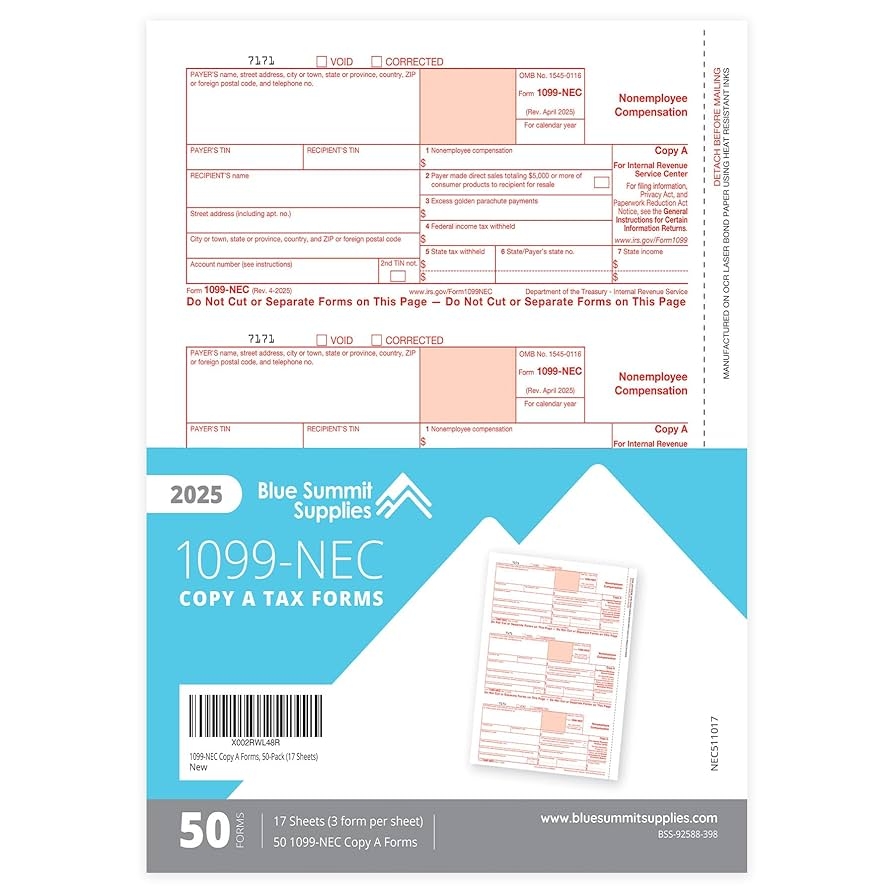

When filling out the Form 1099 NEC, you will need to provide the recipient’s name, address, and taxpayer identification number (TIN). You will also need to report the total amount of nonemployee compensation paid to the recipient during the tax year. Make sure to double-check all the information provided on the form to ensure accuracy.

It is important to note that the IRS Form 1099 NEC is not used to report employee wages, which are reported on Form W-2. If you are unsure whether a worker is classified as an employee or a nonemployee, it is recommended to seek guidance from a tax professional to avoid any misclassification issues.

There are various online platforms that offer printable versions of the IRS Form 1099 NEC, making it easy for businesses to fill out and file this form. These printable forms typically come with instructions on how to properly complete the form, ensuring that you are in compliance with IRS regulations.

In conclusion, the IRS Form 1099 NEC is an essential form for businesses that have paid nonemployee compensation during the tax year. By accurately filing this form and meeting the deadline, you can avoid any potential penalties from the IRS. Make sure to use printable versions of this form to simplify the filing process and ensure accurate reporting of nonemployee compensation.